Crypto World

Hedera (HBAR) rises 6.7%, leading index higher

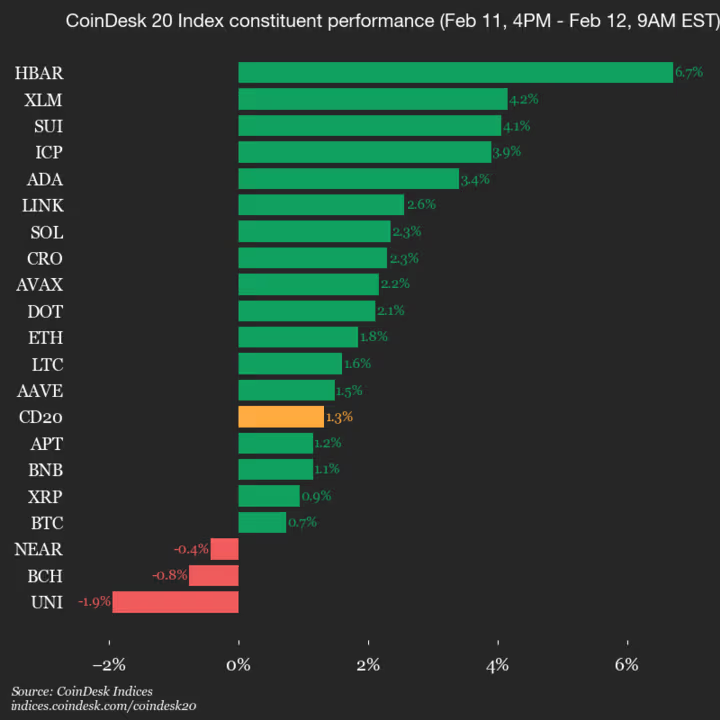

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1943.37, up 1.3% (+25.4) since 4 p.m. ET on Wednesday.

Seventeen of the 20 assets are trading higher.

Leaders: HBAR (+6.7%) and XLM (+4.2%).

Laggards: UNI (-1.9%) and BCH (-0.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Markets Signal Stress as El Salvador Sticks to Its Bitcoin Playbook

Bitcoin’s (BTC) bear market has weighed heavily on investors across the spectrum. Corporate treasuries, major whales, and even nation-state holders have all felt the pressure.

The cryptocurrency’s slide has slashed the value of El Salvador’s holdings as credit default swaps rise to a five-month high, raising concerns over the country’s IMF program and debt outlook.

Sponsored

El Salvador’s Bitcoin Bet Under Pressure as Portfolio Drops

According to the latest data from El Salvador’s Bitcoin Office, the country’s Bitcoin reserves stand at 7,560 BTC, worth approximately $503.8 million. Bloomberg reported that the portfolio’s value has fallen from around $800 million at Bitcoin’s October 2025 peak, marking a drop of nearly $300 million in just four months.

Bukele, an ardent Bitcoin advocate, has continued purchasing one Bitcoin per day. However, this strategy increases the country’s exposure to market volatility.

In contrast, Bhutan recently sold $22.4 million worth of Bitcoin. The divergent strategies of El Salvador and Bhutan reflect fundamentally different risk philosophies.

Bhutan’s Bitcoin mining operations generated more than $765 million in profit since 2019. However, the 2024 Bitcoin halving significantly increased mining costs, compressing margins and reducing returns. Bhutan now appears to be liquidating part of its holdings, while El Salvador continues to prioritize long-term accumulation.

Nonetheless, the country has also diversified its portfolio. Last month, it spent $50 million to acquire gold as demand for the safe-haven metal rose amid macroeconomic tensions.

IMF Loan Talks Face Strain Over El Salvador’s Bitcoin Policy

El Salvador’s deepening commitment to cryptocurrency has impacted relations with the International Monetary Fund. The government’s continued Bitcoin purchases, combined with delays in implementing pension reforms, have complicated the country’s IMF agreement.

Sponsored

The Fund has expressed concern about Bitcoin’s potential impact on fiscal stability. A disruption to the IMF program would weaken one of the key supports behind El Salvador’s sovereign debt recovery. Over the past three years, the country’s bonds have returned more than 130%, making them one of the standout turnaround stories in emerging markets.

“The IMF may take issue with disbursements potentially being used to add Bitcoin. Bitcoin being down also doesn’t help to ease investors’ concerns,” Christopher Mejia, an EM sovereign analyst at T Rowe Price, told Bloomberg.

The IMF approved a 40-month Extended Fund Facility on February 26, 2025, unlocking about $1.4 billion in total, according to official IMF documentation. The first review ended in June 2025, with $231 million disbursed.

However, the second review has remained on hold since September, following the government’s delay in publishing a pension system analysis. During that period, El Salvador continued to add to its Bitcoin reserves despite repeated warnings from the IMF.

Sponsored

A third review is scheduled for March, with each review tied to additional loan disbursements.

“The continued purchase of Bitcoin, in our view, does create some potential challenges for the IMF reviews. The market would react quite poorly if the anchor provided by the IMF were no longer present.” Jared Lou, who helps manage the William Blair Emerging Markets Debt Fund, said.

Meanwhile, bond markets are signaling rising concern over El Salvador’s fiscal outlook. Credit default swaps have climbed to a five-month high, reflecting increasing investor anxiety about the country’s repayment capacity.

According to data compiled by Bloomberg, El Salvador faces $450 million in bond payments this year, with obligations increasing to nearly $700 million next year.

El Salvador’s Bitcoin policy now sits alongside key fiscal and IMF negotiations. The outcome of upcoming IMF reviews and the country’s bond repayment schedule will play a significant role in shaping investor confidence and the sustainability of its debt trajectory.

Crypto World

DeFi’s Role in a Multi-Chain Financial System

For a while, crypto acted like high school cliques. One chain. One tribe. One ecosystem. But finance doesn’t work that way. Capital moves. Liquidity hunts yield. Users want speed, low fees, and security — not ideology.

Welcome to the multi-chain era.

The Shift From “One Chain to Rule Them All”

Early narratives pushed a single dominant smart contract platform. Then reality happened.

-

Network congestion

-

High gas fees

-

Fragmented liquidity

-

Scalability ceilings

Today, value flows across ecosystems like:

-

Ethereum

-

Solana

-

Avalanche

-

Arbitrum

-

Optimism

Each chain optimizes for something different: decentralization, speed, throughput, cost efficiency, or developer tooling.

No single network can dominate all dimensions at once. And that’s exactly where DeFi becomes critical.

DeFi as the Financial Glue

In a multi-chain world, DeFi acts as infrastructure — not just applications.

It provides:

1. Liquidity Routing

Capital doesn’t stay loyal. It moves toward better yields and incentives. Cross-chain bridges and liquidity layers enable assets to flow between networks, allowing users to deploy capital wherever it’s most productive.

Without DeFi, each chain would be an isolated island. With DeFi, they become connected economic zones.

2. Composability Across Ecosystems

DeFi introduced composability — the “money lego” concept.

In a multi-chain system, this expands further:

-

A lending protocol on one chain

-

A DEX aggregator on another

-

A yield optimizer somewhere else

-

Wrapped or bridged assets, tying them together

This interconnected design turns separate chains into a distributed financial stack.

3. Risk Diversification

Multi-chain finance reduces systemic concentration risk.

If one chain experiences congestion or technical issues, capital can migrate elsewhere. This flexibility strengthens the overall system, similar to global financial markets operating across jurisdictions.

In traditional finance, markets are interconnected but geographically distributed. DeFi mirrors that model digitally.

4. Specialized Financial Zones

Different chains are becoming financial “specialists”:

-

High-speed trading environments

-

Institutional settlement layers

-

NFT ecosystems

-

Experimental governance playgrounds

DeFi protocols adapt to each environment’s strengths.

Instead of forcing every activity onto one blockchain, multi-chain DeFi allows specialization without isolation.

The Rise of Cross-Chain Infrastructure

Multi-chain finance would collapse without secure interoperability.

Key components include:

Security remains the biggest challenge. Bridge exploits have historically drained billions. A resilient multi-chain future depends on robust cryptographic verification and minimized trust assumptions.

This is where innovation is accelerating rapidly.

Governance in a Multi-Chain World

As protocols deploy across multiple ecosystems, governance becomes more complex.

-

Should voting power be unified?

-

Should token emissions vary by chain?

-

How are incentives aligned across environments?

DAOs are evolving from single-chain governance systems into cross-chain coordination networks.

The future isn’t just multi-chain liquidity. It’s multi-chain decision-making.

What This Means for the Future of Finance

A multi-chain financial system resembles a digital federation:

DeFi is not just a product layer — it is the coordination layer.

It ensures that capital efficiency, innovation, and accessibility are not confined to one ecosystem.

And here’s the strong opinion:

The chains themselves may compete.

But DeFi wins either way.

Because wherever value flows, DeFi builds the rails.

Final Thoughts

The future of crypto finance isn’t maximalist — it’s modular. A multi-chain world enables specialization, resilience, and global access. DeFi transforms fragmented networks into an interconnected financial web.

The result? A permissionless, borderless system where capital moves at the speed of code — not paperwork. And that’s not just evolution. That’s financial infrastructure getting an upgrade.

REQUEST AN ARTICLE

Crypto World

Hibachi Launches FX Exchange for Stablecoin Settlement on Arc Network

TLDR:

- Stablecoin market reached $308 billion in 2025 with $46 trillion in annual transaction volume.

- Traditional FX markets still require T+2 settlement despite stablecoin instant transfer capabilities.

- Hibachi offers private orderbooks with onchain verification and self-custody options for traders.

- Circle Ventures backed Hibachi through Arc Builders Fund for sub-second finality infrastructure.

Hibachi has announced the launch of a new foreign exchange platform designed for stablecoin settlement. The platform addresses gaps in current FX markets by combining instant settlement with professional-grade execution.

Built on Circle’s Arc network, the exchange targets regulated institutions and professional traders. Stablecoin market capitalization reached $308 billion in 2025, creating demand for modern FX infrastructure.

Bridging the Gap Between Traditional and Onchain Markets

The stablecoin market processed $46 trillion in transaction volume last year. However, traditional FX markets continue operating on outdated infrastructure requiring T+2 settlement.

Banks maintain control through opacity and restricted liquidity access in the $10 trillion daily spot FX market. This creates friction as stablecoin adoption accelerates across enterprise users.

Hibachi shared its vision through a post on social media platform X. The company stated that no existing venue combines stablecoin settlement with exchange-grade execution and transparent orderbooks.

Traditional FX venues require bank intermediation and nostro accounts across multiple currencies. Centralized crypto exchanges introduce counterparty risk through custody requirements.

Current onchain venues present different challenges for institutional participants. These platforms lack privacy protections, exposing trading strategies and order flow to competitors.

Most fail to meet compliance standards that regulated firms require. The result leaves professional traders without adequate infrastructure for stablecoin-based FX operations.

The new platform aims to solve these limitations through specific design choices. Hibachi will offer instant settlement alongside tight bid-ask spreads and deep liquidity pools.

Orders and positions remain private while maintaining onchain verification capabilities. The exchange will support both self-custody and third-party custodian integrations.

Arc Network Powers Next-Generation Infrastructure

Hibachi selected Circle’s Arc network as its technical foundation. The blockchain network provides sub-second transaction finality and uses stablecoins for gas fees.

Arc also offers configurable privacy features that address institutional requirements. Circle Ventures backed Hibachi through participation in the Arc Builders Fund.

The exchange will serve spot and derivatives trading for multiple currency pairs. Professional market participants need matching speeds and uptime that rival traditional venues.

Hibachi plans to deliver these capabilities while maintaining regulatory compliance features. The platform includes reporting tools designed for regulated financial institutions.

A Deloitte survey found that 99 percent of enterprise CFOs envision using stablecoins long-term. This growing acceptance creates opportunity for specialized infrastructure providers.

Stablecoin-denominated currencies in different nations enable competition against legacy banking systems. Transparent orderbooks and broad access challenge the existing walled garden approach.

The FX market transformation reflects broader changes in digital asset utility. Stablecoins evolved from crypto-native products into mainstream payment rails over five years.

Regulatory frameworks continue developing to accommodate enterprise adoption. Hibachi positions itself to capture this market shift through purpose-built infrastructure for always-on trading.

Crypto World

Trump-linked World Liberty Financial to launch forex remittance platform

World Liberty Financial, a cryptocurrency venture backed by the family of U.S. President Donald Trump, said on Thursday it plans to launch a new foreign exchange and remittance platform aimed at simplifying global money transfers and reducing associated fees.

Summary

- Trump-linked World Liberty Financial plans to launch a foreign exchange and remittance platform aimed at lowering the cost of cross-border money transfers.

- The platform, called World Swap, will connect users directly to bank accounts and debit cards and is built around the firm’s USD1 stablecoin.

- The expansion has drawn scrutiny from ethics experts due to the Trump family’s financial ties to the venture and its overlap with U.S. crypto policy.

World Liberty Financial plans World Swap FX platform

Speaking at the Consensus Web3 event in Hong Kong, co-founder Zak Folkman said the platform, named World Swap, will connect users directly to debit cards and bank accounts around the world, allowing foreign exchange and remittance transactions at costs significantly lower than those charged by traditional financial institutions.

“There’s over $7 trillion of money moving around the world from currency to currency, and all of this has been taxed very heavily by the incumbent players,” Folkman told the audience.

World Liberty Financial is building the service as part of its broader push into decentralized finance using its USD1 stablecoin, which the firm launched last year.

Folkman noted that the company’s lending platform, World Liberty Markets, has already facilitated $320 million in loans and more than $200 million in borrowings since its debut four weeks ago.

The planned platform represents a further expansion of World Liberty’s ambitions to carve out a role in the global payments and remittance ecosystem, a space dominated by legacy banks and money transfer services that often charge high fees and long settlement times.

World Liberty’s activities have generated substantial revenue for the Trump family business, known as the Trump Organization, particularly from foreign entities, according to earlier Reuters reporting. That growth has prompted scrutiny from government ethics experts, who say the timing, with Trump overseeing U.S. crypto policy, could pose potential conflicts of interest. The White House has denied that such conflicts exist.

The company did not say when World Swap will officially launch or provide detailed pricing, but the announcement signals its intent to challenge established players in the global remittance market.

Crypto World

Coinbase Posts $667 Million Quarterly Loss Amid Crypto Market Downturn

TLDR:

- Coinbase reported $667 million net loss in Q4, reversing $1.3 billion profit from year earlier

- Revenue declined 20% to $1.8 billion as falling crypto prices reduced trading activity broadly

- Diversification through derivatives, stock trading aims to reduce reliance on spot trading fees

- Pending stablecoin legislation threatens revenue-sharing arrangement with Circle’s USD Coin

Coinbase Global Inc. reported a substantial fourth-quarter net loss of $667 million, marking a sharp reversal from the $1.3 billion profit recorded during the same period last year.

The cryptocurrency exchange faced mounting pressure as declining digital asset prices reduced trading activity across the platform.

Quarterly revenue dropped 20% to $1.8 billion, falling short of analyst expectations. The loss stemmed primarily from unrealized write-downs on the company’s crypto holdings and investments.

Trading Volume Weakens Across Customer Segments

The exchange experienced decreased activity from both retail and institutional traders during the quarter. “Soft revenue with strong institutional and weak consumer,” said Dan Dolev, an analyst at Mizuho Securities.

Bitcoin’s nearly 50% decline from October highs pushed many retail investors to the sidelines. Transaction fees, traditionally a major revenue source, suffered as overall market participation waned. However, derivatives trading showed relative strength compared to spot markets.

Chief Financial Officer Alesia Haas addressed market conditions in an interview. “We definitely saw softer quarter-over-quarter market conditions,” Haas said.

“However, we outperformed the market on total trading volume.” That performance came primarily from derivatives activity.

Meanwhile, Dolev noted that “the 1Q run-rate fell below consensus expectations” and “EBITDA missed, which needs further investigation.”

Competitor platforms faced similar challenges during the same period. Gemini Space Station announced workforce reductions of up to 25% alongside international operation cutbacks.

Kraken experienced declining quarterly revenue and saw its CFO depart. Meanwhile, Robinhood Markets reported a 38% decrease in crypto trading revenue.

The widespread industry pullback mirrors previous market cycles that forced exchanges to implement cost-cutting measures rapidly.

Analysts remain divided on whether current conditions represent a temporary correction or a prolonged downturn. “Absent renewed euphoria and new volume highs, current conditions appear more consistent with a mid-cycle pullback than a full crypto winter,” Owen Lau of Clear Street wrote.

Conversely, research firm Kaiko labeled this period the “halfway point of the bear market.” The distinction matters for Coinbase’s strategic positioning and revenue stability.

Diversification Strategy Faces Test

The exchange has pursued multiple revenue streams beyond traditional spot trading in recent years. Management acquired Deribit, a crypto options platform, to expand derivatives offerings.

Additionally, the company launched stock trading services and prediction markets to attract different user bases. These initiatives aim to create more consistent income during volatile market periods.

“An overdependence on retail trading is not a future you want to have,” said Mark Palmer, an analyst at Benchmark Co.

Palmer explained the rationale behind diversification efforts. “Especially if the fees associated with trading begin to go in the direction of traditional brokerages, which is to say move towards zero over time,” he added.

The analyst maintains a buy rating on the stock. Stablecoin revenue sharing emerged as a crucial component of the diversification plan. Coinbase generates income through partnerships with Circle Internet Group, issuer of USD Coin.

Analysts view this revenue stream as higher margin and less dependent on trading volumes. The arrangement provides steadier cash flow compared to transaction-based fees.

However, potential regulatory changes threaten this revenue source. Draft legislation under consideration in Washington could restrict rewards tied to stablecoin balances. Such regulations would directly affect Coinbase’s Circle partnership.

CEO Brian Armstrong withdrew support for the proposed bill in January, though discussions continue between the company and policymakers. “We are sitting at the table, and we’ll stay at the table until we get a deal done,” Haas said.

The company participated in two White House meetings alongside the banking industry to negotiate a compromise. The outcome of these discussions could reshape a major revenue component for the exchange.

Market Position Remains Under Scrutiny

The current downturn tests whether Coinbase’s diversification efforts can truly buffer against crypto market volatility. Management maintains confidence that new business lines will protect during weaker trading periods.

“Retail is buying the dip,” Haas said. “I think what’s important is that retail investors are healthy.” The CFO’s comments suggest underlying strength despite broader market weakness.

The company’s stock declined nearly 37% year-to-date before edging higher in after-hours trading following the earnings announcement.

Mizuho Securities analyst Dan Dolev maintained a neutral rating on the shares. The results suggest Coinbase remains substantially exposed to cryptocurrency market cycles.

Nevertheless, the exchange maintains advantages over previous downturns through expanded product offerings and institutional relationships.

Whether these improvements prove sufficient to weather extended market weakness remains uncertain. The coming quarters will determine if diversification can genuinely smooth revenue volatility or merely soften the impact.

A short downturn would support management’s case that new revenue streams can buffer crypto’s inherent volatility. A longer freeze would expose the difficulty of fully separating exchange earnings from boom-and-bust cycles.

Crypto World

U.S. Federal Reserve urges new rules for crypto derivatives

Federal Reserve researchers have proposed treating cryptocurrencies as a separate asset class for derivatives margin rules, citing their unique risks and high volatility.

Summary

- Fed researchers suggest creating a dedicated crypto risk category in derivatives markets.

- The proposal separates stablecoins and floating cryptocurrencies for better risk modeling.

- The move aims to improve margin accuracy and reduce under-collateralization in OTC trades.

U.S. central bank researchers are calling for cryptocurrencies to be treated as a separate asset class in derivatives markets, arguing that digital assets carry risks that do not fit neatly into existing financial categories.

In a paper updated on Feb. 12, analysts examined how crypto-related risks are handled in over-the-counter derivatives. The study, titled “Initial Margin for Crypto Currencies Risks in Uncleared Markets,” focuses on how margin requirements are calculated under the framework used by the International Swaps and Derivatives Association.

Why crypto needs its own category

The researchers argue that the behavior of cryptocurrencies differs greatly from that of traditional assets like stocks, commodities, and foreign exchange. Market stress tends to show up more abruptly, prices move more quickly, and swings are bigger. These features make it harder to measure risk using existing models.

Because of this, the paper suggests creating a separate crypto risk class within the current margin system. The proposal suggests sorting digital assets into two broad categories.

The first would include pegged cryptocurrencies, such as stablecoins designed to mirror the value of traditional currencies. The second would cover floating cryptocurrencies, whose prices are determined entirely by market supply and demand.

This distinction is intended to acknowledge the different levels of risk involved. Stablecoins tend to fluctuate less, while unpegged tokens can swing sharply and without warning. According to the authors, applying the same margin framework to both groups can result in misjudged risk and poorly calibrated requirements.

The study also advises relying on long-term market data, including periods of severe financial stress, when assigning risk weights. While this mirrors established industry methods, it tailors them more closely to the specific behavior of crypto markets.

What this could mean for markets

If market participants adopt the proposal, margin requirements for crypto derivatives could become both stricter and more accurately aligned with underlying risk. In practical terms, traders and institutions might have to commit additional collateral, particularly for contracts linked to highly volatile assets.

Backers argue that this approach would lower the chances of under-collateralization, a situation in which trading losses exceed the margin posted. In stressed markets, that problem can spread quickly and threaten financial stability. A clearer framework could help limit those risks.

At the same time, the paper stresses that it is not a formal regulation. It represents research and analysis by Fed staff, not an official rule or policy decision. Any real changes would need to come through industry adoption or future regulatory action.

Still, the timing is notable. As crypto markets grow and become more connected to traditional finance, regulators and institutions are paying closer attention to risk management. More banks, funds, and trading firms are now involved in digital assets, making standardized rules more important.

By recognizing crypto as its own category, the researchers signal that digital assets have reached a level of maturity that demands tailored oversight. While the proposal does not change the rules today, it adds momentum to ongoing efforts to bring a clearer structure to crypto derivatives markets.

Crypto World

Zcash Draws Institutional Backing Amid Privacy Narrative and Technical Upgrades

TLDR:

-

Zcash secured backing from Vitalik Buterin and Winklevoss twins who deployed $50M and lab donations.

-

Project Tachyon uses recursive zero-knowledge proofs to enable thousands of shielded transactions per second.

-

The shielded pool reached 5,030,093 ZEC representing 30% of total supply at all-time high adoption levels.

-

ZEC trades at $220-250 after 69% correction from $758 peak as community debates critical governance proposals.

Zcash continues to attract institutional attention as privacy becomes a focal narrative in cryptocurrency markets. The digital asset recently received backing from Vitalik Buterin and the Winklevoss twins.

ZEC trades between $220-250 after a 69% correction from its November 2025 peak of $758. The shielded pool reached an all-time high of 5,030,093 ZEC, representing 30% of total supply.

Community governance proposals including Project Tachyon are under consideration as the network evaluates technical upgrades.

Institutional Validation and Strategic Backing

Vitalik Buterin made his second donation to Shielded Labs on February 6, 2026, specifically supporting the Crosslink upgrade.

The Ethereum co-founder stated that Zcash remains one of the most honorable crypto projects with a steadfast focus on privacy.

Shielded Labs’ Crosslink work aims to enhance security while reducing the security budget for long-term sustainability.

The Winklevoss twins restructured Cypherpunk Technologies, formerly Leap Therapeutics, into the first Digital Asset Treasury focused exclusively on Zcash.

They deployed $50 million to acquire ZEC and donated 3,221 ZEC valued at $1.2 million to Shielded Labs. Tyler Winklevoss emphasized that privacy remains crucial for a free and open society.

Grayscale maintains its Zcash Trust (ZCSH) as the only institutional product offering pure ZEC exposure. The trust has operated through multiple market cycles.

These institutional moves validate Zcash’s position in the privacy sector as regulatory scrutiny on transparent blockchains intensifies.

Technical Upgrades and Project Tachyon

Project Tachyon represents a complete architectural redesign of how privacy scales on the network. Sean Bowe, the cryptographer behind Halo and Sapling, leads this effort to solve fundamental bottlenecks in privacy coin adoption. Current systems require wallets to scan every transaction on the blockchain to identify relevant ones.

Tachyon uses Proof-Carrying Data and recursive zero-knowledge proofs to flip this model entirely. Wallets maintain their own cryptographic proof of solvency instead of scanning all network transactions.

The system enables oblivious synchronization where wallets sync in seconds rather than hours. This approach allows Zcash to scale to thousands of shielded transactions per second.

The upgrade targets mainnet deployment within a year. Benchmarks demonstrate the cryptographic primitives work as designed. Community funding supports the development effort.

The technology aims to enable planetary-scale encrypted money that works for billions of users with mobile-first accessibility.

Governance Decisions and Community Sentiment

The Zcash Coinholder Protocol Feature Sentiment Poll addresses 11 questions shaping the network’s future direction.

Key proposals include Project Tachyon, Network Sustainability Mechanism fee removal, Zcash Shielded Assets, and Consensus Accounts. The community actively debates each proposal through established governance channels.

The Network Sustainability Mechanism proposes burning 60% of transaction fees to address long-term security funding.

ZIP 233, ZIP 234, and ZIP 235 introduce infrastructure to remove funds from circulation and smooth issuance curves. The mechanism extends the security budget timeline while maintaining the 21 million ZEC cap.

Zcash Shielded Assets would enable custom token issuance within the Orchard shielded pool. QEDIT developed ZIP 226 and ZIP 227 for the technical implementation.

However, some community members express concerns about protocol complexity and regulatory exposure. The governance process ensures thorough community review before implementation.

Market Conditions and Price Outlook

ZEC currently trades at $220-250 after declining from $758. The recent drop swept the October 17, 2025 low of $187, creating a potential liquidity grab.

Support zones exist at $220-250, $180-200, and $120. Resistance levels appear at $300-310, $380-420, and $540-560.

The Electric Coin Company development team resigned in January 2026 due to commercialization disagreements. The Zcash Foundation, Shielded Labs, and community contributors continue development work. This transition reduces reliance on a single organization for protocol advancement.

Dubai’s Financial Services Authority banned privacy coins from DIFC-regulated venues in January 2026. However, the SEC closed its investigation into the Zcash Foundation in late 2025 without action.

Zcash’s optional transparency through view keys and transparent addresses provides regulatory flexibility compared to fully anonymous alternatives.

Crypto World

Israel Arrests Two Over Polymarket Trades on Iran Strikes

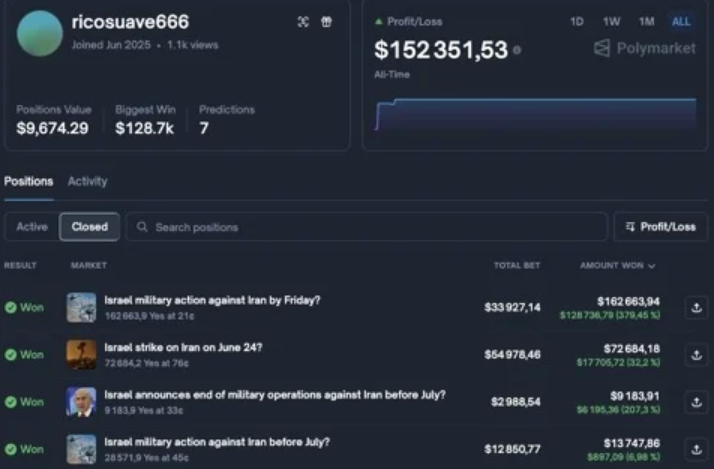

Israeli authorities have arrested and indicted two people for allegedly using secret information to place bets on the predictions market Polymarket related to Israel striking Iran.

In a joint statement on Thursday, Israel’s Defense Ministry, its internal security service Shin Bet, and police said a military reservist and a civilian were arrested after an investigation found that the reservist obtained classified information to place the bets.

The prosecutor’s office will pursue criminal charges for security-related offenses, bribery, and obstruction of justice. Authorities said the reservist was working for Shin Bet.

Prediction markets have seen major insider trading scandals this year after a Polymarket user won a bet that Nicolás Maduro would be ousted as Venezuelan president hours before he was captured by US forces, profiting around $400,000.

The Israeli state-owned news outlet Kan reported last month that the Polymarket user “ricosuave666” placed several bets related to Israel’s military operations in Iran in June 2025, but it’s unknown if those arrested are behind the account.

The account had reportedly wagered tens of thousands of dollars and had profited over $152,300, betting on markets such as “Israel strike on Iran on June 24” and “Israel military action against Iran by Friday,” with the latter of the two bets winning them over $128,700.

Related: Crypto PACs secure massive war chests ahead of US midterms

Prediction markets lead to real security risks when misused

Lawmakers worldwide have raised concerns that insider knowledge could be exploited in prediction markets, undermining market integrity and eroding public trust.

Israel’s Ministry of Defense said bets based on secret information pose a “real security risk for Israel Defense Forces activity and national activity,” adding that Israel’s military, security and police units will continue to pursue action against anyone who uses classified information illegally.

A lawyer representing the reservist told Bloomberg that the indictment is “flawed,” while noting that the charge of harm to national security has been dropped.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Transak announces integration with Ethereum Layer 2 MegaETH

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Transak has completed its integration with MegaETH, enabling users to purchase ETH directly on the high-speed Layer 2 network using standard fiat payment methods.

Transak, the web3 payments infrastructure provider, announced its full integration with MegaETH, a real-time Ethereum Layer 2.

According to the firms, with this integration, over 10 million users globally can purchase ETH natively on MegaETH in seconds using everyday payment methods, including credit and debit cards, Apple Pay, Google Pay, SEPA, etc. And, there will be no need for bridging, centralized exchange accounts, or prior crypto holdings.

Jack Bushell, Director of Sales at Transak, states that this integration is about removing friction at the exact moment users want to get started. He adds that MegaETH has built Ethereum performance that finally matches real-world expectations, and that with Transak, users can jump straight into that experience using the payment methods they already trust: no setup, no complexity, no detours.

As per both companies, Transak’s direct fiat on-ramp eliminates these barriers, opening MegaETH’s high-frequency use cases, such as real-time DeFi trading, on-chain gaming, AI agents, streaming payments, and micro-transactions, to mainstream audiences.

The integration arrives just days after MegaETH opened its Frontier mainnet to builders and ahead of the upcoming “OMEGA” phase that will welcome the broader public. Transak also confirmed that popular stablecoins will be added in the near future, further strengthening liquidity for DeFi and payments on the chain.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin Open Interest at 2024 Lows: Is TradFi Abandoning BTC?

Bitcoin has struggled to stay above the $72,000 mark over the past week, as traders weigh whether a renewed institutional bid is at hand or merely a temporary pause in a broader risk-off cycle. While price action remains choppy, a dramatic shift sits in the derivatives market: aggregate open interest on Bitcoin futures fell to $34 billion in USD terms—the lowest level in months and the steepest decline since November 2024. Yet when measured in BTC, open interest sits around 502,450 BTC, suggesting that the appetite for leverage hasn’t collapsed and that the unwind is not uniform across asset denominations. Over the past two weeks, forced liquidations totaled about $5.2 billion, underscoring the fragility of long bets in a mood of caution and uncertainty.

Key takeaways

- BTC futures open interest dropped to $34 billion, a 28% decline from 30 days earlier; BTC-denominated open interest remains roughly flat at BTC 502,450, implying ongoing leverage demand despite lower USD exposure.

- Bearish leverage signals surfaced as risk appetite cooled: forced liquidations of roughly $5.2 billion in the last two weeks point to sustained volatility and risk management pressure.

- Weak US job data fed concerns about the macro backdrop: the US Labor Department reported 181,000 jobs added in 2025, a number seen as soft against expectations, while gold reclaimed the $5,000 level and equities sit near highs, complicating the narrative for Bitcoin.

- Bitcoin options markets flashed caution: the 30-day delta skew for BTC jumped to about 22%, with put options trading at a premium, signaling a clear tilt toward downside hedging among professional traders.

- On the demand side, Bitcoin ETFs continued to trade thousands of BTC daily, with roughly $5.4 billion of average daily volume across US-listed funds, underscoring that institutional interest remains visible even amid uncertainty.

Bitcoin (BTC) has faced repeated hesitations around the $72,000 level as investors await clearer catalysts from the macro environment. The sheer contrast between price stability in select risk assets—gold rebounding past the $5,000 threshold and the S&P 500 hovering near record territory—and the weakness seen in BTC’s derivatives environment has intensified questions about whether Bitcoin is decoupling from traditional markets or simply pausing before the next leg of a broader risk-off cycle. The immediate concern is whether weak job data will push the Federal Reserve toward earlier or more aggressive easing, which would, in turn, influence capital flows across risk assets, including cryptocurrencies.

The data on open interest paints a nuanced picture. While USD-denominated OI has slid, the BTC-denominated measure suggests that market participants still seek leverage, albeit with tighter risk controls. Some traders attribute part of the USD OI decline to liquidations that amplified through the market in recent weeks, highlighting a landscape where risk management tools are actively trimming exposure. The tension between a calmer price backdrop and a more defensive sentiment in the derivatives space underscores the complexity of the current setup for Bitcoin.

In the background, the labor market remains a critical flashpoint. The US Labor Department’s latest weekly data indicated softer payroll growth, with an uptick in initial claims not far from pandemic-era levels of uncertainty. While the White House has argued that immigration policy has reduced the number of job openings the economy needs to fill, the broader narrative remains that slower growth could push the Fed toward rate cuts sooner than anticipated. This potential for looser financial conditions could, in theory, be supportive for risk assets, including Bitcoin, but the actual market reaction has been restrained and uneven across sectors.

From a historical perspective, the market’s sensitivity to macro indicators is not new for Bitcoin. The 52% drawdown seen in March 2020 occurred amid a broad global shock to economic activity and a surge in uncertainty, and the subsequent policy response helped restore liquidity and drive a notable risk-on phase. Today’s environment—where equities have held near highs while volatility remains elevated—presents a similar but more nuanced backdrop. If growth risks intensify and the Fed signals an accommodative stance ahead of expectations, the cost of capital for both companies and consumers could ease, potentially raising the odds of a renewed appetite for riskier assets, including BTC. The current mix suggests that traders are weighing both macro signals and on-chain indicators as they look for directional clarity.

The options market paints a more conservative picture than equity traders might prefer. The BTC options delta skew at Deribit climbed to approximately 22% on Thursday, indicating that put options are trading at a premium. Historically, a skew in that range signals a protective stance among market participants and a greater reluctance to embrace upside risk without sufficient hedges. By contrast, the lack of a clear appetite for bullish leverage reinforces the sense that the market remains vulnerable to negative catalysts, even as some investors watch for reasons to re-engage with long positions.

Another critical data point is the appetite for exchange-traded products tied to Bitcoin. Despite the volatility signals from the futures market, US-listed Bitcoin ETFs have maintained solid daily volumes, averaging around $5.4 billion. This level of activity suggests that institutional demand has not dried up, even if price action and the structure of the futures market reflect a more cautious stance. The divergence between robust ETF trading and weaker leverage indicators highlights the complexity of the current market regime and the difficulty of predicting the next major inflection point for Bitcoin.

In sum, the market’s current stance combines a cautious, risk-off tilt with ongoing, albeit selective, institutional participation. The near-term trajectory of Bitcoin will likely hinge on evolving macro data—particularly the pace of payroll growth and inflation trends—and how effectively the Fed communicates its policy path. Traders who expect a rapid reacceleration in risk appetite may face headwinds if macro data disappoints further, while any shift toward clearer economic strength or dovish policy cues could catalyze a re-pricing in both equities and crypto.

Why it matters

The divergence between price performance and leverage demand is a meaningful signal for market participants. If Bitcoin can sustain a movement higher with steady or improving leverage demand, it could point to renewed institutional confidence and a potential re-rating of BTC as a risk-on asset, especially if macro conditions align with looser financial conditions. Conversely, persistent weakness in the labor market and a cautious options market could keep downside risk elevated, making downside hedges a persistent theme for professional traders. For developers and ecosystem participants, the current climate emphasizes the need for robust risk management tools, clearer on-chain signals, and improved liquidity infrastructure to withstand a more volatile macro backdrop.

For traders and investors, the key takeaway is to monitor the interaction between macro signals and market microstructure. The presence of solid ETF trading volumes indicates that institutions remain engaged, even as futures markets signal caution. This dynamic could lengthen the time needed for a decisive breakout, suggesting a period of range-bound activity with sharp snaps if new data or policy developments shift sentiment abruptly.

What to watch next

- Upcoming US payroll data releases and inflation metrics that could alter rate-hike expectations and liquidity dynamics.

- Comments from Federal Reserve officials or changes in policy guidance that might signal a shift in monetary conditions.

- Changes in BTC futures open interest and funding rates across major platforms, to assess whether leverage appetite is re-emerging or remaining subdued.

- Bitcoin ETF flow developments and any notable shifts in daily volumes that could indicate persistent institutional involvement.

- Derivatives metrics, including delta skew and implied volatility, to detect evolving risk sentiment among professional traders.

Sources & verification

- Open interest and price data for BTC futures from CoinGlass.

- BTC annualized funding rate data from Laevitas.ch.

- Deribit 30-day options delta skew (via Laevitas) showing a 22% premium to puts.

- US job data from the US Labor Department; payroll figures referenced in the article.

- US policy and immigration-related labor discussions as reported by BBC.

Bitcoin leverage signals and macro cues

Bitcoin (CRYPTO: BTC) has faced a careful balance between resilience in some sectors of the market and caution in others. The latest readings show a split:USD-denominated open interest has retreated, while BTC-denominated exposure remains comparatively steady, underscoring ongoing demand for leverage even as risk sentiment throughout broader markets has cooled. The pullback in futures open interest comes amid a backdrop of soft payroll data and a policy backdrop that could tilt toward looser financial conditions if growth falters. In this environment, the direction for Bitcoin will hinge on whether macro developments translate into clearer catalysts for risk-taking or a renewed risk-off impulse that drives profits to the sidelines. The dynamic illustrates why traders are paying close attention to how traditional markets behave in response to economic data, and why the crypto market remains highly sensitive to liquidity and risk sentiment changes.

Market participants should note that ETF volumes remain a meaningful barometer of institutional involvement. While futures markets may show caution, the sustained level of average daily trading in Bitcoin-linked ETFs points to a persistent base of liquidity and a willingness among large players to maintain exposure. This dichotomy—between derivatives signals and ETFs activity—helps explain why Bitcoin’s near-term path remains uncertain, with potential for both pullbacks and selective strength depending on how macro data evolves and how policy expectations shift in response.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month