This story was originally published by ProPublica. Republished under a CC BY-NC-ND 3.0 license.

Days into President Donald Trump’s second term in the White House, a cryptocurrency billionaire posted a video on X to his hundreds of thousands of followers. “Please Donald Trump, I need your help,” he said, wearing a flag pin askew and seated awkwardly in an armchair. “I am an American. … Help me come home.”

The speaker, 46-year-old Roger Ver, was in fact no longer a U.S. citizen. Nicknamed “Bitcoin Jesus” for his early evangelism for digital currency, Ver had renounced his citizenship more than a decade earlier. At the time of his video, Ver was under criminal indictment for millions in tax evasion and living on the Spanish island of Mallorca. His top-flight legal defense team had failed around half a dozen times to persuade the Justice Department to back down. The U.S., considering him a fugitive, was seeking his extradition from Spain, and he was likely looking at prison.

Once, prosecutors hoped to make Ver a marquee example amid concerns about widespread cryptocurrency tax evasion. They had spent eight painstaking years working the case. Just nine months after his direct-to-camera appeal, however, Ver and Trump’s new Justice Department leadership cut a remarkable deal to end his prosecution. Ver wouldn’t have to plead guilty or spend a day in prison. Instead, the government accepted a payout of $49.9 million — roughly the size of the tax bill prosecutors said he dodged in the first place — and allowed him to walk away.

Ver was able to pull off this coup by taking advantage of a new dynamic inside of Trump’s Department of Justice. A cottage industry of lawyers, lobbyists and consultants with close ties to Trump has sprung up to help people and companies seek leniency, often by arguing they had been victims of political persecution by the Biden administration. In his first year, Trump issued pardons or clemency to dozens of people who were convicted of various forms of white-collar crime, including major donors and political allies. Investigations have been halted. Cases have been dropped.

Within the Justice Department, a select club of Trump’s former personal attorneys have easy access to the top appointees, some of whom also previously represented Trump. It has become a dark joke among career prosecutors to refer to these lawyers as the “Friends of Trump.”

The Ver episode, reported in detail here for the first time, reveals the extent to which white-collar criminal enforcement has eroded under the Trump administration. The account is based on interviews with current and former Justice Department officials, case records and conversations with people familiar with his case.

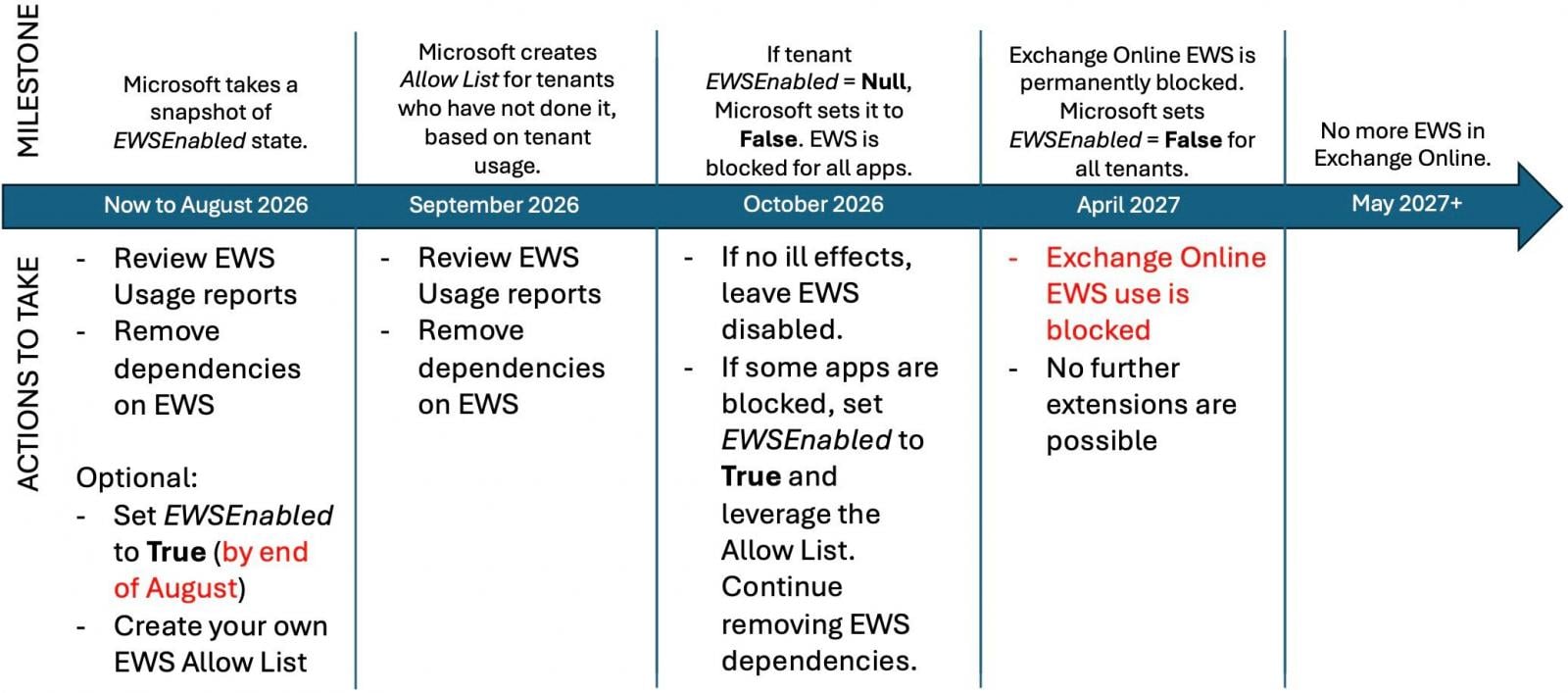

The Trump administration has particularly upended the way tax law violators are handled. Late last year, the administration essentially dissolved the team dedicated to criminal tax enforcement, dividing responsibility among a number of other offices and divisions. Tax prosecutions fell by more than a quarter, and more than a third of the 80 experienced prosecutors working on criminal tax cases have quit.

But even amid this turmoil, Ver’s case stands out. After Ver added several of these new power brokers to his team — most importantly, former Trump attorney Chris Kise — Trump appointees commandeered the case from career prosecutors. One newly installed Justice Department leader who had previously represented Trump’s family questioned his new subordinates on whether tax evasion should be a criminal offense. Ver’s team wielded unusual control over the final deal, down to dictating that the agreement would not include the word “fraud.”

It remains the only tax prosecution the administration has killed outright.

Ver did not reply to an extensive list of questions from ProPublica. In court filings and dealings with the Justice Department, Ver had always denied dodging his tax bill intentionally — a key distinction between a criminal and civil tax violation — and claimed to have relied on the advice of accountants and tax attorneys.

“Roger Ver took full responsibility for his gross financial misconduct to the tune of $50 million because this Department of Justice did not shy away from exposing those who cheat the system. The notion that any defendant can buy their way out of accountability under this administration is not founded in reality,” said Natalie Baldassarre, a Justice Department spokesperson.

In response to a list of detailed questions, the White House referred ProPublica to the Justice Department.“I know of no cases like this,” said Scott Schumacher, a former tax prosecutor and the director of the graduate program in taxation at the University of Washington. It is nearly unheard of for the department to abandon an indicted criminal case years in the making. “They’re basically saying you can buy your way out of a tax evasion prosecution.”

Roger Ver is not a longtime ally of Trump’s or a MAGA loyalist. He renounced his U.S. citizenship in 2014, a day he once called “the happiest day of my entire life.” In the early days of bitcoin, he controlled about 1% of the world’s supply.

Ver is clean-cut and fit — he has a black belt in Brazilian jujitsu. In his early 20s, while he was a libertarian activist in California, Ver was sentenced to 10 months in prison for illegally selling explosives on eBay. He’s often characterized that first brush with the law as political persecution by the state. After his release, he left the U.S. for Japan.

Ver became a fixture in the 2010s on the budding cryptocurrency conference circuit, where he got a kick out of needling government authority and arguing that crypto was the building block of a libertarian utopia. At a 2017 blockchain conference in Aspen, Colorado, Ver announced he had raised $100 million and was seeking a location to create a new “non-country” without any central government. For years, Ver has recommended other wealthy people consider citizenship in the small Caribbean nation of Saint Kitts and Nevis, which has no individual income tax.

“Bitcoin completely undermines the power of every single government on the entire planet to control the money supply, to tax people’s income to control them in any way,” he told a gathering of anarcho-capitalists in Acapulco, Mexico, in 2016. “It makes it so incredibly easy for people to hide their income or evade taxes.” More than one friend, he said with a smirk, had asked him how to do so: They “say, ‘Roger, I need your help. How do I use bitcoins to avoid paying taxes on it?’”

Renouncing U.S. citizenship isn’t a magic get-out-of-tax-free technique. Since 2008, the U.S. has required expatriates with assets above $2 million pay a steep “exit tax” on the appreciation of all their property.

In 2024, the Justice Department indicted Ver in one of the largest-ever cryptocurrency tax fraud cases. The government accused Ver of lying to the IRS twice. After Ver renounced his citizenship in 2014, he claimed to the IRS that he personally did not own any bitcoin. He would later admit in his deal with the government to owning at least 130,664 bitcoin worth approximately $73.7 million at the time. Then in 2017, the government alleged, Ver tried to conceal the transfer of roughly $240 million in bitcoin from U.S. companies to his personal accounts. In all, the government said he had evaded nearly $50 million in taxes.

Ver’s defense was that his failure to pay taxes arose from a lack of clarity as to how tax law treated emerging cryptocurrency, good-faith accounting errors and reliance on his advisors’ advice. He claimed it was difficult to distinguish between his personal assets and his companies’ holdings and pinpoint what the bitcoin was actually worth.

The Biden administration’s Justice Department dismissed this legal argument. Prosecutors had troves of emails that they said showed Ver misleading his own attorneys and tax preparers about the extent of his bitcoin holdings. (Ver’s team accused the government of taking his statements out of context.) The asset tracing in the case was “rock solid,” according to a person familiar with the investigation who spoke on the condition of anonymity for fear of retaliation. A jury, prosecutors maintained, was unlikely to buy Ver’s defense that he made a good-faith error.

By the time of Trump’s election, Ver had been arrested in Spain and was fighting extradition. He was also the new owner of a sleek $70 million yacht that some law enforcement officials worried he might use to escape on the high seas.

In Trump, Ver saw a possible way out. After the 2024 election, he was “barking up every tree,” said his friend Brock Pierce, a fellow ultrawealthy crypto investor who tried to gin up sympathy for Ver in Trump’s orbit.

Ver had initially gone the orthodox route of hiring tax attorneys from a prestigious law firm, Steptoe. Like many wealthy people in legal jeopardy, Ver now also launched a media blitz seeking a pardon from the incoming president. “If anybody knows what it’s like to be the victim of lawfare it’s Trump, so I think he’ll be able to see it in this case as well,” Ver said in a December 2024 appearance on Tucker Carlson’s show. On Charlie Kirk’s show, Ver appeared with tape over his mouth with the word “censored” written in red ink. Laura Loomer, the Trump-friendly influencer, began posting that Ver’s prosecution was unfair. Ver paid Trump insider Roger Stone $600,000 to lobby Congress for an end to the tax provision he was accused of violating.

Ver’s pardon campaign fizzled. His public pressure campaign — in which he kept comparing himself to Trump — was not landing, according to Pierce. “You aren’t doing yourself any favors — shut up,” his friend recalled saying.

One objection in the White House, according to a person who works on pardons, may have been Ver’s flamboyant rejection of his American citizenship. Less than a week after Trump was inaugurated, Elon Musk weighed in, posting on X, “Roger Ver gave up his US citizenship. No pardon for Ver. Membership has its privileges.”

But inside the Justice Department, Ver found an opening. The skeleton key proved to be one of the “Friends of Trump,” a seasoned defense lawyer named Christopher Kise. Kise is a longtime Florida Republican power player who served as the state’s solicitor general and has argued before the U.S. Supreme Court. He earned a place in Trump’s inner circle as one of the first experienced criminal defenders willing to represent the president after his 2020 election loss. Kise defended Trump in the Justice Department investigation stemming from the Jan. 6, 2021, attack on the U.S. Capitol and against charges that Trump mishandled classified documents when leaving the White House.

Kise had worked shoulder-to-shoulder on Trump’s cases with two lawyers who were now leaders in the Trump 2.0 Justice Department: Todd Blanche, who runs day-to-day operations at the department as deputy attorney general, and his associate deputy attorney general, Ketan Bhirud, who oversaw the criminal tax division prosecuting Ver. Kise reportedly helped select Blanche to join Trump’s legal team in the documents case, and he and Bhirud had both worked for Trump’s family as they fought civil fraud charges brought by New York Attorney General Letitia James in 2022.

On Ver’s legal team, Kise worked the phones, pressing his old colleagues to rethink their prosecution against Ver.

Kise scored the legal team’s first big victory in years: a meeting with Bhirud that cut out the career attorneys most familiar with the merits of the case.

In that meeting, however, it wasn’t clear that the new Justice Department leadership would be willing to interfere with the trajectory of Ver’s case. While the Trump administration had backed off aggressive enforcement of white-collar crimes writ large, the administration said it was still pursuing most criminal cases that had already been charged.

Bhirud initially expressed skepticism that Ver accidentally underpaid his taxes. It was “hard to believe” that a man going by “Bitcoin Jesus” would have no idea how much bitcoin he owned, Bhirud said, according to a person familiar with the case.

Bhirud and Blanche did not respond to detailed questions from ProPublica.

The Justice Department stuck to its position that either Ver would plead guilty to a crime, or the case would go to trial.

But Kise would not stop lobbying his former colleagues to reconsider. Blanche and Bhirud had already demanded that career officials justify the case again and again. Over the course of the summer, Kise wore down the Trump appointees’ zeal for pursuing Ver on criminal charges.

Kise and the law firm of Steptoe did not respond to questions.

“While there were meetings and conversations with DOJ, that is not uncommon. The line attorneys remained engaged throughout the process, and the case was ultimately resolved based on the strength of the evidence,” said Bryan Skarlatos, one of Ver’s tax attorneys and a partner at Kostelanetz.

It was a chaotic moment at the Justice Department, an institution that Trump had incessantly accused of being “weaponized” against him and his supporters. After Trump took office, the department was flooded with requests to reconsider prosecutions, with defendants claiming the Biden administration had singled them out for political persecution, too.

While many cases failed to grab the administration’s attention, Kise got results. Last week, Kise’s client Julio Herrera Velutini, a Venezuelan-Italian billionaire accused of trying to bribe the former governor of Puerto Rico, received a pardon from Trump.

“Every defense attorney is running the ‘weaponization’ play. This guy gets an audience because of who he is, because his name is Chris Kise,” said a person who recently attended a high-level meeting Kise secured to talk the Justice Department down from prosecuting a client.

As Kise stepped up the pressure, Ver’s case ate up a significant share of Bhirud’s time, despite his job overseeing more than 1,000 Justice Department attorneys, according to people familiar with the matter. Ordinarily, it would be rare for a political appointee to be so involved, especially to the exclusion of career prosecutors who could weigh in on the merits.

Bhirud began to muse to coworkers about whether failure to pay one’s taxes should really be considered a crime. Wasn’t it more of a civil matter? It seemed to a colleague that Bhirud was aware Ver’s advocates could try to elevate the case to the White House.

The government ceded ground and offered to take prison time off the table. Eventually, Ver’s team and Bhirud hit on the deal that would baffle criminal tax experts. They agreed on a deferred prosecution agreement that would allow Ver to avoid criminal charges and prison in exchange for a payout and an agreement not to violate any more laws. The government usually reserves such an agreement for lawbreaking corporations to avoid putting large employers out of business — not for fugitive billionaires.

By the time fall approached, Kise and Bhirud, with Blanche’s blessing, were negotiating Ver’s extraordinary deal line by line. Once more, career prosecutors were cut out from the negotiations.

Ver’s team enjoyed a remarkable ability to dictate terms. They rejected the text of the government’s supposed final offer because it required him to admit to “fraud,” according to a person familiar with the negotiations. In the end, Ver agreed to admit only to a “willful” failure to report and pay taxes on all his bitcoin and turned over the $50 million.

The government arrived at that figure in a roundabout manner. It dropped its claim that Ver had lied on his 2017 tax return. The $50 million figure was based on how much he had evaded in taxes in 2014 alone, plus what the government asserted were interest and penalties. In the end, the deal amounted to the sum he allegedly owed in the first place. He never even had to leave Mallorca to appear in a U.S. court.

Under any previous administration, convincing the leadership of the tax division to drop an indicted criminal case and accept a monetary penalty instead would be a nonstarter. While the Justice Department settles most tax matters civilly through fines, when prosecutors do charge criminal fraud, their conviction rate is over 90%.

People “always ask you, ‘Can’t I just pay the taxes and it’ll go away?’” said Jack Townsend, a former DOJ tax attorney. “The common answer that everybody gave — until the Trump administration — was that, no, you can’t do that.”

When the Justice Department announced the resolution in October, it touted it as a victory.

“We are pleased that Mr. Ver has taken responsibility for his past misconduct and satisfied his obligations to the American public,” Bhirud said in the Justice Department’s press release announcing the deferred prosecution agreement. “This resolution sends a clear message: whether you deal in dollars or digital assets, you must file accurate tax returns and pay what you owe.”

Inside the Justice Department, the resolution was demoralizing: “He’s admitted he owes money, and we get money, but everything else about it stinks to high heaven,” said a current DOJ official familiar with the case. “We shouldn’t negotiate with people who are fugitives, as if they have power over us.”

Among the wealthy targets of white-collar criminal investigations, the Ver affair sent a different message. Lawyers who specialize in that kind of work told ProPublica that more and more clients are asking which of the “Friends of Trump” they should hire. One prominent criminal tax defense lawyer said he would give his clients a copy of Ver’s agreement and tell them, “These are the guys who got this done.”

The only one of Ver’s many lawyers to sign it was Christopher Kise.

Source link