Business

Emad Yassa on Building a Career That Spans Healthcare and Global Impact

Emad Yassa is a healthcare entrepreneur and nonprofit founder with more than three decades of professional experience across clinical practice and international philanthropy.

Yassa is the Founder and Chairman of Touch of Love International (TOLI), a nonprofit organisation focused on economic empowerment through micro-loans in underserved communities.

Born and raised in Egypt, Emad studied physical therapy at Cairo University, graduating in 1985. During his university years, he was also a competitive athlete and earned a silver award in single rowing. In 1989, he relocated to the United States, where he began building his career in outpatient physical therapy.

In 1995, Emad founded Physical Therapy and Rehab in West Hills, California. The clinic grew steadily and reflected his hands-on approach to leadership and patient care. After moving to Colorado Springs in 2005, he worked with Cheyenne Mountain Rehab before launching Dynamic Physical Therapy in 2007. He led the practice for over fifteen years, guiding it through growth, operational challenges, and long-term stability. In August 2023, he sold the business to focus full time on his nonprofit work.

Emad founded Touch of Love International in 2006, alongside his clinical career. The organisation provides small micro-loans to individuals and families in Egypt, Kenya, Ethiopia, Uganda, and Nicaragua. His work centres on dignity, accountability, and long-term self-reliance rather than short-term aid.

Today, Emad is recognised for his disciplined leadership style, cross-sector experience, and commitment to building systems that create lasting impact.

A Conversation with Emad Yassa on Building Businesses, Purpose, and Long-Term Impact

Q: You began your career in Egypt. What shaped your early direction?

I grew up in Egypt and studied physical therapy at Cairo University. I was focused on discipline early on. Sports played a big role for me. I rowed competitively and won a silver award while at university. That experience taught me structure and endurance. Those lessons stayed with me long after graduation.

Q: What prompted your move to the United States in 1989?

I wanted broader professional opportunities and exposure to a different healthcare system. Moving countries was challenging, but it pushed me to adapt quickly. I learned how to work within new regulations, new cultures, and higher expectations.

Q: Your first business came in 1995. How did that start?

I founded Physical Therapy and Rehab in West Hills, California. At the time, I was very hands-on. I treated patients, managed operations, and learned the business side through experience. It taught me how important systems and consistency are.

Q: Why did you relocate to Colorado Springs?

In 2005, I moved to Colorado Springs and worked with Cheyenne Mountain Rehab. It gave me a different perspective on practice management and team dynamics. That experience helped prepare me to launch my next clinic.

Q: Dynamic Physical Therapy became a long-term chapter. What made it different?

I founded Dynamic Physical Therapy in 2007. By then, I understood how to build a practice that could last. We focused on steady growth and patient trust. I led the clinic for over fifteen years, which required constant adjustment as healthcare evolved.

Q: You sold the business in 2023. Why then?

It was a deliberate decision. I had already started Touch of Love International years earlier, but I wanted to give it my full attention. Selling the practice allowed me to shift my focus completely.

Q: Tell us about the origin of Touch of Love International.

I founded TOLI in 2006. The idea was simple. Small loans can change lives if they are given responsibly. We work in Egypt, Kenya, Ethiopia, Uganda, and Nicaragua. The focus is self-reliance, not dependency.

Q: How does your business background influence your nonprofit work?

Very directly. Structure, accountability, and follow-through matter in any organisation. I approach the nonprofit with the same discipline I used in healthcare.

Q: How do you define leadership today?

Leadership is about consistency and responsibility. It is showing up, making hard decisions, and building something that lasts beyond you.

Business

King Charles III ‘Ready to Support’ Investigation Into Former Prince Andrew Over Epstein Links

Buckingham Palace has released a statement regarding King Charles III’s sentiments over the newest allegations against the former Prince Andrew.

The former prince, who now goes by the name Andrew Mountbatten-Windsor, has been accused of passing confidential reports to the late sex offender Jeffrey Epstein while the former worked as a British trade envoy.

King Charles ‘Ready to Support’ Investigation

The Thames Valley Police has confirmed that it is assessing the new allegations against Andrew Mountbatten-Windsor, according to a report by People.

In response, the Buckingham Palace released a statement that says, “The King has made clear, in words and through unprecedented actions, his profound concern at allegations which continue to come to light in respect of Mr. Mountbatten-Windsor’s conduct.”

“While the specific claims in question are for Mr. Mountbatten-Windsor to address, if we are approached by Thames Valley Police, we stand ready to support them as you would expect, the statement added.

Buckingham Palace’s statement also reiterates that “Their Majesties’ thoughts and sympathies have been, and remain with, the victims of any and all forms of abuse.”

William, Catherine Address Andrew’s Epstein Issues

William and Catherine, the Prince and Princess of Wales, have also broken their silence regarding the controversy surrounding Andrew Mountbatten-Windsor.

According to a report by ABC News, a spokesperson for Kensington Palace said that “I can confirm The Prince and Princess have been deeply concerned by the continuing revelations.”

“Their thoughts remain focused on the victims,” the spokesperson added.

Business

Podium Minerals announces executive changes

Shares in junior Podium Minerals closed trade Wednesday up 9 per cent to 7.1 cents, on the back of several notable executive appointments.

Business

Entra ASA (ENTOF) Q4 2025 Earnings Call Transcript

Sonja Horn

Chief Executive Officer

Welcome to Entra’s fourth quarter presentation brought to you here from Oslo. Let me start by enlighting you on what you can see on this picture. This is Christian Krohgs gate 2 in Oslo, our planned redevelopment project, which we, in the quarter announced that we have entered into a partnership with Skanska to develop.

So moving on to the highlights. Rental income of NOK 787 million in the quarter. That is NOK 20 million up compared to same quarter last year, meaning also that the effects from previous divestments have been offset by an increase through projects feeding into the management portfolio. Net income from property management of NOK 425 million in the quarter, that is up with NOK 108 million compared to same quarter last year, mainly explained by the completion and divestment of our project in Trondheim. The net value changes in the quarter were NOK 56 million. And in that, we have also included the positive value uplifts on the investment properties of NOK 111 million. Profit before tax of NOK 476 million in the quarter, and our EPRA NRV is up with NOK 2 per share to NOK 169 in the fourth quarter. We’ve had a good quarter in respect of operations with a positive net letting of NOK 4 million, and we have also completed 3 projects this quarter, one new build project in Trondheim, which also has been forward sale. So upon closing of that transaction, we have taken a gain of NOK 101 million in the fourth quarter.

And our Board has decided to

Business

Multiplex likely to build Blackburne’s $350m Karrinyup project

The luxury apartment development looks to be finally going ahead, following its approval three and a half years ago.

Business

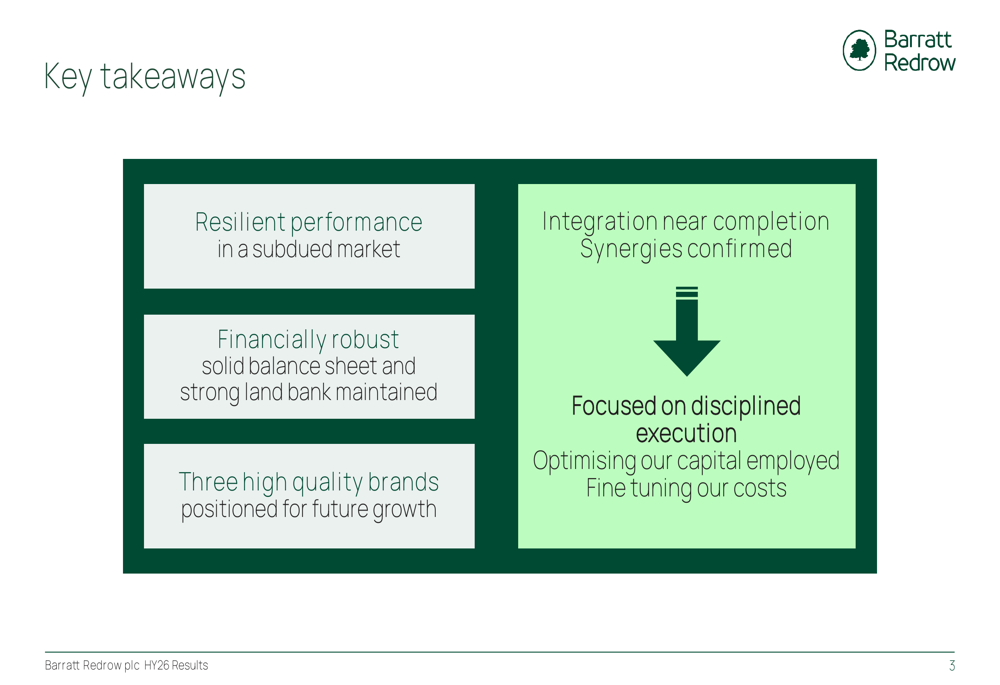

Barratt Redrow HY26 presentation: Completions up 4.7%, margins under pressure

Barratt Redrow HY26 presentation: Completions up 4.7%, margins under pressure

Business

Children bombarded with weight loss drug ads online, says commissioner

The Children’s Commissioner suggested social media advertising for children should be banned.

Business

What’s driving Northern Ireland’s falling fuel costs?

“Locally, the prices are very much linked to geopolitical instability, they’re linked to supply and demand at global level… and money markets, currency exchange rates, which again there’s no ability for people in Northern Ireland to control,” explained Smyth.

Business

How to Choose Your Forex Broker? A 2026 Guide for UK Investors

In the vast and often turbulent ocean of the financial markets, your broker is your vessel. Choose a sturdy, well-equipped ship, and you can navigate through economic storms to reach your destination.

Choose a leaky raft, and you may find yourself sinking before you even leave the harbor. As we settle into 2026, the retail forex industry has become more competitive than ever. Hundreds of brokers are vying for your attention with flashy advertisements and promises of low spreads. However, for the serious investor, the decision must be based on rigorous due diligence rather than marketing hype. Whether you are a seasoned trader looking to switch providers or a novice taking your first steps, selecting the right partner is the single most critical decision you will make. This guide breaks down the essential criteria for choosing a broker that aligns with your financial goals and risk appetite.

1. Regulation and Safety of Funds

The first rule of trading is preservation of capital. Before you even look at spreads or trading platforms, you must verify the broker’s regulatory status. In 2026, the distinction between regulated and unregulated entities is stark.

The Importance of Tier-1 Licenses

A reputable broker will always be authorized by a top-tier regulatory body. In the UK, this is the Financial Conduct Authority (FCA). Other respected regulators include ASIC (Australia) and CySEC (Cyprus). These bodies enforce strict standards, such as segregating client funds from the company’s operating capital. According to Wikipedia, regulatory oversight is the primary defense against fraud in the retail forex market, ensuring that brokers adhere to fair practices and maintain sufficient capital reserves.

Negative Balance Protection

Ensure your broker offers negative balance protection. This feature guarantees that you cannot lose more than your initial deposit. In a market known for its volatility, where gaps can occur over the weekend, this safety net is indispensable for managing your long-term financial health.

2. Trading Costs and Transparency

Every pip counts. Over the course of a year, the difference between a 1-pip spread and a 2-pip spread can amount to thousands of pounds in transaction costs. However, low costs should not come at the expense of execution quality.

Spreads vs. Commissions

Brokers generally operate on two models:

- Commission-Free: You pay no separate fee, but the cost is built into a slightly wider spread.

- Raw Spread/ECN: You get spreads as low as 0.0 pips but pay a fixed commission per lot traded. For high-volume traders and scalpers, the raw spread model often proves cheaper. A leading forex broker will be transparent about these costs, displaying them clearly on their website rather than hiding them in the fine print.

Hidden Fees

Be wary of non-trading fees. Some brokers charge for withdrawals, inactivity, or even currency conversion. Always check the “banking” or “funding” section of the broker’s site to ensure you won’t be penalized for moving your own money.

3. Execution Speed and Infrastructure

In 2026, technology is the great equalizer. The speed at which your order travels from your terminal to the market can determine whether you make a profit or suffer “slippage” (getting filled at a worse price than expected).

Dealing Desk (DD) vs. No Dealing Desk (NDD)

- Market Makers (DD): These brokers take the other side of your trade. While they offer stable spreads, there is an inherent conflict of interest.

- NDD/STP Brokers: These brokers route your orders directly to liquidity providers (banks, hedge funds). This model is generally preferred by professional traders as it ensures transparency and faster execution without human intervention.

Platform Stability

Does the broker offer industry-standard platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader? Proprietary platforms can be good, but they often lack the advanced customizability of established software. Ensure the platform has a track record of stability during high-impact news events.

4. Range of Markets and Instruments

While your primary focus might be forex, a diversified portfolio is key to risk management. The best brokers in 2026 act as multi-asset gateways.

Beyond Currency Pairs

Look for a broker that offers access to:

- Commodities: Gold, Silver, Oil.

- Indices: S&P 500, FTSE 100, DAX.

- Shares: Access to global equities. Having all these assets under one roof allows you to hedge your positions. For example, if the USD weakens, you might want to long Gold. Being able to do this instantly on the same account is a massive logistical advantage.

5. Customer Support and Education

Even the best technology fails occasionally, and you will eventually have a question. When that happens, you need immediate answers.

24/7 Availability

The forex market runs 24/5, and crypto markets run 24/7. Your broker’s support should match these hours. Test their live chat before you sign up. Do they answer in seconds, or are you stuck in a queue?

Educational Resources

A broker invested in your success will provide educational tools. Look for webinars, daily market analysis, and tutorials. Furthermore, understanding risk and return is fundamental to your survival in the markets; a good broker will provide resources that help you grasp these concepts rather than just encouraging you to trade blindly.

Conclusion: Making the Final Call

Choosing a forex broker is not a decision to be rushed. It requires balancing cost, safety, and technological capability. By focusing on regulated entities that offer transparent pricing and NDD execution, you set a solid foundation for your trading career. Remember, the goal is not just to find a place to trade, but to find a partner that facilitates your growth as an investor. Take your time, test their demo accounts, and ensure they meet the high standards required for trading in 2026.

Business

Siemens Energy AG 2026 Q1 – Results – Earnings Call Presentation (OTCMKTS:SMNEY) 2026-02-11

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Clear Channel Outdoor to be Acquired by Mubadala

Out-of-home advertising company Clear Channel Outdoor Holdings agreed to be sold to Mubadala Capital, in partnership with TWG Global, in a deal with a $6.2 billion enterprise value.

The transaction is worth $2.43 a share. Clear Channel shares closed at $2.19 on Monday and rose 5% after hours. The company said the deal provides a 71% premium to the unaffected share price of Oct. 16, the last trading day before media reports about a potential deal.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech7 hours ago

Tech7 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World19 hours ago

Crypto World19 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition