Crypto World

Is BTC Heading for $60K After Rejection at $70K?

Bitcoin encountered renewed selling pressure at the key $70K resistance level, resulting in a clear rejection. As a result, the price action has transitioned into a consolidation phase above the critical $60K support zone, with further fluctuations likely in the near term.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, BTC’s rebound from the $60K demand region stalled at the $70K resistance, where sellers regained control. This level closely aligns with the midline of the descending channel, reinforcing its technical significance. A decisive break above this dynamic boundary would be required to restore bullish momentum.

For now, Bitcoin remains confined within a defined range, bounded by the static $60K support and the channel’s dynamic mid-boundary near $70K. Consolidation appears to be the dominant scenario, with a breakout on either side likely to trigger a more substantial directional move.

BTC/USDT 4-Hour Chart

On the 4-hour chart, the rejection at $70K is more pronounced, with the asset retracing toward the $66K area. A notable bullish divergence between price action and the RSI suggests weakening downside momentum, increasing the probability of a short-term range-bound structure between the $60K and $75K levels.

However, the internal resistance at the channel’s midline continues to cap upside attempts, limiting bullish follow-through and keeping the broader structure neutral-to-bearish until a clear breakout materializes.

Sentiment Analysis

Bitcoin funding rates across all exchanges have recently flipped deeply negative, reaching extreme levels around -0.014 while the price dropped toward the $66.9K region. This sharp shift into negative territory signals aggressive short positioning, as traders are now paying a premium to hold bearish bets.

Historically, such extreme negative funding prints tend to appear during panic-driven sell-offs, when the market becomes crowded on the short side. The current structure suggests that derivatives traders are heavily positioned for further downside following the breakdown below the $70K area.

From a positioning standpoint, this creates conditions for a potential short squeeze if spot demand steps in. When funding remains deeply negative while price stabilizes, it often reflects exhaustion in selling pressure. However, if price continues to trend lower while funding stays negative, it confirms sustained bearish dominance rather than a temporary flush.

At this stage, the funding data highlights elevated fear and aggressive short exposure, placing the market in a sensitive zone where volatility expansion, either through continuation or a squeeze, becomes increasingly likely.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Crypto Lender BlockFills Paused Withdrawals Amid Market Fall

Institution-focused crypto lending platform BlockFills announced it halted customer deposits and withdrawals last week as Bitcoin and the broader crypto market continued to tumble.

The suspension, which remains in effect, was intended to protect clients and restore liquidity on the platform, BlockFills said in an X post on Wednesday.

Last week’s market tumble saw Bitcoin fall another 24% from $78,995 to $60,000.

Blockfills said the withdrawal and deposit halt came “in light of recent market and financial conditions.”

“Management has been working hand in hand with investors and clients to bring this issue to a swift resolution and to restore liquidity to the platform,” BlockFills said.

“Clients have been able to continue trading with BlockFills for the purpose of opening and closing positions in spot and derivatives* trading and select other circumstances,” BlockFills added.

The halt potentially impacts about 2,000 institutional clients, including asset managers and hedge funds, which contributed to more than $60 billion in trading volume on the platform in 2025.

The crypto liquidity and lending platform serves only investors with crypto holdings of $10 million or more.

BlockFills was founded by CEO Nick Hammer and President Gordon Wallace in 2017 and is backed by the likes of Susquehanna Private Equity Investments and CME Group.

Bitcoin is down 46% from its October high

Bitcoin’s price began to fall on Oct. 10 after a social media post on tariffs by US President Donald Trump sent shockwaves through the crypto markets, contributing to nearly $20 billion worth of positions being liquidated.

It fell further in the months following, hitting a year-to-date low of $60,008 on Feb. 5.

Related: Crypto super PAC to spend $5M on Barry Moore’s Senate bid: Report

Bitcoin has since rebounded to $67,575, but is still 46.6% off its all-time high of $126,080 set on Oct. 6.

BlockFills’ withdrawal halt marks the first suspension among major crypto platforms as a result of market conditions.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Elon Musk Announces X Money Limited Beta Launch Within Months

X Money, an upcoming payments system that forms part of Elon Musk’s “everything app” plans, is scheduled to come out as a “limited beta” in the next two months before launching to X users worldwide.

Musk gave the new timeline at his AI company’s “All Hands” presentation on Wednesday, during which he said that X Money was already live “in closed beta within the company.”

“This is intended to be the place where all money is. The central source of all monetary transactions,” he said, calling it a “game changer.”

Payments part of X’s “everything app”

The move is framed as a key upcoming feature to make X more essential, tied with its “everything app” vision, with payments a core driver of daily engagement.

Musk noted that the platform has 1 billion installed users but said its average monthly users were around 600 million.

X Money, rumored to be launched last year, is expected to integrate directly into the X platform, which aims to become a single place for social networking, messaging, content, and financial services, similar to WeChat in China.

“As we give people more reasons to use the X app, whether it’s for communications, or for Grok, or for X Money […] we want it to be such that if you wanted to, you could live your life on the X app,” said Musk.

Elon Musk has been pushing for payments on X since shortly after acquiring Twitter in 2022. The idea ties back to his early career in 1999, when he co-founded X.com, an online bank that merged with Confinity to become PayPal, which was later acquired by eBay.

Crypto integration remains a mystery. Musk has previously shared enthusiasm for Dogecoin (DOGE), but the initial focus is likely to be fiat since the company has partnered with Visa. According to the Blockchain Council, it will support crypto in the future.

Related: Musk’s xAI seeks crypto expert to train AI on market analysis

xAI expands Macrohard data center

Musk also highlighted the company’s AI growth, stating that xAI can “deploy more AI compute faster than anyone else.”

The tech billionaire showcased the firm’s “Macroharder” AI data center in Memphis, Tennessee — an expansion of the existing plant that adds 220,000 more graphics processing units.

“All this will be training the [AI] models that you experience. It’s absolutely fundamental to have large-scale training compute in order to get the best models,” he said.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

MSTR’s STRC returns to $100 par, poised to unlock more BTC accumulation

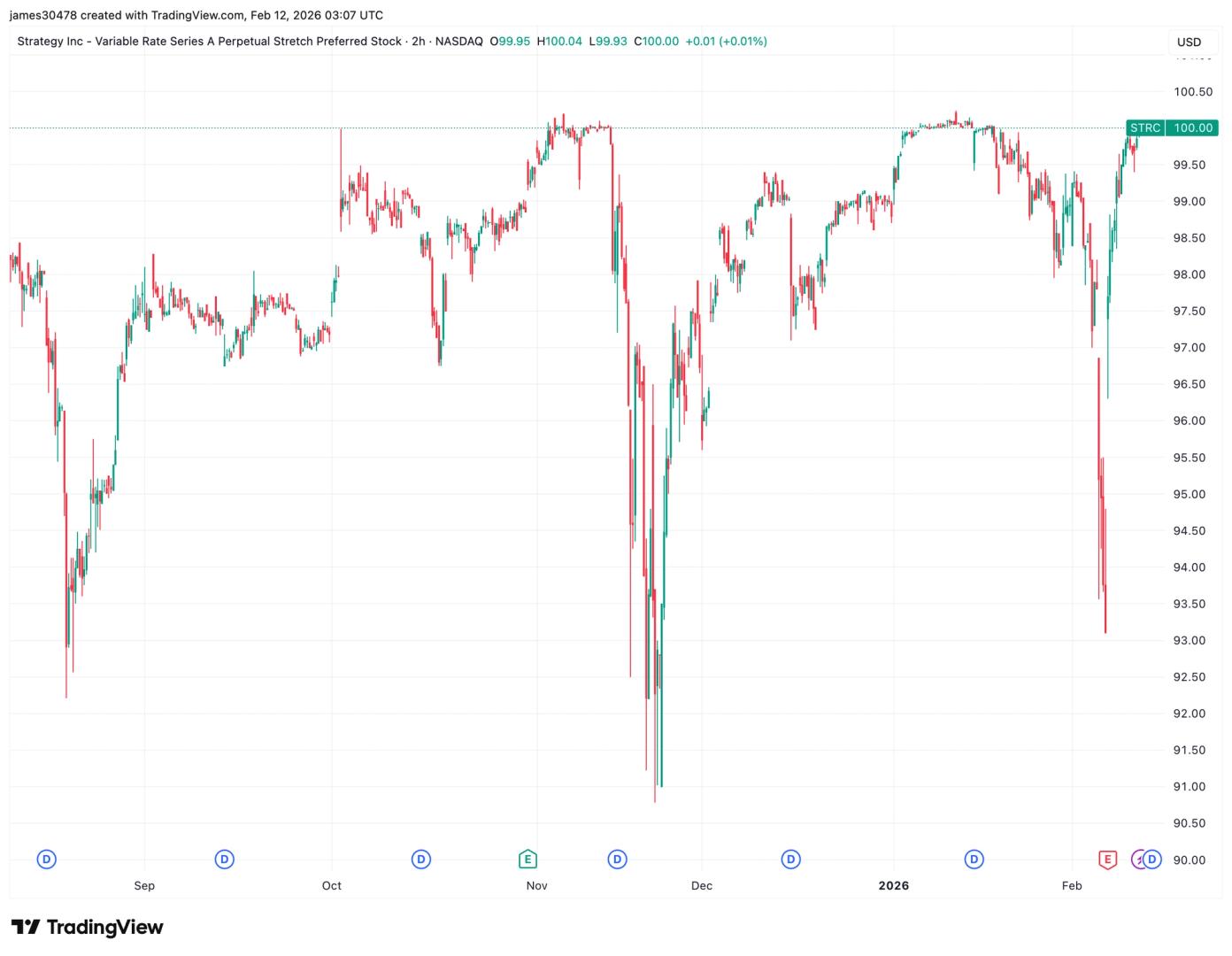

Stretch (STRC), the perpetual preferred equity issued by Strategy (MSTR) the world’s largest corporate bitcoin holder reclaimed its $100 par value during Wednesday’s U.S. session for the first time since mid-January.

STRC trading at or above par enables the company to resume at-the-market (ATM) offerings to fund further bitcoin acquisitions. STRC last hit the $100 level on Jan. 16 when bitcoin hovered near $97,000; however, as the largest cryptocurrency by market capitalization retreated to as low as $60,000 by on Feb. 5, STRC dipped to a low of $93 before its recent rebound.

Positioned as a short-duration, high-yield credit instrument, STRC currently offers an 11.25% annual dividend distributed monthly. To mitigate volatility and incentivize trading near par, Strategy resets this rate monthly, recently hiking it to the current 11.25% yield.

MSTR common stock faced pressure, sliding 5% on Wednesday to close at $126, as bitcoin hovers around $67,500.

Crypto World

Juspay Expands in the Middle East with New DIFC Headquarters

Editor’s note: Juspay has announced its expansion into the Middle East with the launch of its regional headquarters in Dubai International Financial Centre. The move is aimed at supporting enterprise merchants, banks, and financial institutions as digital commerce accelerates across the GCC. By establishing a local presence, the company plans to deepen partnerships and address growing payment complexity linked to multiple currencies, regulations, and local payment methods. The DIFC base signals a long-term commitment to building regulated, enterprise-grade payment infrastructure in the region, at a time when cross-border commerce and scalable financial rails are becoming critical for large businesses operating across global markets.

Key points

- Juspay opens its Middle East regional headquarters in DIFC to support enterprise payment demand.

- The expansion targets merchants and banks facing complex, multi-currency and multi-regulatory environments.

- The company will offer its payments orchestration and infrastructure solutions locally.

- Juspay plans to work closely with regional banks, acquirers, and ecosystem partners.

Why this matters

The Middle East is seeing rapid growth in digital commerce, putting pressure on payment systems to scale reliably across borders and regulatory frameworks. Juspay’s entry into DIFC reflects rising demand for enterprise-grade payment infrastructure that can handle volume, compliance, and localization at once. For large merchants and financial institutions, access to proven orchestration and real-time payments technology can improve authorization rates, reduce operational friction, and support expansion across GCC and global markets. For the region, it reinforces Dubai’s role as a hub for fintech infrastructure.

What to watch next

- Growth of Juspay’s regional team in business development, engineering, and partnerships.

- New collaborations with Middle East banks, acquirers, and payment networks.

- Adoption of Juspay’s platform by regional enterprise merchants.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Dubai, February 10th, 2026 – Juspay a global leader in payment infrastructure solutions for enterprises and banks, today announced its expansion into the Middle East with the opening of its regional headquarters in Dubai International Financial Centre (DIFC). This move marks an important step in Juspay’s international expansion, deepening its focus on serving enterprise merchants, banks, and financial institutions in the Middle East. The DIFC headquarters will support closer engagement with existing partners as enterprise payment demand continues to scale.

With digital commerce accelerating in the GCC region, rapidly scaling enterprises in sectors such as airlines, hospitality, e-commerce, and financial services face increasing complexity driven by multiple regional currencies, evolving regulations, and diverse local payment methods.

To address this complexity, Juspay’s payments orchestration platform provides a unified & reliable payments stack, helping organizations optimize authorisation rates and costs, simplify compliance and scale seamlessly across GCC and global markets with institutional-grade reliability.

Establishing operations in DIFC highlights Juspay’s long-term commitment to the Middle East, with a focus on building , regulated, and enterprise-grade payments infrastructure in the region. As a leading global financial hub, DIFC provides a strong regulatory environment, robust infrastructure, and access to high quality talent. Juspay plans to leverage this and work closely with regional banks, acquirers, networks, and ecosystem partners to deliver scalable and reliable payment solutions tailored for enterprises operating across global markets.

Commenting on the expansion, Sheetal Lalwani, Co-founder & COO of Juspay, said: “Juspay has been building foundational payments infrastructure for large-scale, mission-critical commerce globally for over a decade. We are excited to bring these learnings to the Middle East and partner with merchants, banks, networks, and the broader ecosystem to build secure, scalable payments infrastructure that supports the region’s rapidly evolving digital economy.”

Salmaan Jaffery, Chief Business Development Officer at DIFC Authority said: “We are pleased to welcome Juspay to the Middle East, Africa and South Asia’s most significant fintech and financial services ecosystem. As a global leader in payment infrastructure, Juspay’s presence strengthens our growing digital economy, reinforces DIFC’s role as a catalyst for financial innovation and cements Dubai’s position as a top four global FinTech hub.”

With more than a decade of experience in scaling payment infrastructure, Juspay powers 500+ enterprise merchants and banks globally including Agoda, Amazon, Flipkart, Google, HSBC, IndiGo, Swiggy, Urban Company, Zepto & more. It offers a comprehensive suite of payment solutions that spans full-stack payment orchestration, authentication, tokenisation, reconciliation, fraud solutions and more. The company also provides end-to-end, white-label payment gateway and real-time payments infrastructure tailored for banks. Together these capabilities enable merchants and banks to deliver seamless, reliable and scalable payment experiences to the end-consumers.

Speaking about Juspay’s regional focus, Nakul Kothari, head of Middle East & APAC said, “By establishing our presence in the Middle East with DIFC, we continue our mission of building innovative payment solutions rooted in deep local market understanding. The region holds tremendous potential, and we are investing in long-term partnerships with merchants and banks to help them build future-ready payment stacks that can scale across markets.”

This expansion reflects Juspay’s long-term vision of enabling open, interoperable, and accessible payments worldwide. With a team of over 1,500 payment experts solving payment complexities across Asia-Pacific, Latin America, Europe, UK, and North America, Juspay is strategically positioned to reshape the Middle Eastern payments landscape. The company plans to grow its regional team, specifically targeting growth in business development, solution engineering, and partnerships.

About Juspay

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 300 million daily transactions, exceeding an annualized total payment volume (TPV) of $1 trillion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1500+ payment experts operating across San Francisco, Dublin, São Paulo, Dubai, and Singapore.

Juspay offers a comprehensive product suite for merchants that includes open-source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end-to-end reconciliation, unified payment analytics & more. The company’s offerings also include end-to-end white label payment gateway solutions & real-time payments infrastructure for banks.These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

To learn more about Juspay, visit: www.juspay.io

About Dubai International Financial Centre

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa, and South Asia (MEASA), which comprises 77 countries with an approximate population of 3.7bn and an estimated GDP of USD 10.5trn. With a 20-year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast-growing markets with the economies of Asia, Europe, and the Americas through Dubai. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of 46,000 professionals working across over 6,900 active registered companies – making up the largest and most diverse pool of industry talent in the region.Comprising a variety of world-renowned retail and dining venues, a dynamic art and culture scene, residential apartments, hotels, and public spaces, DIFC continues to be one of Dubai’s most sought-after business and lifestyle destinations.For further information, please visit our website: difc.ae

Crypto World

Charles Hoskinson confirms deal to onboard LayerZero on Cardano

Input Output CEO and founder Charles Hoskinson announced a deal to get LayerZero ported over to the Cardano blockchain during a keynote speech at Consensus Hong Kong on Thursday.

LayerZero is a blockchain aimed at powering institutional-grade markets that received investment from Citadel Securities on Wednesday.

The announcement comes alongside the rollout of Midnight’s mainnet, which was also revealed on Thursday morning.

Hoskinson, who was comically wearing a McDonalds uniform in a nod to the recent market downturn said: “The industry is not healthy. S*** is getting real. Twitter is a nuclear dumpster fire. Sentiment is at an all time low.”

But he insisted it was a micro downturn, and “the macro remains bullish.”

“And to prove it, I’m excited to announce our partnership with LayerZero,” he said. “We’re bringing USDCx to Cardano with a launch date set, complete with broad wallet and exchange support. This means stablecoins with true privacy and immutability, powered by zero-knowledge tech. It’s institutional-grade, and it’s happening now — alongside Midnight’s mainnet rollout. Get ready, folks. This changes everything.”

UPDATE (Feb. 12, 2026, 02:21 UTC): Adds additional information and commentary from Charles Hoskinson.

Crypto World

Paxful To Pay $4M For Moving Funds Tied to Criminal Schemes

Peer-to-peer crypto exchange Paxful has been ordered to pay $4 million after admitting it knowingly profited from criminals who used the crypto platform due to its lack of anti-money laundering checks.

The Justice Department said on Wednesday that Paxful was sentenced to pay the fine after pleading guilty in December to conspiring to promote illegal prostitution, knowingly transmitting funds derived from crime, and violating anti-money laundering requirements.

“Paxful profited from moving money for criminals that it attracted by touting its lack of anti-money laundering controls and failure to comply with applicable money-laundering laws, all while knowing that these criminals were engaged in fraud, extortion, prostitution and commercial sex trafficking,” said Andrew Tysen Duva, the assistant attorney general of the Justice Department’s Criminal Division.

Prosecutors said that from January 2017 to September 2019, Paxful facilitated over 26 million trades worth nearly $3 billion in value and collected more than $29.7 million in revenue.

The Justice Department said Paxful had agreed that the appropriate criminal penalty was $112.5 million, but prosecutors determined the company didn’t have the ability to pay more than $4 million.

Paxful made millions from illegal prostitution ads

The Justice Department said Paxful marketed itself as a platform that didn’t require customer information and presented fake anti-money laundering policies that it knew “were not implemented or enforced.”

According to prosecutors, one of Paxful’s customers was the classified advertising site Backpage, which authorities shut down due to hosting ads for illegal prostitution.

“Paxful’s founders boasted about the ‘Backpage Effect,’ which enabled the business to grow,” the Justice Department said, adding that Paxful’s collaboration with Backpage and a similar site between 2015 and 2022 saw the crypto platform earn $2.7 million in profits.

Related: Crypto scam mastermind gets 20 years for $73M pig butchering scheme

Paxful shut down its operations in November and, in a now-deleted blog post in October, said the decision was due to “the lasting impact of historic misconduct by former co-founders Ray Youssef and Artur Schaback prior to 2023, combined with unsustainable operational costs from extensive compliance remediation efforts.”

Youssef said in response to Paxful’s post that the company “should have closed down when I left the company two years ago.”

Schaback, who is also Paxful’s former chief technology officer, pleaded guilty in July 2024 to conspiring to fail to maintain an effective anti-money laundering program.

Schaback is awaiting sentencing, with a California judge agreeing in December to move a meeting on his sentencing from January to May as prosecutors said he is continuing to provide information for the government’s investigation into Paxful, “which may bear on the government’s sentencing recommendation.”

US authorities have not publicly named or charged Youssef in connection with Paxful.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Coinbase Launches Crypto Wallets for AI Agents

Coinbase has unveiled a wallet infrastructure designed to let AI agents spend, earn, and trade crypto autonomously. The feature, dubbed Agentic Wallets, builds on the AgentKit framework introduced in November 2024 and aims to push agents from answering questions to taking concrete actions in the market. The system enables developers to embed wallets into agents, enabling tasks such as monitoring DeFi positions, rebalancing portfolios, paying for compute and API access, and participating in creator economies. Core to this rollout is x402, Coinbase’s payments protocol built for autonomous AI use cases, which has reportedly processed 50 million transactions to date.

Agentic Wallets are designed to operate across networks, including the Ethereum layer-2 network Base, where agents can manage positions and execute strategies wherever opportunities exist. The approach envisions a future where agents autonomously optimize yields, rebalance liquidity, and deploy capital without requiring explicit, real-time approvals, provided permissions and controls are preconfigured by users. This marks a shift from AI assistants that merely advise to agents that act, according to Coinbase engineers Erik Reppel and Josh Nickerson in a Wednesday post announcing the development.

“The next generation of agents won’t just advise — they’ll act,” Reppel and Nickerson wrote, detailing plans for agents to perform a range of functions from monitoring yields across protocols to executing trades on Base and managing liquidity positions around the clock. They described a scenario in which an agent detects a more favorable opportunity at 3 a.m., rebalances automatically, and does so without explicit approval because user permissions and safety controls are already in place.

AI agents now operable on the Bitcoin Lightning Network

Beyond Ethereum’s Base, Lightning Labs—the team behind Bitcoin’s Layer-2 Lightning Network—rolled out a new toolset enabling AI agents to transact on Lightning through the L402 protocol standard. The update also allows AI agents to run a Lightning node and manage a Lightning wallet containing native Bitcoin (BTC) without accessing private keys. This development broadens the scope for autonomous financial activity on Bitcoin’s network, providing a parallel pathway for agents to engage with programmable money at the base layer’s second tier.

The push toward agent-enabled wallets comes alongside broader industry activity. Crypto.com CEO Kris Marszalek announced ai.com, a platform intended to let users create personal AI agents to perform everyday tasks on their behalf. The capability ranges from managing emails and scheduling meetings to canceling subscriptions, shopping tasks, and even trip planning. Marszalek described a spectrum of tasks that AI agents could handle, illustrating how these tools might eventually operate as your digital proxy across daily routines.

Why crypto leaders are embracing agentic AI

Industry executives have long warned that AI could redefine how value is exchanged online. In late January, Circle CEO Jeremy Allaire suggested billions of AI agents could transact with crypto and stablecoins for everyday payments within three to five years. Former Binance CEO Changpeng Zhao has echoed a similar sentiment, arguing that a native currency for AI agents is likely to be crypto, capable of supporting tasks from purchasing event tickets to paying restaurant bills. These public statements reflect a shared belief that programmable money and autonomous agents will converge to enable more fluid, real-time financial interactions.

At a higher level, the convergence of AI with decentralized finance and payments ecosystems is driving experimentation around agent autonomy. Google’s recent Universal Commerce Protocol, announced in January, is designed to power agentic commerce by enabling agents to initiate transfers on a user’s behalf, with Google Pay acting as the default payment handler for USD-denominated transactions. The protocol signals a broader push in the tech sector to enable AI-driven commerce that can operate across apps, devices, and payment rails without constant human oversight.

“Build agents that monitor yields across protocols, execute trades on Base and manage liquidity positions 24/7. Your agent detects a better yield opportunity at 3am? It rebalances automatically, no approval needed because you’ve already set permissions and controls.”

As these capabilities mature, momentum in the space is likely to hinge on two dimensions: the robustness of autonomous decision-making and the security of permissioning and governance models. Agentic Wallets must balance the convenience of automated actions with safeguards to prevent unintended risk exposure. The ongoing conversations around risk controls and regulatory alignment will shape how broadly such wallets are adopted by retail and institutional users alike.

Market context

The emergence of autonomous wallets sits within a broader cycle of increased on-chain programmability and the maturation of smart contract-enabled finance. As liquidity provision, yield optimization, and creator economy participation become more automation-friendly, the appetite for self-operating agents grows among developers and institutions alike. The convergence of AI tooling with established networks like Base and the Lightning Network underscores a dual-track approach: one path leverages scalable, smart-contract-enabled ecosystems, while the other emphasizes fast, low-friction payments on Bitcoin’s secondary layer. Regulatory clarity and ETF-related flows in traditional markets are likely to influence how aggressively capital participates in these early-stage, automation-centric use cases.

Why it matters

Agentic Wallets represent a tangible step toward programmable money that can autonomously allocate capital, monitor risk, and adjust exposure across multiple protocols. If successful, the approach could reduce the overhead of manual trading and portfolio management, enabling more people to experiment with sophisticated strategies without in-depth technical know-how. The ability to manage DeFi positions and pay for compute or data access autonomously also has implications for developers building AI-powered financial tools, potentially accelerating product development cycles and new business models in the crypto space.

The integration with Bitcoin’s Lightning Network adds a separate layer of significance. By enabling AI agents to transact via L402 on Lightning and hold a Lightning-compatible wallet, the ecosystem expands the set of on-chain and off-chain rails that can be orchestrated by autonomous programs. This broadens practical use cases for AI agents—from micro-payments to cross-network arbitrage—while testing the limits of permissioned automation and the user controls that balance safety with convenience. Taken together, these developments suggest a future in which agents operate across multiple rails with varying latency, fees, and settlement characteristics.

For users and builders, the key takeaway is a shift in how wallets are used and who controls them. Agentic Wallets place agency in the hands of AI-enabled programs, but with computerized governance that requires explicit permissions ahead of time. The risk-management framework around such permissions will be critical to its sustainable adoption, particularly as public enthusiasm for automation intersects with concerns about security and misuse. The coming months are likely to reveal the first generation of real-world deployments and decision-making heuristics that will define the role of agents in everyday crypto activity.

What to watch next

- Expansion of Agentic Wallets beyond Base to other Ethereum layer-2s and compatible networks, including any developer updates from Coinbase.

- Tracking adoption and volume on the x402 payments protocol, including any reported milestones beyond the 50 million transactions already noted.

- Broader deployment of AI agents on Bitcoin via the Lightning Network using L402, and the integration of wallets with Lightning node operations.

- Progress and practical traction for ai.com by Crypto.com, including user adoption metrics and featured autonomous tasks.

- Further details on Google’s Universal Commerce Protocol and collaboration milestones that enable agent-initiated transfers and payments in real-world settings.

Sources & verification

- Coinbase: Introducing AgentKit — developer-facing overview and the roadmap for embedding wallets into autonomous agents.

- Coinbase Developer Platform status updates on AgentKit and Agentic Wallets deployment.

- Lightning Labs: L402 protocol standard enabling AI agents to transact on Lightning and manage Lightning-enabled wallets.

- Crypto.com: ai.com platform launch and its scope for personal AI agents performing daily tasks.

- Google: Universal Commerce Protocol and Agent Payment Protocol 2 for agent-enabled transfers in commerce.

Key figures and next steps

Coinbase’s public framing of Agentic Wallets as a step toward “agents that act” follows a broader wave of AI-powered automation across crypto layers. The combination of AgentKit, x402, and multi-network reach—spanning Base and the Lightning Network—provides a multi-faceted testbed for autonomous financial activity. Investors and builders will be watching for evidence of sustainable user authorization models, transparent risk controls, and clear metrics around automated yield optimization and liquidity management. As the ecosystem experiments with agent-based transactions, market participants will assess whether these autonomous wallets can reliably operate without compromising security or user intent.

Crypto World

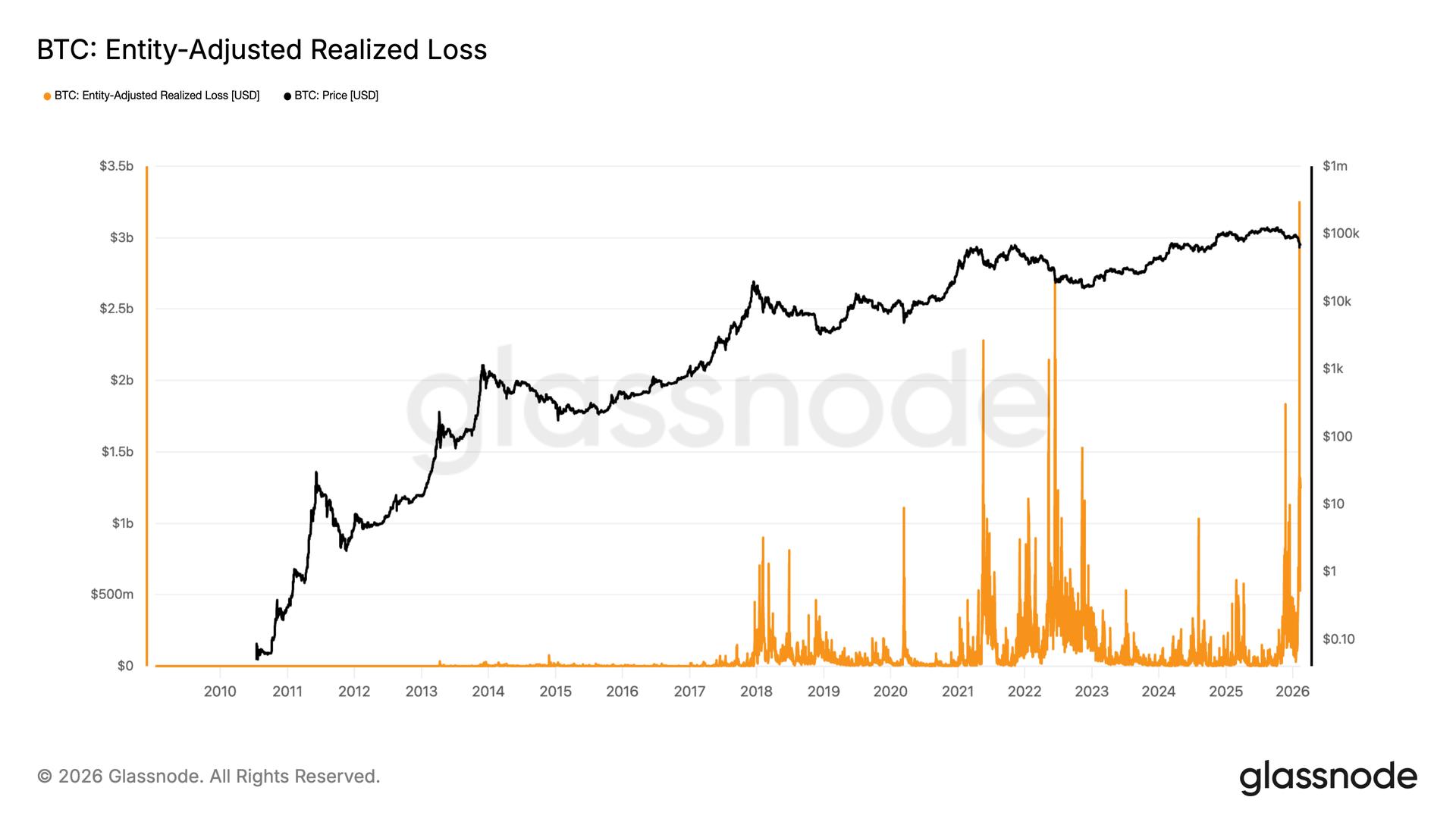

Last week’s rout delivered BTC’s biggest realized loss ever; bottoming signals grow

The largest realized loss in bitcoin history occurred during last week’s market downturn, shattering previous records as the asset plummeted from $70,000 to $60,000 on Feb. 5.

According to Glassnode, the Entity-Adjusted Realized Loss reached $3.2 billion. This metric exclusively tracks the USD value of moved coins sold below their acquisition price while filtering out internal transfers between the same entity.

This massive capitulation surpassed even the darkest days of 2022, eclipsing the $2.7 billion loss recorded during the collapse.

According to data platform Checkonchain, “Last week’s bitcoin sell-off meets the criteria of a textbook capitulation event. It occurred rapidly, on heavy volume, and crystallised losses from the lowest-conviction holders.”

With daily net losses exceeding $1.5 billion, the scale of this sell-off represents the most significant absolute USD loss ever crystallized in the network’s history. This points to more signs of a bear market bottom.

As of press time bitcoin is trading around $67,600.

Crypto World

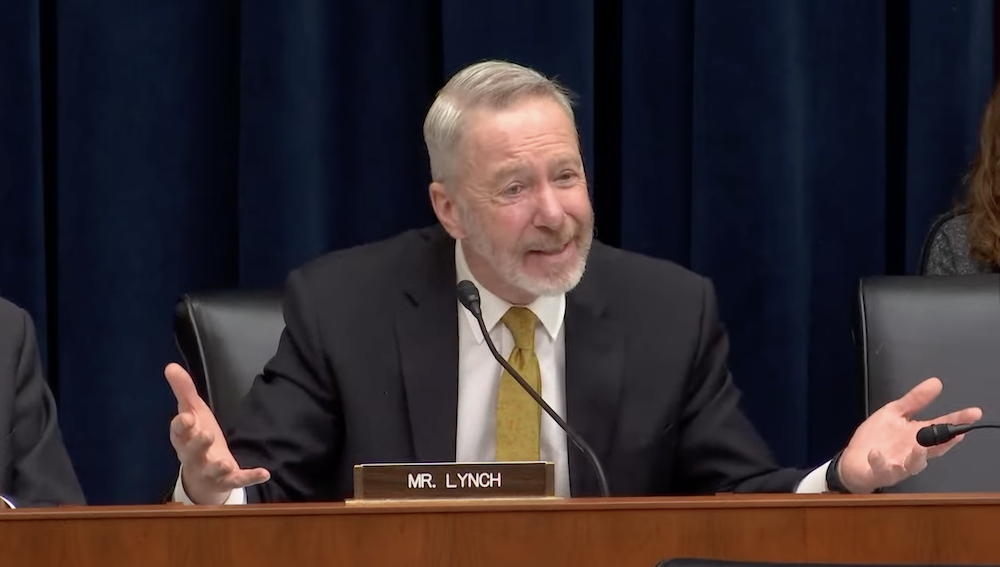

SEC’s Cooled Enforcement Policy ‘Not Good’ for Crypto Industry: Congressman

US lawmakers questioned Securities and Exchange Commission (SEC) Chair Paul Atkins at a hearing on Wednesday about the agency’s enforcement actions against the crypto industry and why several cases were dismissed since the leadership change.

Enforcement actions since US President Donald Trump assumed office, and appointed Atkins as SEC chair, are down by 60%, Representative Stephen Lynch said.

The Massachusetts Democrat cited the dismissal of several SEC lawsuits against the crypto industry, including the SEC’s motion to dismiss the Binance case in May 2025, as examples of the dropped enforcement cases.

Lynch also said that foreign investments in World Liberty Financial (WLFI), a decentralized finance platform linked to the Trump family, and memecoins launched by the family, were also causes for concern.

Recent reports indicate that Aryam Investment 1, an Abu Dhabi investment vehicle backed by Sheikh Tahnoon bin Zayed Al Nahyan, the national security adviser of the United Arab Emirates (UAE), purchased 49% of the startup company behind WLFI. Lynch said:

“This is hurting the crypto industry, all these scams. Look at crypto today. I think it’s down 25% in the last month. People are losing trust, and it’s not good for crypto. It’s certainly not good for consumers, and it’s awful the reputational damage that the SEC is suffering.”

“We have a very robust enforcement effort, and we are bringing cases,” Atkins responded. The comments rehashed previous concerns voiced by Democratic lawmakers about the Trump family’s involvement in crypto and how it could effect US national security.

The comments come during a US midterm election year and could signal resistance toward crypto from Democrats, which could stall market structure legislation if the Democratic Party takes back control of at least one chamber of Congress.

Related: Trump-linked WLFI faces probe over $500M UAE crypto deal

Rep. Maxine Waters claims crypto industry pardons, dropped lawsuits are politically motivated

“These cases were dismissed, despite the fact that the SEC was winning in court, proving that the SEC’s crypto enforcement program was well-grounded in the law,” California Representative Maxine Waters said.

The crypto industry executives who benefited from the pardons and the dropped regulatory lawsuits gave “millions of dollars” to Trump and his family, Waters continued.

Waters, who is a vocal critic of both Trump and the crypto industry, has repeatedly called for probes into the president’s family’s crypto activities, characterizing the projects as a potential backdoor for foreign entities to influence Executive Branch policy through bribery.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

MSTR Stock Struggles as Bitcoin’s Value Dips Below $70,000

TLDR

- MSTR stock dropped 4.8% today, following a significant decline in Bitcoin’s price.

- Michael Saylor linked the stock’s decline to a four-month Bitcoin bear market.

- Strategy’s stock has shown extreme volatility, with 58 moves greater than 5% in the past year.

- A 13.4% drop in Strategy’s stock occurred just six days ago due to Bitcoin’s sharp decline.

- Canaccord Genuity analyst Joseph Vafi slashed his price target on Strategy by over 60%.

Shares of Strategy (NASDAQ: MSTR) experienced a 4.8% drop in the afternoon session today. The decline follows the movement of Bitcoin, which faced a notable decrease in its value. Strategy’s strong correlation with Bitcoin’s performance has made the company’s stock price highly volatile.

MSTR Stock Moves in Tandem with Bitcoin

Strategy’s stock price has consistently followed Bitcoin’s fluctuations, given the company’s large holdings in the cryptocurrency. As Bitcoin dropped from over $110,000 to near $70,000, MSTR stock reflected a similar decline. Michael Saylor, Strategy’s executive, directly attributed the recent decrease to the ongoing four-month bear market for Bitcoin. He stated, “The stock’s decline is tied to the market’s response to Bitcoin’s performance.” This strong link between the two assets has resulted in high volatility for Strategy’s shares.

The company’s stock has moved more than 5% on 58 occasions over the past year, showing its sensitivity to market shifts. Today’s drop, however, is viewed as another typical move within the volatility that investors expect. The market, however, does not appear to see this as a fundamental change in the business outlook. Investors are continuing to monitor Bitcoin’s movements as they assess Strategy’s performance.

Previous Drop and Analyst’s Impact on MSTR

The latest drop comes after a 13.4% decrease in Strategy’s stock just six days ago. This drop followed Bitcoin’s sharp decline, which impacted the value of Strategy’s holdings. Canaccord Genuity analyst Joseph Vafi reduced his price target for the company by over 60% due to Bitcoin’s declining price. The drop in Bitcoin’s value below $70,000 also coincided with the market waiting for Strategy’s fourth-quarter earnings report.

The large-scale impact of Bitcoin’s movement on Strategy’s stock is a key focus for analysts. Investors have remained concerned about the company’s crypto exposure, especially as its Bitcoin holdings lose value. Despite these concerns, Strategy continues to be the largest corporate holder of Bitcoin, which has made its stock price sensitive to changes in the cryptocurrency’s performance.

Strategy’s stock has dropped 19.8% since the beginning of the year, with its current price at $126.10 per share. This price is a far cry from its 52-week high of $455.90, a 72.3% drop from that peak. Investors who bought $1,000 worth of Strategy stock five years ago would now see an investment valued at $1,249.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports3 hours ago

Sports3 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World5 hours ago

Crypto World5 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’