Crypto World

Quant Joins Bank of England Synchronisation Lab for Multi-Bank Treasury Testing

TLDR:

- Quant is testing synchronised multi-bank treasury operations in the Bank of England RT2 Lab.

- Treasury actions like liquidity rebalancing will execute as single atomic settlement bundles.

- Quant Flow automates multi-bank cash movements using PayScript® for auditable workflows.

- Participation is experimental; it does not indicate endorsement or policy adoption by the Bank.

Quant selected to participate in the Bank of England’s Synchronisation Lab marks a new stage in the firm’s work on programmable settlement infrastructure.

The company will test synchronised payment techniques inside the Bank of England’s simulated RT2 environment. The programme forms part of the RTGS Future Roadmap after the renewed core ledger and settlement engine went live.

The initiative focuses on experimentation rather than policy direction or endorsement.

RT2 Synchronisation Lab and Atomic Multi-Bank Settlement

Quant selected to participate in the Bank of England’s Synchronisation Lab enables structured testing within a controlled RT2 simulation.

The Lab allows participants to assess synchronisation models for future payment and settlement workflows. It operates in a non-live environment following delivery of the renewed RTGS core.

A spokesperson for Quant said participation centres on a practical corporate treasury scenario. “The Synchronisation Lab provides a simulated RT2 environment in which participants can explore how synchronisation techniques could support future payment and settlement workflows,” the spokesperson stated.

Quant’s proposed use case focuses on synchronized multi-bank treasury rebalancing. Large corporates and upper-SMEs often manage liquidity across several domestic banks. Treasury teams currently execute independent CHAPS or high-value transfers to rebalance positions.

According to Quant, this sequential structure introduces operational constraints. “This sequential model introduces structural challenges, including partial settlement risk, intraday liquidity buffers, manual intervention, and complex reconciliation,” the company noted.

Quant Flow and Programmable Treasury Orchestration

Quant selected to participate in the Bank of England’s Synchronisation Lab builds on its enterprise platform, Quant Flow.

The platform orchestrates multi-bank cash movements using PayScript®, a domain-specific language for auditable financial workflows.

Within the simulation, Quant Flow packages treasury actions into a synchronised settlement bundle. “Each participating bank prepares and reserves funds before settlement, with all legs committed together or not at all,” the company explained.

Quant said the prepare-and-commit structure changes treasury execution mechanics. “This prepare and commit approach removes the failure modes inherent in sequential transfers and enables deterministic finality across multiple banks in a single treasury action,” the spokesperson added.

The company also clarified the scope of its participation. “Participation in the Synchronisation Lab involves experimentation and technical validation within a non-live environment,” Quant stated.

It added that involvement does not represent approval, endorsement, or adoption by the Bank of England, and future deployment remains independent of the Lab.

Crypto World

Sui Blockchain Secures Institutional Backing as Grayscale Files ETF with Coinbase Custody

TLDR:

- Grayscale’s S-1 amendment for Sui ETF with Coinbase custody brings institutional capital access channels.

- zkLogin technology eliminates seed phrases by enabling Google, Face ID, and phone authentication methods.

- Object-centric architecture processes transactions simultaneously, maintaining sub-cent fees during peak usage.

- Move programming language prevents asset duplication and deletion, eliminating common smart contract exploits.

The Sui blockchain has entered a new phase of development in February 2026 as institutional finance shows increased interest in the platform.

Grayscale recently amended its S-1 filing for a Sui exchange-traded fund, naming Coinbase as custodian. This development marks a shift from retail-driven speculation toward institutional infrastructure adoption.

The move signals growing recognition of Sui’s technical capabilities and regulatory compliance standards within traditional finance circles.

Institutional Capital Opens New Access Channels

The Grayscale ETF filing represents more than a routine regulatory submission. Exchange-traded funds transform digital tokens into recognized financial instruments accessible to pension funds and retirement accounts.

These institutional investors can now gain exposure without managing wallets or private keys directly. Coinbase’s role as custodian addresses security and compliance requirements that traditional finance demands.

Bitcoin ETFs previously demonstrated how institutional access drives capital inflows at scale. However, Bitcoin had already matured before ETF approval.

Sui remains in earlier development stages, meaning institutional capital entering now carries greater relative impact. Fixed supply dynamics combined with increasing demand create favorable conditions for long-term growth.

The institutional validation extends beyond price speculation. Regulatory recognition attracts enterprise developers and commercial applications.

Projects building on blockchains with clear compliance pathways face fewer legal uncertainties. This regulatory clarity reduces friction for businesses considering blockchain integration.

Capital markets now view Sui as legitimate infrastructure rather than experimental technology. The shift reflects broader industry maturation as crypto moves from speculative trading toward functional utility.

Traditional finance involvement brings stability and resources that support long-term ecosystem development.

Technical Architecture Removes Adoption Barriers

Sui addresses two critical obstacles that have prevented mainstream adoption. The platform eliminates seed phrase requirements through zkLogin technology developed by partners, including Human.tech’s Wallet-as-a-Protocol and Ika.

Users authenticate with Google accounts, Face ID, or phone numbers while maintaining full asset control. Zero-knowledge authentication verifies identity without exposing private keys to third parties.

This onboarding simplification removes the most intimidating aspect of cryptocurrency usage. Traditional wallet setup requires writing down twelve-word phrases and understanding address systems.

Sui reduces this process to familiar login methods users already trust. The technology breakthrough makes blockchain accessible without requiring technical education.

The underlying architecture also delivers performance improvements. Sui employs an object-centric model where assets exist as independent objects rather than account balances.

Tokens, NFTs, and smart contracts process simultaneously instead of sequentially. This parallel execution prevents network congestion even during high-demand periods.

Transaction fees remain under one cent with finality achieved in approximately 400 milliseconds. The Mysticeti consensus upgrade further reduced latency.

Move programming language adds security advantages by treating assets as resources that cannot be copied or accidentally deleted.

This design eliminates common exploit categories, including reentrancy attacks. The combination of usability and technical performance positions Sui for practical application deployment across finance and gaming sectors.

Crypto World

Figure Technology Data Breach Exposes Customer Personal Information

Figure Technology, a blockchain-based lending firm, was reportedly hit by a data breach after attackers manipulated an employee in a social-engineering scheme.

The incident allowed hackers to obtain “a limited number of files,” a company spokesperson told TechCrunch. The company said it has begun notifying affected parties and is offering free credit-monitoring services to anyone who receives a breach notice.

Details about the scope of the incident, including how many users were affected or when the intrusion was detected, were not disclosed publicly. Cointelegraph reached out to Figure for comment, but had not received a response by publication

The hacking collective ShinyHunters claimed responsibility on its dark-web leak site, alleging the company declined to pay a ransom. The group published roughly 2.5 gigabytes of data said to have been taken from Figure’s systems.

Related: ‘Hundreds’ of EVM wallets drained in mysterious attack: ZachXBT

Leaked Figure data includes names, addresses

TechCrunch reported that it reviewed samples of the leaked material, which included customers’ full names, home addresses, dates of birth and phone numbers. This information could be used for identity fraud and phishing attempts.

As Cointelegraph reported, crypto phishing attacks linked to wallet drainers dropped sharply in 2025, with total losses falling to $83.85 million, an 83% decline from nearly $494 million in 2024, according to Web3 security firm Scam Sniffer. The number of victims also fell to about 106,000, down 68% year over year across Ethereum Virtual Machine chains.

Researchers said the drop does not mean phishing has disappeared. Losses closely tracked market activity, rising during periods of heavy onchain trading and easing when markets cooled. The third quarter of 2025, during Ethereum’s strongest rally, recorded the highest losses at $31 million, with monthly totals ranging from $2.04 million in December to $12.17 million in August.

Related: Crypto hack counts fall, but supply chain attacks reshape threat landscape

Figure Technology goes public

Figure Technology went public in September last year, listing on the Nasdaq Stock Exchange. The fintech firm, known for its blockchain-based lending, priced its initial public offering (IPO) at $25 per share, raising $787.5 million and achieving an initial valuation of approximately $5.3 billion to $7.6 billion.

Last month, Figure Technology launched the On-Chain Public Equity Network (OPEN), a platform on its Provenance blockchain that lets companies issue real shares and allows investors to lend or pledge those shares directly to one another without traditional brokers, custodians or exchanges.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

Kevin O’Leary Wins $2.8 Million Defamation Judgment Against BitBoy Crypto

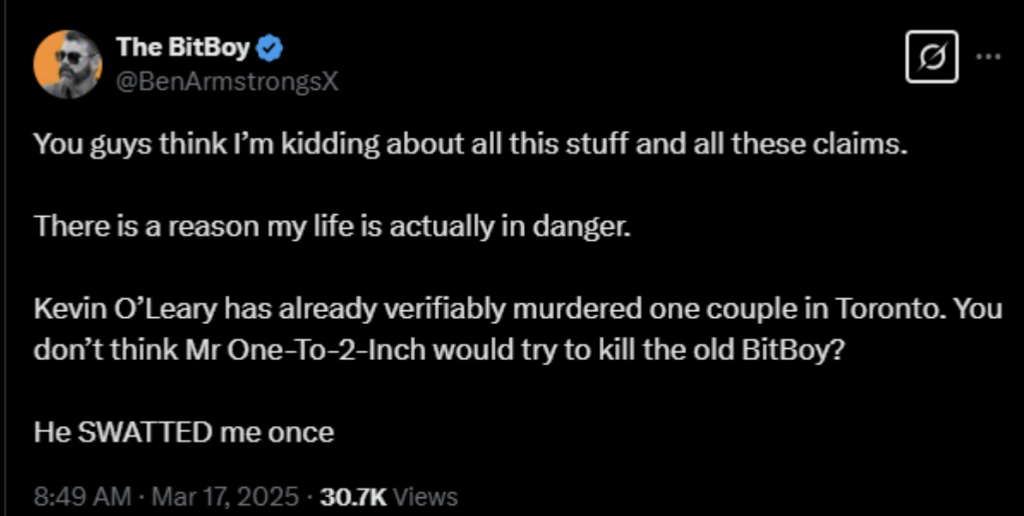

Kevin O’Leary just walked away with a $2.8 million courtroom win. The Shark Tank investor secured a default judgment against former crypto influencer Ben Armstrong, better known as BitBoy Crypto.

The funny thing? Armstrong did not even properly defend himself. A federal judge in Florida stepped in and awarded heavy punitive damages after claims surfaced that Armstrong publicly called O’Leary a “murderer.”

- Judge Beth Bloom awarded O’Leary $2 million in punitive damages plus $750,000 for emotional distress.

- The court rejected Armstrong’s attempt to blame the default on mental health struggles and incarceration.

- Armstrong previously taunted O’Leary online, posting his personal phone number and alleging a cover-up regarding a 2019 boat crash.

The Feud Behind Kevin O’Leary Lawsuit

This whole fight traces back to a tragic 2019 boat crash involving O’Leary’s wife, Linda, where two people lost their lives. She was fully acquitted in 2021. Case closed.

Years later, Armstrong went online and ignored that outcome completely. He posted claims saying O’Leary and his wife “murdered a couple and covered it up.” Then it escalated. He shared O’Leary’s private phone number and urged followers to call him, throwing out lines like he was a “rabid dog” going after him.

At one point, Armstrong even mocked critics by asking, “What are you gonna do, sue me?”

Turns out, that is exactly what happened. And on March 26, 2025, he got his answer in court.

Breaking Down the $2.8 Million Judgment

The ruling included $78,000 for reputational damage and $750,000 for emotional distress.

O’Leary even pointed to increased security measures and changes to studio access because of fears tied to Armstrong’s online following.

Then came the real blow. An extra $2 million in punitive damages, meant to send a message. Armstrong had already defaulted after failing to respond to the lawsuit in 2025. He later tried to undo that default in early 2026, arguing incarceration and mental health struggles kept him from defending himself.

The court did not buy it.

This judgment adds to what has already been a brutal stretch for Armstrong, who was pushed out of the HIT Network and is now staring at serious financial fallout.

The post Kevin O’Leary Wins $2.8 Million Defamation Judgment Against BitBoy Crypto appeared first on Cryptonews.

Crypto World

Massive 500% PI Surge Forecast as Pi Network Leadership Sends Key Message

The PI token is among the notable gainers in the past 24 hours and has risen far above its recent all-time low.

Despite growing criticism and controversy surrounding the project, many Pioneers continue to publicly praise and support the Pi Network Core Team and the ecosystem they have built.

The underlying asset has finally shown notable signs of recovery, prompting a prominent analyst to hint at buying PI and making bold price predictions.

“Adding Some PI”

Captain Faibik, a renowned cryptocurrency analyst with well over 100,000 followers on X, made a rare call on Pi Network’s native token. In a recent tweet, Faibik outlined their 500% surge expectation for PI after explaining that they had added some of the token for the midterm.

Adding Some $PI for the Midterm..!!

Expecting +500% Bullish Rally..🔜#Crypto #PI #PIUSDT pic.twitter.com/LQppQBAblo

— Captain Faibik 🐺 (@CryptoFaibik) February 14, 2026

PI has performed rather well in the past day, jumping by 10% to over $0.16. This means the asset is now 23% higher than its all-time low of $0.1312, set on February 11. Despite this daily increase, PI remains deep in the red on almost all other scales, down nearly 95% from its all-time low recorded last February.

If Captain Faibik’s 500% surge prediction is to come true, the token could be on its way to $1. However, that seems unlikely at the moment, given the overall market environment and PI’s inability to stage a longer, more profound recovery.

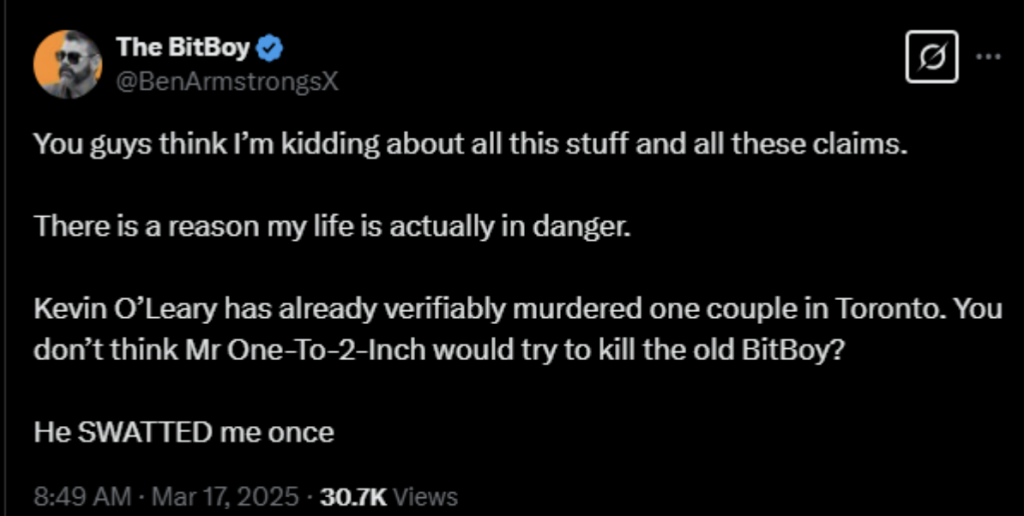

There’s a big elephant in the Pi Network room for the next few weeks. The token unlock schedule from PiScan indicates that, on average, more than 7.2 million PI will be released daily over the next month, but the number will frequently exceed 13.5 million by February 25. The unlocks will ease in March, though.

You may also like:

These large unlocking events are viewed as bearish, as they can increase immediate selling pressure from investors who have been waiting for their tokens for a long time.

Co-Founder Speaks Out

Pi Network’s Core Team has faced significant scrutiny over the past several weeks. However, this didn’t stop them from announcing a new series of upgrades with a February 15 deadline for Mainnet nodes.

One of the project’s co-founders, Dr. Nocolas Kokkalis, also issued the same reminder to his over 120,000 followers on X, claiming that the PI nodes are the “4th role in the PI ecosystem.” He urged users to run the PI node on their laptop or desktop to validate transactions, strengthen network security, and support global consensus and trust.

🚀 Pi Nodes — The 4th Role in the Pi Ecosystem 🌐

💻 Run Pi Node on your laptop or desktop and help power decentralization:

✅ Validate transactions on a distributed ledger

🔐 Strengthen network security

🌍 Support global consensus & trust

⚡ Every node makes the network stronger… pic.twitter.com/jrxy0IKSyM— Dr. Nicolas Kokkalis (@drnicolas_) February 14, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Figure Blockchain Lender Confirms Customer Data Breach Following Social Engineering Attack

TLDR:

- Figure Technology employee tricked in social engineering attack enabling unauthorized data access

- ShinyHunters published 2.5GB of customer data including names, addresses, and phone numbers

- Attack part of broader campaign targeting companies using Okta single sign-on authentication

- Figure offers free credit monitoring and maintains customer funds remain secure despite breach

Figure Technology disclosed a customer data breach on Friday after an employee fell victim to a social engineering attack.

The blockchain lender confirmed that hackers accessed limited customer files through the compromised account. Hacking group ShinyHunters claimed responsibility for the incident and published approximately 2.5 gigabytes of stolen data. The company has launched a forensic investigation and implemented additional security measures.

Attack Details and Compromised Information

Figure explained the breach in a statement, noting that attackers manipulated an employee through deceptive tactics to gain unauthorized system access.

“We recently identified that an employee was socially engineered, and that allowed an actor to download a limited number of files through their account,” the company said. Figure identified the incident quickly and responded to contain the threat.

The lender emphasized its swift response to the security incident. “We acted quickly to block the activity and retained a forensic firm to investigate what files were affected,” Figure stated. The company worked to determine the full scope of compromised data following the discovery.

ShinyHunters stated that Figure refused to pay a ransom demand before publishing the stolen data. TechCrunch reviewed portions of the leaked files and confirmed they contained sensitive customer information.

The exposed data includes full names, home addresses, dates of birth, and phone numbers of affected individuals.

The New York-based lender specializes in home equity lines of credit using its Provenance blockchain platform. Founded in 2018, Figure went public in September 2025 under ticker symbol FIGR.

The initial public offering raised $787.5 million and valued the company at approximately $5.3 billion.

Broader Campaign and Company Response

A ShinyHunters member told TechCrunch the attack was part of a larger campaign targeting organizations using Okta single sign-on services.

Harvard University and the University of Pennsylvania were among other alleged victims in this widespread operation. The connection suggests a coordinated effort exploiting vulnerabilities in shared authentication systems.

Figure is communicating with partners and affected customers about the breach. “We are offering complimentary credit monitoring to all individuals who receive a notice,” the company said. These protective measures aim to help customers guard against potential identity theft or fraud.

The lender reassured customers about account security despite the data exposure. “We continuously monitor accounts and have strong safeguards in place to protect customers’ funds and accounts,” Figure stated. The company maintains that customer funds remain secure throughout the incident.

Data breaches have become increasingly common across industries in recent years. Privacy Rights Clearinghouse reported over 8,000 notification filings in 2025 tied to more than 4,000 separate incidents. These breaches affected at least 374 million people throughout the year.

Figure announced a secondary public offering on the same day as the breach disclosure. The company plans to offer up to 4.23 million shares of Series A Blockchain Common Stock.

The stock closed Friday up 3.57% at $35.29, though it has declined 37% over the past month.

Crypto World

Memecoin Market Signals Classic Capitulation, Santiment Warns

A reversal in memecoins could be on the horizon even as broader crypto markets remain choppy, according to a contemporary assessment from Santiment, a sentiment analytics platform. The report frames a period of renewed attention on meme-friendly tokens after a prolonged pullback, suggesting that capitulation in a beaten-down niche sometimes creates the setup for a contrarian rebound. While Bitcoin and other major assets waver in recent sessions, chatter around nostalgia for meme assets has grown louder among some traders, who view it as a potential precursor to a bottoming process.

Key takeaways

- Memecoin market capitalization declined 34.04% over the last 30 days to roughly $31.02 billion, amid a broader crypto downturn that pushed Bitcoin near $60,000 on Feb. 3.

- Among the top 100 memecoins, Pippin (PIPPIN) jumped about 243.17% over the past week, with Official Trump (TRUMP) and Shiba Inu (SHIB) up modestly, at around 1.37% and 1.11% respectively.

- Historically, meme-sector capitulation can precede a contrarian rebound, as traders begin to re-enter sectors written off by the crowd.

- Analysts are increasingly debating whether the traditional rotation pattern—Bitcoin to Ethereum to risky altcoins—will repeat in a more mature market environment.

- Market sentiment on social channels has swung toward fear in places, potentially signaling room for a rebound should disappointment translate into renewed demand.

Tickers mentioned: $BTC, $ETH, $SHIB, $TRUMP, $PIPPIN, $DOGE

Sentiment: Neutral

Price impact: Negative. The memecoin segment hastrended lower, underscoring broad risk-off conditions even as some tokens show selective strength.

Trading idea (Not Financial Advice): Hold. While contrarian signals emerge, the overall risk environment remains unsettled, and selective movers could drive bursts of activity without guaranteeing a sustained recovery.

Market context: The memecoin cycle is navigating a quieter macro backdrop where Bitcoin’s performance has become less predictable, and institutional interest across larger assets is reshaping rotation dynamics. The emerging narrative around nostalgia and capitulation is intersecting with caution around broader price action and liquidity in crowded meme markets.

Why it matters

The memecoin ecosystem has long functioned as a barometer for retail appetite and market psychology. When a segment is broadly dismissed, it can trap participants into a capitulation phase that retests key support levels and creates an attractive entry point for those willing to assume risk. Santiment highlights this phenomenon, arguing that a widespread perception of the “end of memes” can become a contrarian catalyst: as fear ascends and attention wanes, the crowd may underprice the stakes for a rebound. This perspective matters because it shifts the calculus for traders who monitor narrative shifts and social sentiment as leading indicators of turning points.

The current data show that the total memecoin market cap has slipped to about $31.02 billion after a 30-day decline of more than a third, a reminder that meme assets are highly sensitive to liquidity and risk sentiment. While the top tokens have posted a mixed set of movements—PIPPIN experiencing a remarkable spike while others like TRUMP and SHIB have posted modest gains—the broader decline underscores how intrinsic volatility can outpace narrative-driven optimism. In this setting, investors who watch for a bottom rather than a rally may find value in the patience that often precedes a durable recovery, provided macro conditions and on-chain signals align.

Historically, the conventional cycle has seen risk-on capital flow from Bitcoin into Ethereum and then into a suite of altcoins. Yet as Bitcoin matures and institutions become more deeply involved, some analysts question whether this rotation will function in the same way. The possibility of a more selective altseason—where only a subset of coins leads—adds a layer of uncertainty to mid-cycle expectations. In practice, this means that even if Penned narrative of a meme revival gains traction, it could unfold unevenly across the memecoin universe rather than delivering a broad-based uplift.

Beyond price action, the social sentiment surrounding the crypto market has shown a tilt toward bearish commentary in some corners, even as price figures recover in isolated pockets. Santiment cautions that market psychology often moves in opposition to mainstream expectations, and that the crowd’s skepticism may ultimately become a stabilizing force that helps avert parabolic moves before a more sustainable climb materializes. In this framing, the latest data do not promise an immediate bull market but do suggest that the door remains open for a repricing of risk if sentiment shifts and liquidity returns to the space.

In sum, the current landscape presents a paradox: a market that has endured a meaningful retracement in memecoins while simultaneously hosting pockets of strength in specific tokens, alongside contrarian narratives that hinge on capitulation dynamics. The balance between fear-driven selling pressure and recovering demand will likely determine whether the memecoin sector forms a bottom or slides further before any meaningful revival takes hold.

What to watch next

- Monitor whether memecoin market capitalization stabilizes above the recent troughs, or if further declines materialize over the next few weeks.

- Track social sentiment gauges and Santiment’s weekly updates for signs that fear is transitioning toward cautious optimism.

- Observe price action of standout memecoins such as PIPPIN, TRUMP, SHIB, and DOGE for sustained momentum rather than short-lived spikes.

- Watch Bitcoin’s price dynamics around key levels (for example, the $60,000 zone) to gauge broader risk appetite and its influence on altcoin rotations.

- Look for any regulatory or exchange-driven developments tied to meme tokens that could alter liquidity or accessibility for meme-focused projects.

Sources & verification

- Santiment’s weekly insights and commentary on nostalgia in memecoins and contrarian signals as part of This Week in Crypto (W2 February 2026).

- CoinMarketCap memecoin overview page documenting overall market cap declines and relative performance across the top memecoins.

- CoinMarketCap Dogecoin page for price dynamics and historical context within the memecoin ecosystem.

- Bitcoin price context and recent price levels referenced by market data and coverage on BTC price movements.

- Official price indices and trackers used to illustrate specific token movements such as PIPPIN, TRUMP, and SHIB.

Market signals point to a potential memecoin reversal amid a cautious market

In a crypto landscape characterized by fluctuating liquidity and evolving risk appetite, a contrarian view on memecoins is gaining traction. The latest data indicate that the broader memecoin sector has contracted sharply, with a 34.04% decline in market capitalization over the prior 30 days to about $31.02 billion, even as select tokens produced outsized moves. Across the top 100 memecoins, a handful of projects posted notable performance: Pippin (PIPPIN) surged about 243.17% over the past week, outperforming the pack as other meme assets logged much smaller gains. Official Trump (TRUMP) and Shiba Inu (SHIB) registered modest increases of roughly 1.37% and 1.11%, respectively.

From a narrative standpoint, the discussion around a possible “end of the meme era” has evolved into a potential contrarian catalyst. Santiment argues that when a segment becomes visibly written off, it can invite renewed attention from traders who view such capitulation as a sign that the worst is potentially behind them. The logic behind this stance is simple: when the crowd exits a space in force, the subsequent re-entry can generate price discovery that is less about hype and more about selective demand, especially if other indicators align.

Yet the market’s anatomy remains mixed. The memecoin sector’s downbeat price drift fits within a broader risk-off environment, where Bitcoin’s moves have been less tethered to a single direction. In the most recent sessions, the cryptocurrency king traded around the $60,000 mark—an approximate level that critics say has become a touchstone for risk tolerance and liquidity shifts in the ecosystem. The interaction between Bitcoin’s price path and altcoin dynamics remains a critical driver of whether a durable memecoin rebound can take hold. The observed divergence—where a few tokens post sharp gains while the overall segment remains under pressure—suggests that any recovery may be selective rather than universal, with tokens that boast stronger narrative or utility leading the way.

Within this frame, market participants are also weighing the potential impact of longer-term structural factors. As institutional engagement grows and the market matures, some analysts question whether the old rotation—BTC first, ETH next, then a broad ascent in riskiest altcoins—will reassert itself. The prospect of a more solo-driven altseason, anchored by select tokens rather than a broad rally, could define the next phase of meme-market activity. In practice, this means that investors aiming to capitalize on a memecoin revival will need to identify catalysts beyond mere hype—whether through on-chain signals, narrative momentum, or fundamental developments within specific projects.

The social sentiment backdrop adds another layer of nuance. Santiment has pointed to a notable tilt toward bearish commentary in some channels, even as prices rebound in isolated pockets. The juxtaposition of gloom and opportunity highlights a key tension in modern crypto markets: the possibility that fear can coexist with opportunities for meaningful gains if and when buyers return to the space with conviction. Taken together, these factors establish a framework in which a memecoin reversal is plausible but not guaranteed, contingent on liquidity, narrative durability, and the broader macro environment.

Crypto World

Ripple Bulls Reveal Bold Price Predictions as XRP Surges to Weekly Highs

XRP’s price jumped by over 7% in the past day and neared $1.50 for the first time in a week.

The ever-vocal Ripple community has taken the main stage on X again amid the underlying asset’s impressive price performance over the past day.

Here are some of the biggest XRP price predictions, as well as some really mindblowing forecasts about the token’s role in global finance.

Double Digits for XRP?

The past 24 hours have been kinder to the cryptocurrency markets, with BTC going past $70,000 for the first time in a week, and ETH reclaiming the $2,100 resistance. Ripple’s cross-border token has solidified its position as the fourth-largest cryptocurrency with a 7.5% surge to $1.48.

This has given the XRP Army wings to post some quite optimistic predictions once again, despite the token being 60% down from its all-time high of $3.65 marked in July last year.

Cobb alleged that the current price slump looks “so fake and orchestrated.” They added that it could have the opposite effect and “end up being one of the greatest fakeouts of all time and then BOOM $10 out of nowhere.”

In a separate tweet responding to John Squire’s $10,000 prediction, Cobb noted that the “real XRP trenchers” are actually hoping for a more modest target of $10-$30. ChartNerd agreed, actually, saying that the 1.618 Fibonacci extension sees the token skyrocketing to $27.

real XRP trenchers are looking for $10-$30 https://t.co/s2mkdyLoHT

— Cobb (@Cobb_XRPL) February 14, 2026

You may also like:

Needless to say, even the lowest of the aforementioned targets – $10 – sounds more than just far-fetched at the moment. Despite XRP’s positive momentum in the past 24 hours, the asset would have to surge by 580% to reach $10 and by a whopping 1,950% to tap $30.

XRP to Bridge Global Finance?

But, for the sake of argument, let’s assume that XRP could indeed surge to $10 or beyond anytime soon. It would need some sort of a major catalyst, right? The SEC legal case conclusion and the hope of spot XRP ETFs in the US managed to send it to as high as $3.65, so there must be something big for a double-digit price target.

Squire, perhaps the most vocal bull within the XRP Army, made another shocking claim, saying the token “will become the bridge asset for global finance.” He believes banks won’t opt for BTC, and would go for XRP because of its speed, liquidity, and compliance.

XRP will become the bridge asset for global finance.

Banks won’t choose Bitcoin.

They will choose speed, liquidity and compliance.Agree or disagree?

— John Squire | Global Finance & Crypto (@TheCryptoSquire) February 14, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

bitcoin claws back to $70,000 after $8.7 billion wipeout

Bitcoin has clawed its way back above $70,000, recovering from a sharp drop near $60,000 earlier in the month.

The cryptocurrency is up nearly 5% in the last 24-hour period, while the broader CoinDesk 20 (CD20) index rose 6.2% in the same period.

The rebound comes as investors react to a cooler-than-expected U.S. inflation print and signs of renewed risk appetite. The Consumer Price Index for January rose 2.4% year-over-year, just below the forecasted 2.5%.

That gave markets a reason to believe interest rate cuts could arrive sooner than expected, lifting both stocks and cryptocurrencies. Lower interest rates make risk assets more attractive, as the rate of return on risk-free or low-risk investments lowers.

Traders on prediction market Kalshi are currently weighing a 26% chance of a 25 bps rate cut in April, up from 19% earlier in the week. On Polymarket, the odds rose from 13% to 20%.

Still, the rally masks deeper fractures beneath the surface.

The Crypto Fear & Greed Index continues to reflect deep anxiety, hovering near extreme fear levels last seen during the 2022 bear market over the collapse of FTX. The index has been sitting in “extreme fear” since the beginning of the month.

Bitwise analysts noted that $8.7 billion in bitcoin losses were realized in the last week, second only to the fallout from the 3AC collapse.

“Nevertheless, the rotation of supply from weaker hands to conviction investors has historically been associated with market stabilisation phases, though such redistribution requires time to fully unfold,” Bitwise wrote.

Bitcoin treasury firms were sitting on over $21 billion of unrealized losses, an all-time high. Bitcoin’s recovery has seen that figure drop to $16.9 billion.

Thinner trading volumes are supporting the current rally during the weekend and seller exhaustion. The $8.7 billion in realized losses in the last week could be seen as a “textbook capitulation event.”

Yet, the extreme fear gripping the market poses a challenge. AS Bitwise research analyst Danny Nelson told CoinDesk, the market’s “main driver right now is fear. Fear that we’ll go lower.”

That fear is seeing investors take any coming rally as a chance to sell. Whether that will keep on materializing or the shift to higher-conviction holders will see the market change directions remains to be seen.

Crypto World

Bitcoin layer 2s keep failing because they’re not real L2s

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Over the past two years, the Bitcoin (BTC) ecosystem has witnessed a proliferation of “layer 2s” that have claimed to bring decentralized finance to the world’s oldest blockchain network. Despite the high hopes many Bitcoin enthusiasts held for these protocols, their results have fallen catastrophically short.

Summary

- Most “Bitcoin L2s” aren’t L2s at all: They’re sidechains with bridges, new tokens, and weaker security models that don’t inherit Bitcoin’s base-layer guarantees.

- Token-first design is the real red flag: When speculation leads, and security inheritance lags, it’s marketing — not scaling.

- Real Bitcoin scaling must preserve L1 assurances: No bridges, no new trust assumptions, no dilution of Bitcoin’s proof-of-work security.

This pattern reveals the core reason behind the constant failure, and it’s not what you think. Instead of selling a scaling solution for Bitcoin, they were selling speculative tokens about Bitcoin. The difference is critical, and it’s exposed by the one test that matters. Do they meet the architectural standards of a true layer 2?

What real layer 2s actually look like

Ethereum’s (ETH) mature layer-2 ecosystem provides the gold standard for what scaling solutions should accomplish. Real layer 2s require three non-negotiable features: data availability on layer 1 (the base layer must hold data needed to reconstruct the state), verifiable execution through fraud or validity proofs, and permissionless exits based solely on layer-1 data.

By this definition, which focuses on security inheritance rather than marketing claims, almost nothing in the Bitcoin ecosystem meets the criteria. Despite 73 Bitcoin scaling solutions in development, most are sidechains masquerading as L2s, running parallel to Bitcoin rather than on top of it.

Judge the difference and risk-reward of using any Bitcoin L2 to just using Ethereum. Any so-called Bitcoin L2 that fails to meet this standard asks you to accept its novel security model, whereas using Ethereum’s genuine L2s allows you to simply inherit Ethereum’s.

Three fatal flaws

Every major Bitcoin L2 shares the same architectural failures that doom it from the start. First, each project relies on bridges or federations to facilitate the movement of BTC in and out of the network. This creates a centralized chokepoint and massive custodial risk. You’re reintroducing the exact “trusted third party” that Bitcoin was created to eliminate.

Second, these projects are “token first.” They lead with tokens that have no necessary function for the protocol’s core operation. This creates perverse incentives and turns the project into a speculative go-to-market approach rather than a utility-first scaling strategy.

Third, users must sacrifice the security of Bitcoin to use these networks. They must leave Bitcoin’s sovereign, proof-of-work security model and submit to a new, often proof-of-stake consensus run by a small set of validators. You’re trading the world’s most robust and decentralized security for a weaker, novel one.

Taken together, these three flaws are fatal for “Bitcoin layer 2s.” They turn the claim of Bitcoin scalability into a mere marketing ploy. If it doesn’t preserve L1 assurances, it’s not actually scaling Bitcoin.

The graveyard is already full

The numbers tell the story better than any technical argument. Merlin Chain once topped Bitcoin L2 total value locked (TVL) rankings, but now it is bleeding value daily. Babylon promised the “Bitcoin staking revolution” and delivered an 84% loss. These projects raised millions, launched with fanfare, and collapsed within months.

Meanwhile, legitimate developments like Tether (USDT) on the Lightning Network show what real Bitcoin scaling looks like. Lightning processes real payments, while these L2s process exit liquidity. The pattern is clear for new pump-and-dumps. Announce a Bitcoin L2, launch a token, pump on a “Bitcoin scaling” narrative, and dump when the reality hits that you’ve built another sidechain with extra steps.

Build on Bitcoin, not beside it

As research shows, projects like BitVM are working toward realistic rollups that actually inherit Bitcoin security. Others are exploring metaprotocol approaches, systems that use Bitcoin’s base layer as an immutable data ledger and settlement layer, where all activity is ultimately rooted in standard Bitcoin transactions.

Start on layer 1, prove product-market fit, then scale with techniques that keep users within Bitcoin’s trust domain. There’s no bridge custody, and users retain their L1 exit guarantees.

The “SlowFi” advantage directly addresses the speed critique. For core financial primitives, stablecoins, lending, and decentralized exchanges, Bitcoin’s deliberate finality and security create stickier liquidity and more sustainable growth, avoiding the farm-and-dump cycles of high-speed chains. Speed is the enemy of stability.

The future of Bitcoin scaling isn’t about creating faster, separate systems; it’s about using Bitcoin’s own finality and security to create a more stable and sovereign form of finance.

The return to first principles

Bitcoin DeFi’s potential is real, with institutions increasingly interested in Bitcoin-native yield opportunities. The current L2 boom is a distraction, building fragmented, high-risk sidechains instead of unifying and strengthening the Bitcoin network.

The future of Bitcoin is about making the base layer itself more powerful and programmable. Any solution that requires a bridge, a new token, or a new consensus mechanism is considered a legacy approach.

As VCs pour hundreds of millions into Bitcoin sidechains, let’s remember that funding doesn’t equal innovation. The projects that will define Bitcoin’s next decade are those building genuine L1 enhancements and true security inheritance, not repackaged sidechains with Bitcoin branding.

The L2 solution trend must end. Bitcoin deserves better than extraction disguised as innovation. The builders who understand this distinction will inherit the future. The rest will join the growing graveyard of failed tokens that promised to “unlock Bitcoin” and instead unlocked only losses.

Crypto World

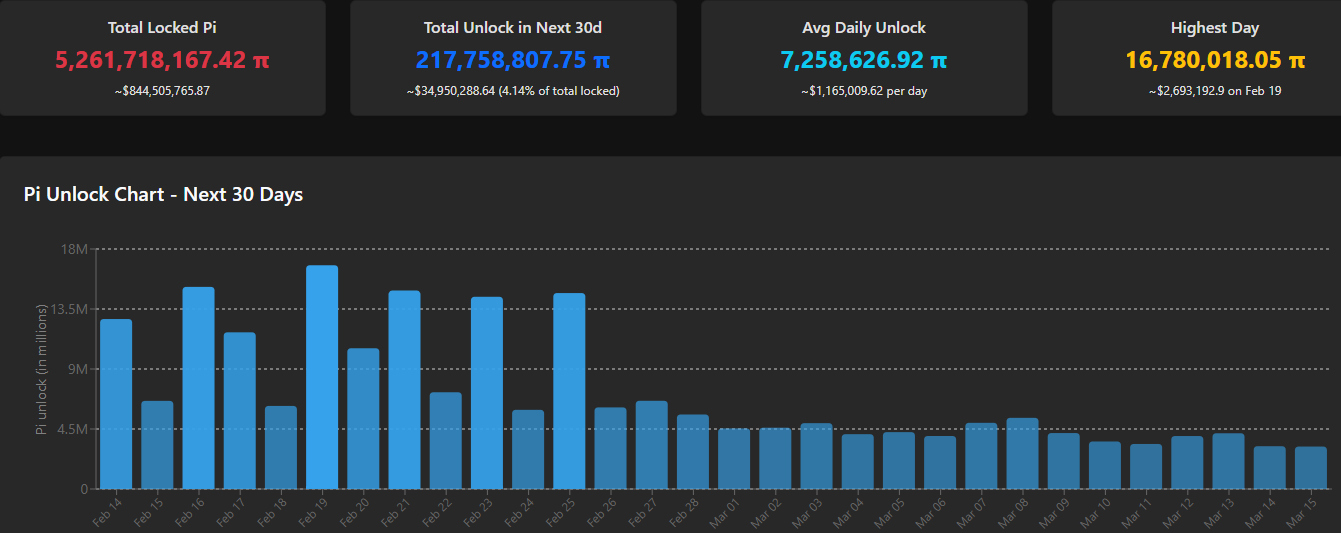

Is Trump Media Good for Crypto After All? Files for Bitcoin, Ether, and Cronos ETFs

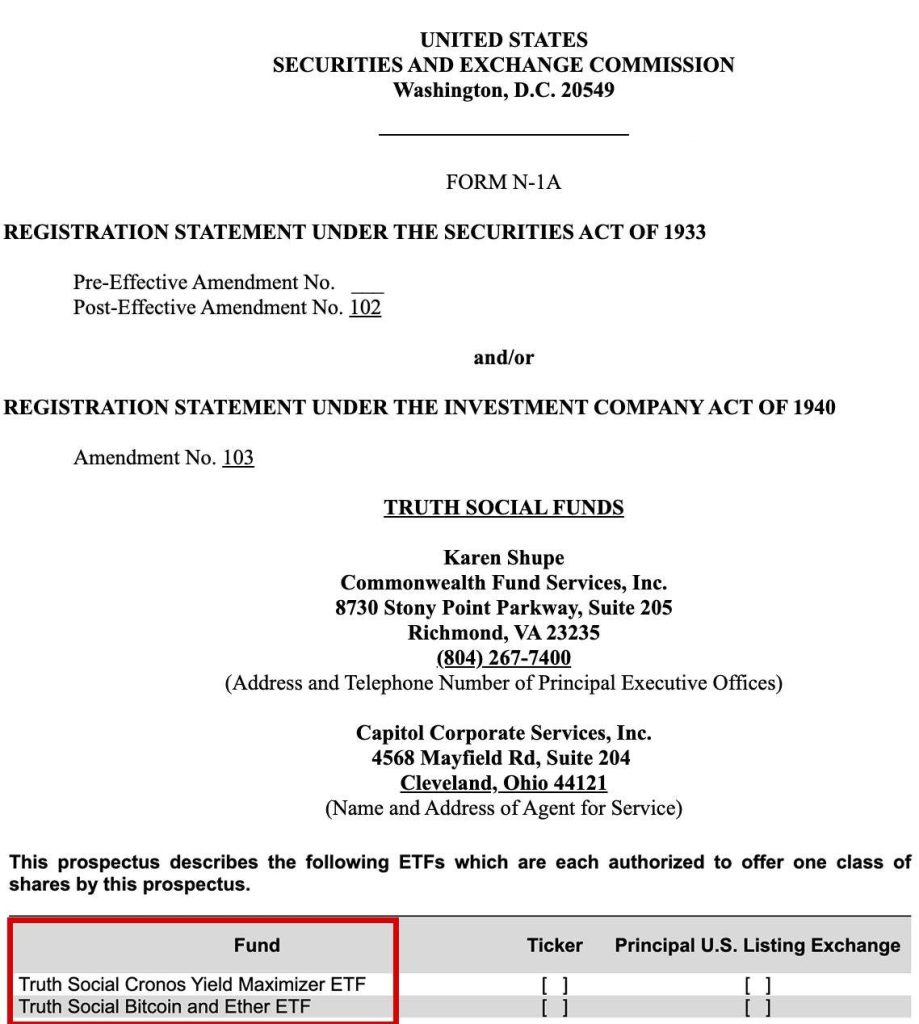

Trump Media is stepping deeper into crypto, and this time it is not subtle.

The company just filed with the SEC to launch two new crypto linked ETFs tied to Bitcoin, Ether, and even Cronos.

This is not just about tracking price either. The plan targets active traders who want exposure plus potential yield through staking rewards. It is an expansion of the so called America First strategy straight into digital assets.

- TMTG filed for a blended Bitcoin/Ether fund and a specialized Cronos Yield Maximizer ETF.

- Both funds propose a 0.95% management fee, with Crypto.com providing custody and liquidity services.

- The move defies current trends, as Bitcoin ETFs recently saw heavy outflows totaling over $360 million.

Truth Social Expands Crypto ETFs Footprint Amid Desperate Market

The new ETFs would be managed by Yorkville America Equities and offered through Foris Capital. More interesting though is the deeper link with Crypto.com.

Back in September, they teamed up to build a treasury vehicle focused on accumulating CRO. So this is not random.

The timing is intersting. U.S. spot Bitcoin ETFs have seen four straight weeks of outflows. That tells you institutions are cautious right now.

Big asset managers are not leaving the space. Some are still quietly increasing exposure, treating this dip as a longer term opportunity. Trump Media seems to be doing exactly that.

Staking Rewards and The Cronos Surprise

These are not basic spot ETFs. The structure is built for yield. The Truth Social Bitcoin and Ether ETF would hold roughly 60% BTC and 40% ETH, with a clear plan to stake the ETH portion and generate rewards.

Then there is the Cronos Yield Maximizer ETF. Pretty sound name if you ask me. It is designed to track CRO while also earning income through staking on the Cronos network.

That puts a direct spotlight on Crypto.com ecosystem exposure, not just Bitcoin and Ethereum.

With a projected 0.95% management fee, these funds are positioning themselves as more active, premium vehicles rather than low cost, passive spot trackers.

The post Is Trump Media Good for Crypto After All? Files for Bitcoin, Ether, and Cronos ETFs appeared first on Cryptonews.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World10 hours ago

Crypto World10 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle