Crypto World

Banks push OCC to curb crypto trust charters until GENIUS rules clear

The American Bankers Association is pressing the Office of the Comptroller of the Currency to slow the wheel on national trust bank charters for crypto and stablecoin firms until key questions around the GENIUS Act, which would reshape U.S. stablecoin regulation, are settled. In a recent comment letter responding to the OCC’s notice of proposed rulemaking on national bank charters, the ABA warned that the sector’s regulatory picture remains fragmented across federal and state authorities. The trade group argued that advancing applications now could leave uninsured, digital-asset‑focused trusts exposed to unresolved safety, operational, and resolution issues, even as the industry connects customer assets to federally chartered platforms.

The ABA’s critique centers on the risk that a patchwork of oversight can create gaps for entities that manage crypto and stablecoins. The letter contends that until forthcoming GENIUS Act rulemakings lay out clear regulatory obligations, it would be prudent for the OCC to pause or slow down approvals. The GENIUS Act, which aims to streamline or redefine how digital assets fit into the U.S. banking framework, has not yet produced a settled regulatory map. Without that clarity, the ABA argues, banks seeking charters could face obligations that are not yet defined, complicating risk management and supervisory expectations for these new structures.

Beyond governance, the association underscored distinct safety and soundness concerns tied to uninsured, digital-asset‑focused national trusts. Chief among them are questions about how customer assets are segregated and protected, potential conflicts of interest, and the cyber safeguards necessary to withstand sophisticated threats. The letter points to the possibility that uninsured digital-asset trusts could be used to sidestep traditional registration and scrutiny by agencies such as the SEC or CFTC when activities would ordinarily trigger securities or derivatives regulation. The overarching worry is that these charters could become a back door to bypass comprehensive, integrated oversight.

The ABA’s stance comes as the OCC has recently moved to greenlight a path for several crypto firms to hold and manage customer digital assets under a federal charter while staying outside the deposit-taking and lending business. In December 2025, the OCC granted conditional national trust bank approvals to five notable players: Bitgo Bank & Trust, Fidelity Digital Assets, Ripple National Trust Bank, First National Digital Currency Bank, and Paxos Trust Company. This sequence—clear progress followed by calls for prudence—has amplified calls from industry observers and policymakers to align new models with robust regulatory guardrails.

As the regulatory dialogue intensifies, the broader banking lobby has amplified its push for Congress to act. Proposals such as the Digital Asset Market Clarity (CLARITY) Act have gained attention for attempting to curb the appeal of stablecoin rewards and other yield-bearing programs that could blur the line between traditional banking products and crypto offerings. At the same time, coverage of GENIUS Act proposals has underscored the tension between innovation and prudential supervision. The industry’s worry is that without a unified framework, chartered entities could be forced into a regulatory limbo where consumer protection and financial stability are not fully safeguarded.

While the ABA’s letter emphasizes caution, the OCC’s recent actions reflect a different facet of the ongoing balancing act: enabling regulated access to digital assets under a federal charter while attempting to avoid the full deposit-taking framework. The OCC’s stance has drawn support from some voices within the crypto sector who argue for clear, uniform standards that would prevent a fragmented patchwork of state-by-state approaches. The debate also intersects with ongoing discussions about how to treat banks and crypto similarly or differently, a point highlighted by industry and regulatory leaders alike. A separate OCC statement and related commentary have argued that there is no justification to treat banks and crypto differently; the underlying question remains how to translate those principles into enforceable, uniform rules across multiple agencies.

Warning after new crypto trust charters

The timing of the ABA’s intervention is notable: it follows the OCC’s conditional approvals announced earlier in December 2025 that would allow these firms to hold and manage customer digital assets under a federal umbrella while remaining out of the deposit-taking and lending business. The OCC described these structures as national trusts designed to segregate digital assets and provide custody capabilities without converting to traditional banking operations. The five charter recipients—Bitgo Bank & Trust, Fidelity Digital Assets, Ripple National Trust Bank, First National Digital Currency Bank, and Paxos Trust Company—represent a cross-section of the market and reflect a broader appetite to experiment with federal oversight in the crypto custody space. The OCC’s action signals a potential pathway for regulated custody of digital assets, even as lawmakers and industry groups push for clarifying legislation and more precise supervisory expectations.

The push for governance clarity is not happening in a vacuum. Industry participants and lawmakers alike have been weighing proposals like GENIUS Act and CLARITY Act, which seek to define the boundaries of crypto activities within the traditional banking regime and curb practices that could be mischaracterized as bank-like products without full bank regulation. The evolving regulatory mosaic poses a dilemma for firms seeking charters: how to align innovative custody models with a robust, predictable framework that ensures customer protection and systemic stability—without dampening the competitiveness and speed of financial-technology innovation.

As regulatory scoping continues to evolve, observers note that the OCC’s framework for conditional approvals to national trust charters could have meaningful implications for market structure, consumer safeguards, and the scope of permissible activities for non-deposit-taking digital asset custodians. The tension between fostering innovation and ensuring a resilient financial system remains at the heart of the debate. Several pieces of legislation and policy proposals that would influence this trajectory are already in circulation, reinforcing the sense that 2026 could be a critical year for how crypto custody and stablecoins are governed at the federal level.

Why it matters

For investors, the ongoing regulatory clarifications affect risk assessment and the perceived legitimacy of crypto custody solutions. A formal, well-defined regulatory framework could reduce ambiguity around the protections afforded to customer assets held by uninsured digital-asset trusts and influence risk pricing for associated products. For builders and operators, clear rules can help map out feasible business models that align with capital, governance, and risk-management expectations. And for policymakers, the interplay between GENIUS Act provisions, banking supervision, and securities/derivatives regulation underscores a key objective: ensuring that innovation remains aligned with financial stability and consumer protection.

From a market structure perspective, the debate highlights how custody and settlement infrastructures could evolve under federal oversight. If the OCC’s conditional trust charters become a common feature, watchers will be looking for transparency around capital requirements, resilience standards, and the safeguards that would prevent consumer confusion—especially around institutions that use “bank” in their names for branding purposes despite not engaging in traditional banking activities. The industry’s insistence on naming rules reflects a broader concern about trust and clarity in a landscape where digital assets can be held by entities operating under a federal umbrella but without full deposit-taking powers.

Meanwhile, the GENIUS Act and related proposals continue to shape the policy dialogue on stablecoins and digital assets within the U.S. financial system. As the regulatory math evolves, the market will be watching how agencies interpret and implement these concepts in real-world chartering decisions. The balancing act remains: enable responsible innovation in custody and settlement while preserving a robust, transparent, and enforceable supervisory regime that protects consumers and maintains market integrity.

What to watch next

- OCC’s formal response to the ABA comment letter and any adjustments to the proposed rulemaking timeline.

- Developments in GENIUS Act rulemaking and any accompanying guidance that clarifies obligations for crypto custody under national bank charters.

- Details on the five crypto firms granted conditional national trust charters, including milestones for capital, risk controls, and asset segregation.

- Legislative progress on the CLARITY Act and related measures that would influence stablecoin governance and disclosure requirements.

Sources & verification

- The ABA letter to the OCC regarding national bank chartering (PDF).

- OCC press release: conditional national trust bank approvals for Bitgo Bank & Trust, Fidelity Digital Assets, Ripple National Trust Bank, First National Digital Currency Bank, and Paxos Trust Company (nr-occ-2025-125.html).

- OCC updates on GENIUS Act-related rulemaking and related policy discussions cited in industry coverage.

- Cointelegraph reporting on the OCC’s stance toward treating banks and crypto equally and the broader lobbying around the GENIUS Act and related reforms.

What the ABA letter says, in context

The ABA’s position centers on prudence and transparency. The association argues that the OCC should resist rushing charter approvals for entities handling uninsured customer funds in crypto and stablecoin operations until the GENIUS Act rulemakings are fully defined and integrated into a coherent supervisory framework. It emphasizes that without a clear, comprehensive set of obligations, chartered entities could encounter undefined capital, operational resilience, and customer-protection standards. The letter calls for greater clarity on how capital and resilience benchmarks will be calibrated in conditional approvals and presses for tighter naming rules to prevent consumer confusion when entities use “bank” in their branding, despite not engaging in traditional banking activities. The overarching theme is to align innovation with robust safeguards and to keep deposit-empowered banks as the reference point for consumer protections and risk management.

Key figures and next steps

As the regulatory conversation continues, observers will be watching a trio of developments: the OCC’s formal responses to stakeholder comments, the progression of GENIUS Act rulemaking, and the practical implications of the five conditional charter approvals already granted. The dialogue around whether banks and crypto should be treated differently is likely to persist, but the current emphasis appears to be on ensuring that any new chartering framework provides explicit obligations and strong oversight. With policy and industry stakeholders navigating these questions, the coming months could define how crypto custody, stablecoin issuance, and related digital-asset activities are integrated into the U.S. banking system on a long-term, predictable basis.

Crypto World

Digital assets exchange-traded product landscape: past, present and future

In today’s newsletter, Joshua De Vos, head of research at CoinDesk, summarizes their latest crypto ETF report covering U.S. adoption, the speed at which it’s happening and asset concentration.

In Keep Reading, we link to the U.S. and Global ETF reports for those who want to do a deeper dive.

Digital assets exchange-traded product landscape: past, present and future

Crypto for Advisors – February – Digital Asset ETPs

Digital asset Exchange-Traded Products (ETPs) are now one of the clearest signals of how quickly crypto is being integrated into traditional portfolio infrastructure. As presented in CoinDesk’s latest research report, the market has moved beyond the early phase of fragmented access and into a period where regulated wrappers and exchange-traded fund (ETF) distribution are materially shaping how capital enters the asset class.

The state of crypto ETP adoption

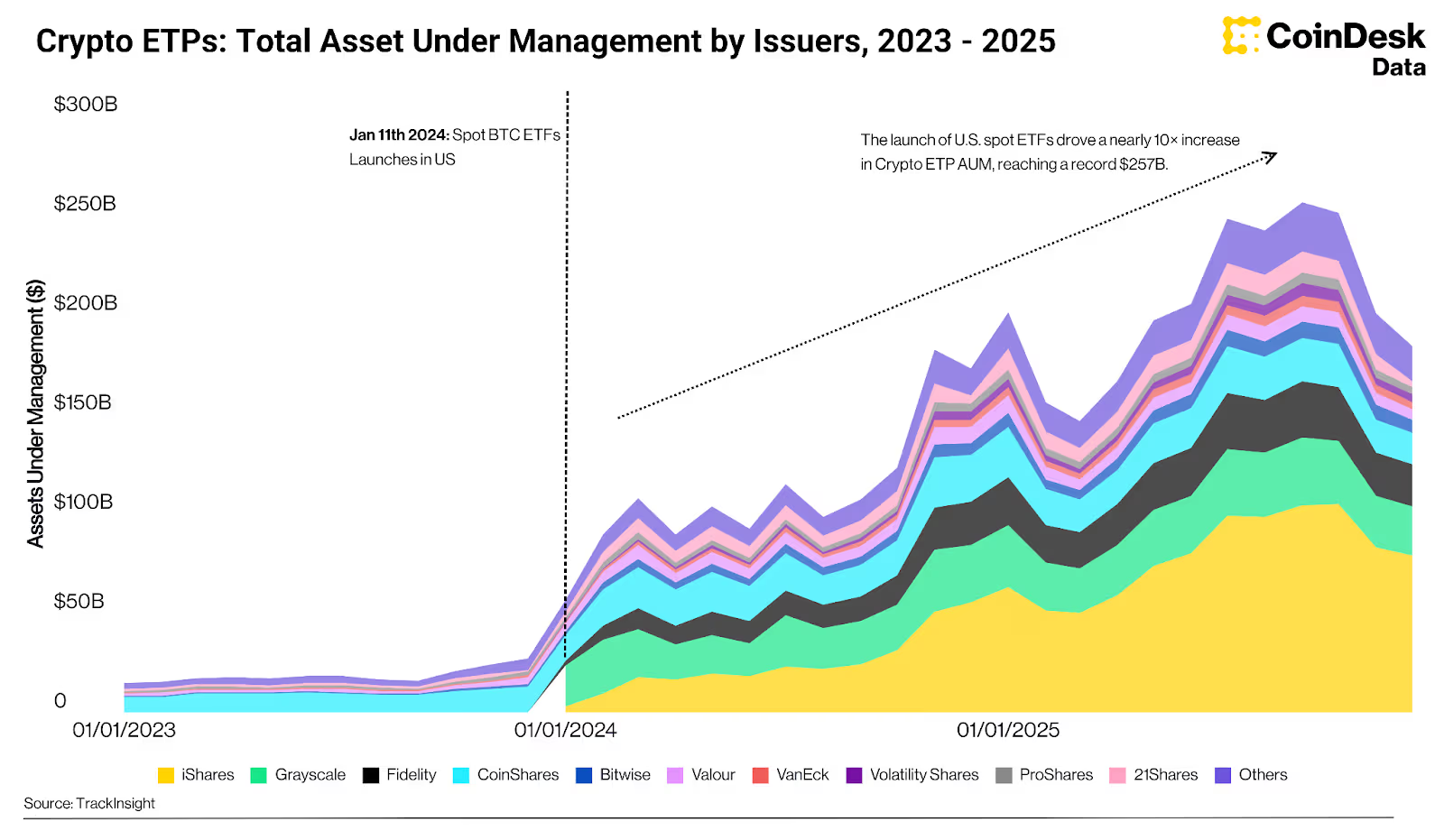

As of the end of 2025, crypto ETP assets under management (AUM) reached $184 billion. The United States remains the center of gravity, accounting for approximately $145 billion, or close to 80% of global assets AUM. ETFs dominate the product landscape, representing 84.6% of crypto structured products by assets. The market is also heavily skewed toward simple exposure. Around 94.1% of crypto ETPs employ a delta-one strategy, and 96.1% are passively managed.

The growth in AUM has been driven primarily by the launch of U.S. spot bitcoin ETFs in January 2024. The step-change was immediate. The launch cycle pushed crypto ETP assets sharply higher and created a product category that now sits inside the same ETF allocation frameworks used across equities, fixed income and commodities.

The pace of adoption has also been unusually fast when compared to earlier ETF cycles. U.S. bitcoin ETFs reached $100 billion in assets in just 11 months, while U.S. gold ETFs took nearly 16 years to surpass the same milestone. By early 2025, bitcoin ETFs had matched 91% of the top 10 U.S. gold ETFs by AUM, before gold’s subsequent rally widened the gap. This is less a statement about relative value and more a statement about how quickly bitcoin has been absorbed into institutional distribution channels once the wrapper became available.

Scale and concentration

Within the crypto ETP market, exposure remains heavily concentrated. Bitcoin-based products account for $144 billion in AUM, representing 78.2% of total AUM. Ether-based products have reached $26.5 billion, indicating that institutional demand is gradually broadening beyond bitcoin. Outside of those two assets, exposure remains limited. Solana- and XRP-linked products manage $3.8 billion and $3.0 billion respectively, while multi-cryptocurrency ETPs represent 0.62% of total AUM, or $2.16 billion.

The pipeline broadens

This hierarchy is consistent with how ETF markets typically develop. Institutions tend to begin with the most liquid assets, in the most established structures, before expanding into broader exposure as markets deepen and benchmarks standardise. That dynamic is now beginning to appear in the crypto ETP pipeline. As of end-2025, more than 125 digital asset ETP filings were pending, with bitcoin continuing to lead the filing landscape, followed by XRP and Solana as the most active single-asset categories.

The other notable development is the growing momentum behind basket products. Multi-cryptocurrency ETPs remain a small segment by AUM, but they represent the second most active category by number of pending filings. This matters because basket products tend to become more relevant as markets mature, correlations evolve and concentration risk becomes more apparent. Indices such as the CoinDesk 5 and CoinDesk 20 are increasingly being used as reference points for ETPs, structured notes and derivatives, reflecting the market’s gradual shift toward diversified exposure.

Advisor access

The expansion of crypto ETPs has also occurred before broad adoption across major advisory platforms. Many large advisors remain in evaluation or early allocation phases, suggesting current AUM reflects initial positioning rather than full participation. That is beginning to change, with firms such as Vanguard only recently expanding client access to crypto ETFs.

Looking ahead, the scale of the global ETF market provides context for how large the category could become. Global ETF and ETP assets are projected to grow to roughly $30 trillion by 2030. Within that framework, even modest allocation decisions have the potential to translate into a materially larger crypto ETP market over time.

This summary was created based on CoinDesk Research’s latest report; Digital Assets ETP Landscape: Past, Present and Future.

– Joshua De Vos, research team lead, CoinDesk

Keep Reading

Read the full global and U.S. ETF reports here:

Crypto World

Flipster FZE Secures In-Principle Approval from VARA, Reinforcing Commitment to Regulated Crypto Access

[PRESS RELEASE – Dubai, UAE, February 12th, 2026]

Flipster, a global cryptocurrency trading platform, has received in-principle approval from Dubai’s Virtual Assets Regulatory Authority (VARA) under Flipster FZE. The approval is a key milestone in Flipster’s expansion into the Middle East and reinforces its focus on building safe, compliant access to digital assets in regulated markets.

The in-principle approval allows Flipster FZE to progress toward offering regulated virtual asset services under VARA’s framework, with spot trading as the initial offering. It reflects Flipster’s long-term strategy to operate within established regulatory frameworks in key global markets.

“This milestone is a meaningful vote of confidence in our long-term commitment to the region,” said Benjamin Grolimund, General Manager at Flipster FZE. “The Middle East has become a blueprint for how digital assets should be regulated and adopted. VARA’s clear framework enables innovation while prioritizing trust and security — and we’re committed to building trading solutions that meet the highest standards globally.”

Flipster’s regulatory progress is matched by its continued enhancement of its compliance infrastructure. The platform’s partnership with Chainalysis enhances its capabilities in transaction monitoring and risk management — supporting Flipster’s readiness to meet VARA’s regulatory standards and operate with greater accountability and oversight.

Flipster first announced its entry into the Middle East in May 2025, with the appointment of Benjamin Grolimund, a seasoned fintech executive with prior leadership roles at Rain and Bloomberg. The UAE’s regulatory clarity and maturing digital asset ecosystem continue to position it as a strategic base for Flipster’s global growth plans.

About Flipster FZE

Flipster FZE is a regulated digital asset exchange planning to offer spot trading across leading cryptocurrencies. The platform is engineered for dependable execution, transparent pricing, and a streamlined user experience.

With a strong emphasis on compliance and security, Flipster provides users with a trusted venue to access digital asset markets with confidence.

Users can learn more at flipster.io or follow X.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum price nears oversold zone as ETH staking metric hits key milestone

Ethereum price remained in a bear market as the crypto market continued to weaken ahead of the U.S. consumer inflation report.

Summary

- Ethereum price has moved into a bear market after falling by 60% from its all-time high.

- The Relative Strength Index is approaching the oversold level.

- Ethereum’s staking ratio has jumped to a record high of 30%.

Ethereum (ETH) dropped to $1,985, down by 60% from its highest level in August last year. This is the token’s fourth consecutive week in the red, a move that has shed billions of dollars in value.

Ethereum’s price retreated as demand for its ETFs and futures open interest declined. Data compiled by SoSoValue shows that spot ETH ETFs shed over $129 million in assets on Wednesday, bringing the monthly outflow to over $224 million. It is the fourth consecutive month of outflows, with the cumulative net inflows being $11.75 billion.

More data show that Ethereum’s futures open interest has continued to fall over the past few months. Its open interest dropped to $23 billion, down sharply from last year’s high of over $70 billion. Falling open interest is a sign that investor demand has waned.

However, there are signs that more Ethereum is being moved today to staking pools. Data show that Ethereum staking recently crossed 30% of the total supply for the first time.

More data show that the staking queue has continued soaring in the past few months. There are now over 4 million ETH tokens in the queue waiting to be staked, with less than 25,000 waiting to exit.

Ethereum price prediction: Technical analysis

The weekly timeframe chart shows that the ETH price has been in a strong downward trend in the past few months, moving from $4,950 in August to the current $1,988.

It has crashed below the crucial support level at $2,112, its lowest level in August 2024.

On the positive side, the coin has formed an inverted head-and-shoulders pattern, a common bullish reversal sign in technical analysis.

Also, the Average Directional Index has dropped from 33 in July last year to 21 now, a sign that the downtrend is losing momentum.

Most notably, the Relative Strength Index is nearing the oversold level of 30, its lowest level since April last year. Ethereum has often rebounded whenever the RSI has moved into the oversold zone.

Therefore, as Tom Lee noted, there are signs that Ethereum is about to bottom. If this happens, the next level to watch will be the psychological $2,500 level.

Crypto World

BlackRock’s BUIDL Fund Hits Uniswap as UNI Jumped 40%

UNI surged 40% in minutes after Uniswap enabled trading for BlackRock’s tokenized BUIDL fund via UniswapX integration.

Uniswap’s UNI token jumped about 40% within half an hour, after Uniswap Labs announced that BlackRock’s tokenized money market fund BUIDL can now trade through its protocol.

The move links one of the world’s largest asset managers with a decentralized exchange, drawing attention from traders and institutional watchers alike.

BlackRock Fund Trading Goes Live on Uniswap Rails

In a February 11 press release, Uniswap Labs said it partnered with Securitize to make BlackRock’s USD Institutional Digital Liquidity Fund available for trading via UniswapX, its request-for-quote trading system.

The company stated that investors can swap BUIDL with approved counterparties at any time using smart contracts for settlement.

Hayden Adams, CEO of Uniswap Labs, said the integration aims to make markets cheaper and faster, while Securitize CEO Carlos Domingo said it brings traditional financial standards to blockchain-based trading.

BlackRock’s global head of digital assets, Robert Mitchnick, called the launch “a notable step” for tokenized funds interacting with decentralized finance systems. The asset manager also confirmed it has made an investment within the Uniswap ecosystem, though it did not disclose the amount or whether it bought UNI tokens.

Market reaction followed quickly, with UNI rising by more than 40% in about 30 minutes to touch $4.57 after the announcement and news of BlackRock’s involvement spread across trading desks.

You may also like:

As of the latest CoinGecko data, the excitement around the token seems to have petered down somewhat, with UNI now trading near $3.40, which is still up about 5% over 24 hours.

Despite the short-term jump, the token is still down about 9% over seven days and more than 35% in the past month, showing that the spike came after a longer decline.

Tokenized Assets Keep Drawing Major Finance Firms

The integration builds on a wider trend of institutions putting financial products on public blockchains. Earlier in the year, the official Ethereum account on X noted that 35 major firms, including BlackRock, JPMorgan, and Fidelity, have launched services tied to the network. Those projects range from tokenized stocks and funds to stablecoins and deposit tokens.

Securitize, which manages more than $4 billion in assets, has worked with asset managers such as Apollo, KKR, and BNY to tokenize funds. By linking its compliance-focused platform with Uniswap’s trading system, the companies are testing a structure where regulated investors can access blockchain liquidity while remaining within whitelisted environments.

UNI’s recent price swings show how closely traders track institutional activity tied to decentralized finance.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tom Lee Says Ethereum Has Never Failed This Pattern and Expects Another V-Shaped Recovery

BitMine bought roughly $83 million in ETH this week, even as Ethereum struggles to reclaim $2,000-mark.

Ethereum has remained volatile since October, while the sell-off intensified over the last month. Fundstrat head of research Tom Lee said investor frustration around the leading altcoin’s recent weakness overlooks a long and consistent historical pattern of sharp declines followed by equally rapid recoveries.

In fact, he believes that the bottom is near.

Ethereum Near the Bottom?

While speaking at a conference in Hong Kong this week, Lee said that since 2018, Ethereum has experienced drops of more than 50% on eight different drawdowns, including a steep 64% fall between January and March last year. In every one of those instances, ETH formed a “V-shaped bottom,” recovering fully and doing so at roughly the same pace as its decline. From his perspective, this track record indicates that the current drawdown does not represent any change in Ethereum’s outlook, and he expects another V-shaped bottom to emerge following the latest sell-off.

Lee also cited BitMine market analyst Tom DeMark’s assessment, who believes Ethereum may need to revisit the $1,890 level to form a “perfected bottom.” Lee added that, based on BitMine’s assessment, ETH appears to be very close to such a bottom, as he drew parallels to previous downturns in late 2018, late 2022, and April 2025.

While Lee refrained from pinpointing the exact low, he argued that the magnitude of the decline itself is more important, and that investors should be thinking in terms of opportunity rather than offloading their stash.

“If you have already seen a decline, you should be thinking about opportunities here instead of selling.”

BitMine Is Buying

His comments came as Ether prices fell to $1,760 on February 6, as it approached the 2025 low of almost $1,400. So far, ETH has continued to struggle to reclaim the $2,000 level after a more than 36% drop over the past 30 days. As weakness in the market continues, BitMine, the ETH-focused treasury firm chaired by Lee, purchased roughly $83 million worth of ETH this week.

It executed two large buys of 20,000 ETH each via institutional platforms BitGo and FalconX, even as its existing holdings remained significantly underwater.

You may also like:

Meanwhile, the drawdown has already led to large-scale portfolio adjustments. For instance, Trend Research, a trading firm led by Liquid Capital founder Jack Yi, fully exited its Ethereum positions and closed what was once Asia’s largest ETH long. The firm had built roughly $2.1 billion in leveraged ETH exposure but ultimately realized losses of about $869 million after unwinding its positions despite Yi reiterating a bullish long-term outlook just days earlier.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Standard Chartered sees bitcoin (BTC) sliding to $50,000, ether (ETH) to $1,400 before recovery

Investment bank Standard Chartered lowered its short-term and full-year price forecasts for major cryptocurrencies, citing continued downside risk as exchange-traded fund (ETF) outflows and a challenging macro backdrop pressure the market.

The bank now expects bitcoin to fall to around $50,000 in the coming months, with ether potentially bottoming near $1,400.

The world’s largest cryptocurrency was trading around $67,900 at publication time. Ether, the second-largest, was trading around $1,980.

Geoff Kendrick, Standard Chartered’s head of digital assets research, said the selloff in recent weeks could extend as ETF investors, many sitting on losses, are more likely to reduce exposure than “buy the dip.”

Once prices establish a bottom, Kendrick said, he expects a recovery through the rest of 2026. The analyst reduced his year-end target for bitcoin to $100,000 from $150,000, ether to $4,000 from $7,500, solana to $135 from $250, BNB Chain to $1,050 from $1,755 and to $18 from $100.

The crypto market has weakened sharply in early 2026, with major assets like bitcoin sliding significantly from late-2025 highs and the total market cap down sharply over recent weeks. Bitcoin has dropped almost 23% since the start of the year.

The downturn has been marked by heightened volatility, large liquidations of leveraged positions and broad risk-off sentiment, which has seen crypto correlate more closely with weakening equity markets.

Macro pressures such as concerns about global growth and interest-rate outlooks have pushed investors toward traditional havens like gold, while stalled regulatory clarity, particularly in the U.S., and liquidity strains at some institutions have weighed on confidence. Combined, these forces have led to reduced trading revenues for crypto-exposed firms and bearish sentiment across many tokens.

Holdings of bitcoin ETFs have declined by nearly 100,000 BTC from their October 2025 peak, according to Kendrick. The average ETF purchase price is around $90,000, leaving many investors with unrealized losses of roughly 25%.

Macro conditions are also weighing on sentiment. Kendrick noted that while U.S. economic data show signs of softening, markets expect no interest-rate cuts before Kevin Warsh’s first Federal Open Market Committee meeting as Federal Reserve chair in mid-June, limiting near-term support for risk assets.

Despite the expected capitulation, the bank said the current drawdown is less severe than previous cycles. At its worst point in early February, bitcoin was down about 50% from its October 2025 all-time high, and roughly half of supply remained in profit, declines that are sharp but not as extreme as in prior downturns.

Crucially, this cycle has not seen the collapse of major crypto platforms, unlike 2022’s failures of Terra/Luna and FTX. Kendrick said that suggests the asset class is maturing and more resilient.

The analyst left his longer-term projections unchanged, maintaining end-2030 targets of $500,000 for bitcoin and $40,000 for ether, arguing that usage trends and structural drivers remain intact.

The analyst previously reduced his bullish bitcoin forecasts in December.

Read more: Standard Chartered Throws in the Towel on Bullish Bitcoin Forecast

Crypto World

BYDFi Joins Solana Accelerate APAC at Consensus Hong Kong

VICTORIA, Seychelles, February 12, 2026 — Global crypto trading platform BYDFi participated as a sponsor of Solana Accelerate APAC at Consensus Hong Kong 2026, held alongside Consensus Hong Kong at the Hong Kong Convention and Exhibition Centre. The combined gathering brought founders, institutions, policymakers, and builders together, highlighting Hong Kong’s role as a leading regional hub and a key meeting point for Web3 and blockchain innovation.

BYDFi at Solana Accelerate APAC in Hong Kong

Solana Accelerate APAC convened the Solana community and broader crypto ecosystem around the future of internet capital markets and onchain innovation, set against the backdrop of a global financial center known for clear frameworks and active market participation. BYDFi’s participation marked a first deeper step into Solana-focused programming and community dialogue. Discussions also reflected ongoing market focus on crypto regulation Hong Kong and crypto licensing Hong Kong.

During the event, the BYDFi team was on site to meet attendees, share product context, and distribute limited merchandise, including Newcastle United co-branded items as part of BYDFi’s ongoing brand collaboration with the club. The booth saw strong foot traffic throughout the day.

What BYDFi Is Sharing in Hong Kong

BYDFi used the event to share how a CEX + DEX dual-engine approach can support clearer participation across venues and workflows, particularly for users who want both centralized liquidity and onchain discovery in one connected experience. MoonX, BYDFi’s onchain trading engine, supports Solana and is designed to help users track and navigate fast moving onchain markets with a workflow built for speed, signal clarity, and execution efficiency.

In parallel, BYDFi highlighted reliability foundations that support long term trust in volatile markets, with an emphasis on operational safeguards and service responsiveness. These include over 1:1 Proof of Reserves with periodic public reporting, an 800 BTC Protection Fund, and 24/7 multilingual customer support with timely responses across official channels, including social media.

Why This Matters for BYDFi and the Solana Ecosystem

Solana Accelerate APAC brought ecosystem builders and market infrastructure discussions into the same orbit. BYDFi’s participation centered on two goals: listening closely to Solana-native users and teams, and exploring deeper collaboration opportunities that can strengthen product coverage, user experience, and market access as the crypto market continues to mature.

Michael, Co-Founder and CEO of BYDFi, said: Solana Accelerate APAC creates the right setting for practical conversations between builders, market participants, and policymakers. BYDFi joined to learn, connect, and contribute in a way that holds up over time. Reliability is built through consistent infrastructure, clear safeguards, and responsive support, and BYDFi will continue strengthening all three as engagement across the Solana ecosystem deepens.

About BYDFi

Founded in 2020, BYDFi now serves over 1 million users across 190+ countries and regions. BYDFi is Newcastle United’s Exclusive Official Crypto Exchange Partner. Recognized by Forbes as one of the Best Crypto Exchanges In Canada For 2026, BYDFi offers intuitive, low-fee trading across Spot and Perpetual Contracts to Copy Trading, and Automated Crypto Trading Bots, empowering both new and experienced traders to navigate digital assets with confidence.

BYDFi is dedicated to delivering a world-class crypto trading experience for every user.

BUIDL Your Dream Finance.

Twitter( X ) | LinkedIn | Telegram | YouTube | TikTok | How to Buy on BYDFi

Crypto World

Solana Price Prediction: SOL Faces $42 Target as Head-and-Shoulders Pattern Emerges

The price of Solana (SOL) is teetering on the edge of a major technical breakdown today.

After plummeting 42% over the last 30 days and testing two-year lows, analysts warn that a massive head-and-shoulders pattern on the monthly chart signals a potential freefall.

If support fails, there might be no further support until the price hits $30.

Solana is currently stuck in a “make-or-break” juncture.

Sitting at approximately $82, the token has erased billions in market value, reflecting a staggering 72% loss from its ATH of $293 in January 2025. While typical market corrections are expected, this downward spiral has validated a classic head-and-shoulders bearish structure across its chart from April 2025 to February 2026.

For traders assessing the damage, whether SOL is one of the best cryptos to buy now might depend on whether key support levels can hold against this macro pressure.

Solana Price Prediction: Does the Head-and-Shoulders Pattern Indicate Imminent Collapse?

Is the bottom in, or is the pain just starting? The charts paint a grim picture.

Pseudonymous X crypto analyst “Shitpoastin” highlighted that a massive head-and-shoulders (H&S) pattern has formed on the monthly chart. This specific setup is notorious in technical analysis for signaling prolonged downturns.

Analyst Bitcoinsensus confirmed a breakdown from this macro structure, projecting a downside target as low as $50 per SOL.

Other market watchers are even more bearish. Analyst Alex Clay flagged an aggressive target of $42, a level that aligns with a long-watched demand zone from previous cycles. This represents a potential further downside of nearly 50% from current levels.

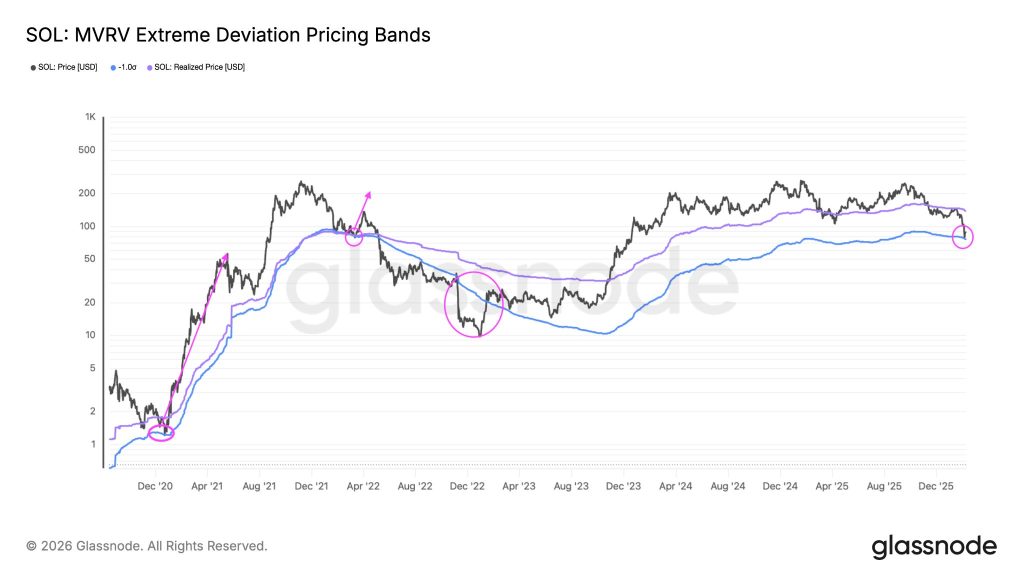

However, it is not all doom and gloom. Solana’s MVRV extreme deviation bands suggest a potential floor at $75. Historically, SOL has staged rallies, like the 87% bounce in March 2022, after testing these lower boundaries.

Discover: Best crypto to buy for portfolio diversification

What Traders Should Watch Next

If you are holding SOL, the $75 level is your line in the sand.

A decisive daily close below this support could trigger the secondary phase of the correction, mirroring the catastrophic drops seen during the 2022 crashes. This would likely open the floodgates toward the $30 to $42 range mentioned by analysts.

Despite the price carnage, Solana’s network activity remains high, with fee revenue nearly doubling Ethereum’s recently.

Divergences between price and fundamentals often create opportunities to buy the best crypto, but only for traders who wait for confirmation.

Watch for a reclaim of $100 to invalidate the bearish thesis. Until then, the head-and-shoulders pattern dictates caution.

Discover: The best meme coins on Solana today

The post Solana Price Prediction: SOL Faces $42 Target as Head-and-Shoulders Pattern Emerges appeared first on Cryptonews.

Crypto World

Is XRP Ready to Blast Off? 3 Signs the Ripple Bulls Are Back

Here’s what signals that XRP’s bears might step back soon.

The latest market downtrend has not been kind to Ripple’s XRP, whose price slipped by nearly 25% over the past two weeks.

However, some key factors suggest the bulls may soon regain control.

Rally on the Way?

Last week, Ripple’s cross-border token fell to almost $1.10, its lowest point since November 2024. In the following days, it recovered from the sharp decline and currently trades at roughly $1.40, still well below the levels seen in previous months.

Certain elements, including the XRP exchange reserves, suggest that a further revival could be on the horizon. According to CryptoQuant’s data, the amount of coins stored on Binance recently fell to approximately 2.55 billion, the lowest mark since the beginning of 2024. As of this writing, the reserves on that particular platform stand at around 2.57 billion XRP, or quite close to the local bottom.

This trend indicates that investors have been shifting from centralized trading venues to self-custody methods, which in turn reduces immediate selling pressure.

The spot XRP ETFs are the next bullish factor on the list. Recall that the first such product in the USA, which has 100% exposure to the asset, saw the light of day in November 2025. It was introduced by Canary Capital, whereas shortly after, Bitwise, Franklin Templeton, 21Shares, and Grayscale did the same.

The investment vehicles have seen solid demand, with total cumulative net inflows surpassing $1.23 billion. The last negative daily netflow occurred on January 29, meaning institutional investor appetite remains high.

You may also like:

Some technical setups also hint that XRP could make a decisive move to the upside soon. X user Niels spotted the formation of an “inverse head and shoulder pattern” on the token’s price chart. The configuration consists of three bottoms, with the middle being the lowest, and a “neckline” that connects the highs between the dips.

Analysts believe a breakout above the “neckline” could fuel a substantial pump. Niels, for instance, claimed that a jump above the $1.44 level might be that spark.

Something for the Bears

It is important to note that the environment of the broader crypto market remains predominantly bearish, so a renewed downtrend for many leading digital assets (including XRP) in the near future is not out of the question.

XRP’s Relative Strength Index (RSI) also suggests that the bulls may have to take another blow soon. The technical analysis tool measures the speed and magnitude of recent price changes and is often used by traders to identify potential reversal points.

It ranges from 0 to 100, and readings above 70 signal that the asset is overbought and due for a pullback. In contrast, anything below 30 is considered a buying opportunity. Data shows that XRP’s RSI currently stands at around 72.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

UNI price jumps as BlackRock’s BUIDL token lists on Uniswap, but risks remain

- Uniswap (UNI) price surged on BUIDL news but quickly pulled back as momentum faded.

- Institutional access boosts Uniswap’s profile but remains tightly restricted.

- Whale activity before the news raised insider trading concerns.

Uniswap’s UNI token experienced a sharp price surge after the announcement of the listing of BlackRock’s BUIDL token on the protocol.

UNI briefly rallied toward the $4.50 region before losing momentum and pulling back, reflecting a mix of excitement and caution among traders.

Alongside the optimism, concerns have emerged that could limit sustained upside for the UNI price.

BlackRock’s BUIDL listing on Uniswap brings institutional credibility

BlackRock’s BUIDL token is a treasury-backed, tokenised money market fund designed for institutional investors.

By enabling BUIDL to be traded through Uniswap’s infrastructure, the protocol has taken a significant step toward hosting real-world assets on-chain.

This integration relies on a request-for-quote model rather than open liquidity pools, reflecting the compliance needs of large financial institutions.

Only whitelisted market makers and qualified investors are allowed to participate in these trades.

As a result, the integration showcases Uniswap as an execution and settlement layer rather than a fully permissionless marketplace in this case.

For UNI holders, the announcement strengthened the narrative that Uniswap can benefit from institutional adoption without changing its core architecture.

The market responded quickly, pushing UNI higher as traders priced in potential long-term fee growth and relevance.

UNI price surge followed by a pullback

UNI’s rapid surge was followed by an equally notable pullback, suggesting many traders treated the rally as a short-term opportunity rather than a structural shift in valuation.

Volume spiked sharply during the surge, indicating aggressive positioning from both buyers and sellers.

Then, soon after, selling pressure increased as the price failed to hold above key resistance levels.

The pullback has returned UNI closer to its recent trading range, despite the significance of the announcement.

This behaviour reflects a market that is still cautious about translating institutional experiments into lasting token value.

It also highlights that Uniswap’s fundamentals, while improving, remain exposed to broader crypto market sentiment.

Insider trading concerns

Adding complexity to the situation were reports of large UNI movements shortly before the BlackRock-related news became public.

A long-dormant whale wallet reportedly moved millions of UNI tokens after years of inactivity.

Shortly before #BlackRock announced plans to buy an undisclosed amount of #Uniswap‘s $UNI token, we noticed something interesting.

A $UNI whale wallet (0x9c98) that had been inactive for 4 years moved 4.39M $UNI($14.75M) to a new wallet (0xf129).https://t.co/fZabEVYlcn… pic.twitter.com/JfFbPP67Da

— Lookonchain (@lookonchain) February 11, 2026

The timing of this transfer raised speculation that some market participants may have had early knowledge of the announcement.

While no evidence confirms wrongdoing, the optics alone were enough to spark debate.

Insider trading concerns can undermine confidence, especially when institutional names are involved.

For regulators and institutional investors, perception matters almost as much as facts.

Any lingering doubts about fairness or information asymmetry could limit follow-through buying.

This risk sits alongside the structural limitation that BUIDL access remains restricted to institutions.

Retail traders may benefit indirectly, but they are not participants in the actual BUIDL market.

Uniswap price forecast

UNI is now trading well below its recent peak, placing technical levels back at the centre of attention.

The first key support zone lies around the $3.20 to $3.30 area, where buyers previously stepped in.

A sustained break below this range could expose UNI to deeper downside toward the psychological $3.00 level.

Below that, the $2.80 to $2.90 region stands out as a major support that aligns with prior consolidation.

On the upside, traders will watch the $3.80 to $4.00 zone as near-term resistance.

A clean move above $4.00 would signal renewed bullish momentum and open the door for a retest of $4.50.

Failure to reclaim these levels would suggest the BlackRock-driven rally has fully cooled.

For now, UNI sits at a crossroads where strong narratives compete with technical weakness.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports15 hours ago

Sports15 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World17 hours ago

Crypto World17 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video12 hours ago

Video12 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

₿ (@Shitpoastin)

₿ (@Shitpoastin)

See you there

See you there