Crypto World

Your Definitive Guide on P2P Crypto Wallet Development For 2026 & Beyond

Capital in Web3 is moving with intent, not experimentation, and P2P crypto wallet solutions sit at the center of that shift. In 2025 alone, cross-border P2P transaction volume expanded by 51%, while embedded finance adoption advanced 36% as enterprises embedded native payment rails into digital ecosystems. Biometric authentication reached 58% penetration across leading platforms, and 71% of users actively favored contactless scan-and-pay experiences, signaling a decisive move toward frictionless yet secure finance. Voice-enabled payments grew 24%, reinforcing the demand for intelligent, always-on payment infrastructure. These are not usage anomalies but structural indicators of where capital efficiency, user trust, and platform defensibility converge for long-term value creation.

What is a P2P Crypto Wallet?

A P2P crypto wallet is a software wallet designed to enable peer-to-peer exchange and settlement of digital assets directly between users, without routing trades through a central matching engine. P2P wallets can be non-custodial, meaning users keep their private keys, or hybrid, offering optional custody services. They typically provide on-wallet order books or secure on-chain trade settlement, atomic swap or smart contract mediated exchanges, and in-app messaging or negotiation layers so counterparties can discover and agree on terms. The key differentiator is that trades are executed directly between participants and settled on-chain or via cryptographic settlement channels. Now, let us scroll through the blog to deeply understand the factors impacting the rise of peer-to-peer transactions and how a crypto wallet supports it.

What is The Hype About P2P Transactions & Web3 Wallet Solutions?

The momentum behind P2P Web3 crypto wallets stems from multiple converging forces. Institutional demand for self-custody and transparency has grown, while retail users seek lower fees and censorship-resistant rails. Regulators have tightened oversight of custodial services, which increases the attractiveness of non-custodial and privacy-preserving mechanisms for compliance-conscious players. At the same time, infrastructure improvements such as cross-chain messaging, layer 2 settlement, and programmatic escrow primitives make direct peer settlement practical at scale. These advances position P2P wallets as a market segment where decentralization and enterprise needs can be reconciled.

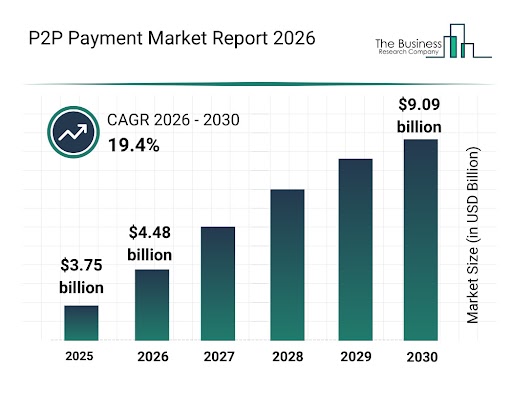

Source link: https://www.thebusinessresearchcompany.com/report/p2p-payment-global-market-report

Core P2P Payment Market Trend

- Cross-border P2P transfers jumped 51% in 2025, driven by lower fees and wider access.

- Embedded finance grew 36% as more brands added native P2P options in 2025.

- Gen Z and millennials fueled a 28% rise in social-payment P2P apps in 2025, prioritizing social features.

- Voice-activated payments via AI assistants rose 24% in 2025, reflecting demand for hands-free convenience.

- 71% of users favored apps with contactless scan-and-pay in 2025, accelerating innovation.

- Biometric authentication reached 58% adoption across major P2P apps in 2025, strengthening security.

- Real-time processors like Zelle maintained the industry standard by settling transactions in seconds in 2025.

Key market context to consider: analysts place the global cryptocurrency wallet development market in the multi-billion dollar range in 2026, underlining the rapid adoption and strong commercial opportunity for wallet providers.

Advantages of P2P Crypto Wallet Development

Investors should view P2P crypto wallet development as more than technology; it is a strategic lever that creates durable business advantages. A thoughtfully designed P2P wallet builds network effects, predictable revenue channels via platform services, and clear pathways to enterprise partnerships and bank integrations. It makes product roadmaps measurable, governance models transparent, and M&A or tokenization outcomes cleaner. Understanding these levers today lets you quantify upside, stress test assumptions, and negotiate terms from a position of strength when the market demands scale and regulatory clarity.

1. Greater user control and trust retention- Users hold keys or retain control over keys, improving trust metrics and reducing counterparty risk exposure for the product.

2. Reduced counterparty solvency risk- Direct settlement reduces dependence on exchange ledgers and central custody, lowering systemic risk from exchange failures.

3. Lower ongoing regulatory capital and reserve requirements- Operators of non-custodial P2P wallets avoid some capital and reserve obligations that custodial exchanges face, while still being able to provide compliance tooling where required.

4. New monetization channels without custody- Fees on on-chain settlement, premium matching, liquidity brokering, and enterprise SDK licensing create recurring revenue with lower operational overhead.

5. Increased resilience and censorship resistance- P2P structures reduce single points of failure and make it harder for a single authority to interrupt user access.

6. Competitive edge in markets with high fiat friction- P2P wallets that integrate local payment rails and stablecoin flows can capture remittance and cross-border volumes where traditional rails are slow or expensive.

7. Better alignment with institutional treasury policies- Institutional clients increasingly demand custody flexibility and programmable controls that P2P flows can support via multisig, time locks, or policy engines.

Features Essential for P2P Crypto Wallets Built For Success

Basic feature set

- Secure key management and mnemonic handling with clear recovery flows

- Simple send and receive UX with transparent gas and fees

- Multi-chain support for major EVM chains and Bitcoin via compatible bridges

- On-chain settlement support and clear transaction status indicators

- Address book, QR scanning, and transaction history auditing

- Basic wallet encryption, PIN, and biometric unlock

Advanced Enterprise Grade Capabilities

- Integrated P2P order matching and negotiation engine with optional on chain escrow contracts

- Smart routing: atomic swaps, cross-chain bridges, and layer 2 settlement channels

- Role-based access and enterprise wallet profiles for treasury management

- Multi-signature workflows and threshold signature schemes for institutional custody

- Real-time blockchain analytics and risk scoring integrated with compliance pipelines

- Decentralized identity integration and selective disclosure using verifiable credentials

- Replay protection, transaction batching, and gas optimization modules for cost efficiency

- Insurance orchestration and proof of reserves integration for optional custody guarantees

- API and SDK suites for partners and white-label customers.

You can always achieve this level of success and acquire the wide range of advantages mentioned above by hiring an accredited team of blockchain experts from a renowned cryptocurrency wallet development company. Apart from this, the company will also help you achieve success after with their alternative solutions, like customized solutions as per business needs.

Plan Your P2P Wallet Strategy With Our Experts

Are White Label P2P Crypto Wallets the Winning Path?

White-label blockchain wallet solutions are an attractive route for enterprises and institutional entrants because they compress time to market and offer proven building blocks. For investors, a professionally engineered white-label product reduces execution risk and often includes battle-tested security modules, audit trails, and compliance hooks. This allows businesses to focus on customer acquisition and integrations rather than building cryptographic infrastructure from scratch. However, the trade-off is customization. For high compliance or differentiated product strategies, a hybrid approach where a white-label core is extended with bespoke modules often yields the best risk-adjusted return.

Market practitioners report that high-quality white label cryptocurency wallet service providers can deliver robust deployments quickly, while providing upgrade paths for enterprise integrations and regulatory controls.

How Much Does a P2P Crypto Wallet Development Cost?

The cost of a P2P crypto wallet development is primarily determined by the level of customization required, rather than a fixed pricing model. A basic white-label wallet with minimal modifications typically requires lower investment because the core architecture, UI framework, and security modules are already prebuilt, and development mainly involves branding and minor configuration.

As customization increases, the cost rises due to the need for deeper integrations, extended multi-chain support, tailored compliance workflows, and enterprise-grade APIs or SDKs. These requirements involve additional engineering, testing, and infrastructure setup.

A fully custom P2P crypto wallet requires the highest investment since the architecture, smart contracts, security layers, and user experience are designed specifically for the business model. Advanced capabilities such as multisignature custody, cross-chain routing, escrow mechanisms, and bespoke dashboards demand extensive development time, third-party audits, and ongoing maintenance, all of which significantly influence the overall cost.

How Much Time Does It Take To Create a P2P Crypto Wallet?

A P2P crypto wallet development timeline differs by approach. Below are practical estimates mapped to development phases.

1. White label deployment with light customization

-

- Typical duration: 1 to 4 weeks

- Activities: branding, token preloads, basic compliance toggles, testing, and deployment.

2. White label with enterprise integrations and moderate customization

-

- Typical duration: 4 to 10 weeks

- Activities: integrate KYC provider, analytics, and fiat on-ramp; add off-chain order features, QA, and security checks.

3. Full custom enterprise build

-

- Typical duration: 3 to 6 months or longer

- Activities: architecture design, smart contract development, multisig and custody integrations, compliance workflow construction, security audits, penetration testing, user acceptance testing, and regulatory sign-offs.

Note that parallelizing activities such as UI design, smart contract audit, and legal compliance work reduces overall calendar time. Real-world schedules also depend on the availability of third-party integrations, audit timelines, and regulatory filings.

Security & Compliance Realities Investors Must Weigh

Security is not optional. Rising on-chain criminal flows and targeted attacks are reshaping risk models, and platforms must invest in proactive controls. Threats include hot wallet exploits, social engineering, private key compromise through coercion, and off-chain identity fraud. Monitoring, anomaly detection, wallet heuristics, and safe recovery models are required to maintain institutional trust. Recent industry reports highlight notable rebounds in illicit on-chain flows and reaffirm the need for rigorous analytics and cooperation with law enforcement.

Regulation is also evolving. Many jurisdictions now distinguish custodial and non-custodial wallet development services more clearly, and AML KYC expectations are tightening, including live selfie verification and geo-tagging in some markets. For global deployments, you must design compliance as a first-class component rather than an afterthought.

Why Partner With Antier?

P2P crypto wallets are a high-potential and high-responsibility segment of the market. For investors, the opportunity lies in products that combine strong cryptography, pragmatic compliance, and enterprise integrations.

Connect with our team today to learn about our offerings and the entire process. We build white label P2P wallet solutions with an emphasis on security, auditability, and regulatory readiness. Our team combines cryptography engineers, compliance experts, and product designers who can guide you from requirements to launch, including policy design for KYC and AML, architecture for multisig custody, and production-grade smart contract audits. We also assist with jurisdictional analysis so your rollout aligns with local supervisory expectations. If you are evaluating investments or planning a wallet product, we can provide a technical due diligence brief, a costed implementation roadmap, and a compliance checklist tailored to your target markets.

Frequently Asked Questions

01. What is a P2P crypto wallet?

A P2P crypto wallet is a software wallet that enables direct peer-to-peer exchange and settlement of digital assets between users, without relying on a central matching engine. It can be non-custodial or hybrid, offering features like on-wallet order books and secure trade settlement.

02. Why are P2P transactions gaining popularity in Web3?

P2P transactions are gaining popularity due to increased institutional demand for self-custody, lower fees sought by retail users, tighter regulatory oversight of custodial services, and advancements in infrastructure that facilitate direct peer settlement.

03. What are the benefits of using P2P crypto wallets?

P2P crypto wallets offer benefits such as enhanced privacy, lower transaction fees, and the ability for users to maintain control over their private keys, making them attractive for both compliance-conscious players and those seeking decentralized financial solutions.

Crypto World

SanDisk (SNDK) Stock Rallies 5% as Memory Shortage Gets Worse – Time to Buy?

TLDR

- SanDisk stock climbed 5.16% Thursday as Kioxia’s strong guidance triggered a rally across memory chip stocks

- Japanese chipmaker Kioxia reported customers booking NAND supply for 2027-2028, two years earlier than typical one-year advance contracts

- Memory chip shortage expected to persist through 2026 as manufacturers prioritize high-bandwidth memory over NAND production

- SanDisk trades at 15x forward P/E despite sitting 14% below February peak, with gross margins expanding to 50.9%

- Micron’s early HBM4 chip shipments reinforce tight supply expectations as AI data center demand continues growing

SanDisk shares jumped 5.16% Thursday after Kioxia issued guidance pointing to an extended memory chip shortage. The rally lifted other memory stocks including Seagate Technology, up 5.87%, and Western Digital, up 3.78%.

Kioxia forecast full-year sales and operating income above analyst expectations. Fourth-quarter revenue is projected at ¥890 billion with adjusted net income of ¥340 billion, both beating estimates.

The Japanese manufacturer revealed customers are securing memory contracts for 2027 and 2028. This represents a major shift from the industry norm of one-year advance bookings.

Early Contract Bookings Signal Supply Crunch

The rush to lock in future supply suggests companies expect shortages to last years, not months. Kioxia CFO Hideki Hanazawa confirmed tight supply is pushing selling prices sharply higher.

Micron started shipping next-generation HBM4 memory chips ahead of schedule. The early rollout reinforces expectations that supply constraints will continue through 2026.

NAND flash memory is used in solid-state drives for cloud servers. As companies build AI infrastructure, they need massive storage capacity for training data and outputs.

The current shortage stems from decisions made after the pandemic. Memory makers overbuilt capacity during strong electronics demand. The resulting oversupply crashed NAND prices and turned gross margins negative.

Why SanDisk Benefits Most

Companies responded by cutting NAND production and shifting capacity to DRAM and high-bandwidth memory. HBM delivers better margins and became essential for AI chip performance.

But AI data centers started buying huge quantities of NAND-based storage. With production slashed and demand surging, prices skyrocketed.

SanDisk led Thursday’s gains because it manufactures NAND chips through a joint venture with Kioxia. The company has direct exposure to rising flash memory prices.

Western Digital and Seagate, which sell data center storage products, typically follow memory pricing trends.

SanDisk stock trades 14% below its February highs despite Thursday’s rally. The pullback has created a potential entry point at attractive valuations.

The stock trades at 15 times forward earnings for fiscal 2026 ending June. That multiple drops to 7.5 times fiscal 2027 estimates.

Last quarter, SanDisk posted 61% revenue growth. Gross margins expanded from 32.3% to 50.9% year-over-year. Adjusted earnings per share jumped fivefold.

The company represents one of the few pure-play investments in flash memory after spinning off from Western Digital about a year ago.

Memory stocks had cooled earlier this year following a strong rally. Kioxia’s guidance reassured investors that elevated chip prices will continue supporting profits.

The NAND market appears to be transitioning from a cyclical business to structural growth driven by AI data center buildouts. Kioxia’s comments about 2027-2028 bookings suggest tight conditions will persist longer than many expected.

Crypto World

Kalshi enters $9B sports insurance market with new brokerage deal

Kalshi is moving deeper into the sports insurance market after announcing a partnership with sports insurance broker Game Point Capital, according to comments from CEO Tarek Mansour.

Summary

- Kalshi has partnered with Game Point Capital to expand into the $9 billion sports insurance and reinsurance market, which is projected to double by 2030.

- Game Point executed two basketball bonus hedges on Kalshi at significantly lower prices (6% and 2%) compared to traditional OTC reinsurance rates of 12–13% and 7–8%.

- Kalshi is positioning its exchange as a cheaper, more transparent alternative to traditional reinsurers like Lloyd’s of London, citing growing liquidity and institutional capacity.

The collaboration targets the fast-growing sports insurance and reinsurance industry, currently valued at around $9 billion annually and projected to double by 2030.

The market covers a range of risks, including brand sponsorship guarantees, game cancellations, player compensation structures, and performance-based bonuses.

Game Point Capital issues hundreds of millions of dollars in sports insurance each year. One of its most in-demand products is team and player performance bonus insurance, which protects teams against large payouts triggered by milestones such as playoff appearances, championship wins, or statistical achievements.

Kalshi undercuts traditional reinsurance pricing

Last week, Game Point executed two basketball-related performance bonus hedges on Kalshi’s exchange. One contract covered a bonus tied to a team making the postseason, priced at 6% on Kalshi compared with roughly 12–13% in the over-the-counter (OTC) market.

Another hedge, linked to advancing to the second round, was priced at 2% on Kalshi versus approximately 7–8% OTC.

Traditionally, insurers seeking to offload risk negotiate directly with reinsurance providers such as Lloyd’s of London. These OTC arrangements often involve bilateral negotiations, limited transparency, and higher pricing, particularly for volatile or higher-risk contracts.

Mansour argued that exchanges offer a competitive alternative by expanding liquidity and allowing multiple counterparties to bid in an open market, improving price discovery and lowering costs.

Kalshi’s pitch hinges on liquidity. During the recent Super Bowl, the exchange could have processed a $22 million trade without significantly moving market prices, according to the CEO.

With that depth, Kalshi expects to handle tens of millions of dollars in similar hedging transactions from Game Point in the coming months, positioning prediction markets as an emerging tool in institutional sports risk management.

Crypto World

Crypto market wobbles as investors ignore good news, look for the ‘exit ramp’: Crypto Daybook Americas

Crypto Daybook Americas will not be published on Monday, Feb. 16 due to the Presidents’ Day holiday in the U.S. We will be back on Feb. 17.

By Francisco Rodrigues (All times ET unless indicated otherwise)

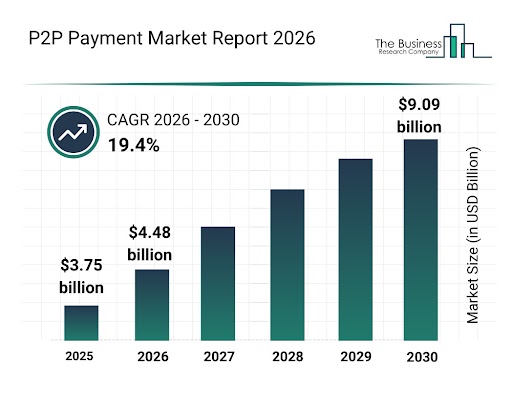

Bitcoin is on track for a fourth straight weekly decline in its longest negative streak since mid-November. The largest cryptocurrency has lost 1.7% in the past 24 hours and 4.8% since Monday morning.

The broader CoinDesk 20 Index (CD20) fell 2% in a market that, according to Bitwise research analyst Danny Nelson, is mostly driven by fear. Indeed, the Crypto Fear and Greed Index has now been in “extreme fear” territory for almost two weeks.

“The market’s main driver right now is fear. Fear that we’ll go lower,” Nelson told CoinDesk. “In a market like this, good news doesn’t register with investors. If they see an exit ramp, they’re taking it.”

To illustrate his point, Nelson pointed to the reaction to Uniswap’s 25% increase after the world’s largest asset manager, BlackRock (BLK), said it was making shares of its $2.2 billion tokenized U.S. treasury fund BUIDL tradable on the decentralized exchange. The token has now given back the gains made after that announcement.

“Sellers bearish on the market’s short-term direction overwhelmed the bulls betting that institutional adoption will drive value long-term,” he said.

Earlier this week, stronger U.S. payroll data and a falling unemployment rate prompted traders to rethink rate-cut expectations for the year. Further guidance may come later today in the form of inflation figures for the world’s largest economy.

The U.S. Consumer Price Index (CPI) for January is forecast to show 2.5% year-over-year inflation.

Adding to that uncertainty is concern over a partial U.S. government shutdown. Odds of that occurring tomorrow are now around 90% on prediction market Kalshi. If one materializes, expect even more volatility amid thin trading. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 13, 8:30 a.m.: U.S. core inflation rate YoY for January (Prev. 2.6%); MoM Est. 0.3% (Prev. 0.2%)

- Feb. 13, 8:30 a.m.: U.S. inflation rate YoY for January (Prev. 2.7%); MoM Est. 0.3% (Prev. 0.3%)

- Earnings (Estimates based on FactSet data)

- Feb. 13: Trump Media & Tech Group (DJT), post-market

- Feb. 13: HIVE Digital Technologies (HIVE), post-market, -$0.07

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Unlocks

- Token Launches

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 1.75% from 4 p.m. ET Thursday at $66,933.65 (24hrs: -0.83%)

- ETH is up 2.05% at $1,961.15 (24hrs: -0.97%)

- CoinDesk 20 is up 1.48% at 1,913.46 (24hrs: -1.96%)

- Ether CESR Composite Staking Rate is down 15 bps at 2.85%

- BTC funding rate is at 0.0019% (2.0947% annualized) on Binance

- DXY is up 0.13% at 97.05

- Gold futures are up 1.41% at $4,993.10

- Silver futures are up 3.65% at $78.30

- Nikkei 225 closed down 1.21% at 56,941.97

- Hang Seng closed down 1.72% at 26,567.12

- FTSE 100 is up 0.12% at 10,414.44

- Euro Stoxx 50 is down 0.16% at 6,001.38

- DJIA closed on Thursday down 1.34% at 49,451.98

- S&P 500 closed down 1.57% at 6,832.76

- Nasdaq Composite closed down 2.03% at 22,597.15

- S&P/TSX Composite closed down 2.37% at 32,465.30

- S&P 40 Latin America closed down 1.71% at 3,741.30

- U.S. 10-Year Treasury rate is down 7 bps at 4.10%

- E-mini S&P 500 futures are down 0.27% at 6,832.50

- E-mini Nasdaq-100 futures are down 0.29% at 24,696.00

- E-mini Dow Jones Industrial Average Index futures are down 0.33% at 49,358.00

Bitcoin Stats

- BTC Dominance: 59.01% (+0.41%)

- Ether-bitcoin ratio: 0.02923 (-0.55%)

- Hashrate (seven-day moving average): 1,027 EH/s

- Hashprice (spot): $33.55

- Total fees: 2.55 BTC / $170,716

- CME Futures Open Interest: 116,875 BTC

- BTC priced in gold: 13.5 oz.

- BTC vs gold market cap: 4.48%

Technical Analysis

- Bitcoin remains pressured below the 200-week exponential moving average of $68,324.

- A confirmed weekly close below this level historically signals a further 20%-25% capitulation.

- The would take it toward the $51,000–$54,000 range before a bottom forms

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $141.09 (-7.90%), +5.87% at $149.37 in pre-market

- Circle Internet (CRCL): closed at $56.63 (-2.13%), +1.71% at $57.60

- Galaxy Digital (GLXY): closed at $20.15 (-1.23%)

- Bullish (BLSH): closed at $31.71 (-0.53%), +0.28% at $31.80

- MARA Holdings (MARA): closed at $7.25 (-4.10%), +1.10% at $7.33

- Riot Platforms (RIOT): closed at $14.20 (-4.05%), +0.85% at $14.32

- Core Scientific (CORZ): closed at $17.48 (-3.37%), +0.11% at $17.50

- CleanSpark (CLSK): closed at $9.31 (-3.22%), +1.18% at $9.42

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.10 (-3.70%)

- Exodus Movement (EXOD): closed at $10.19 (+1.09%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $123.00 (-2.44%), +1.54% at $124.89

- Strive (ASST): closed at $7.70 (-4.82%), +0.52% at $7.74

- SharpLink Gaming (SBET): closed at $6.54 (-1.21%), +1.07% at $6.61

- Upexi (UPXI): closed at $0.74 (-8.82%)

- Lite Strategy (LITS): closed at $1.03 (-3.74%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$410.2 million

- Cumulative net flows: $54.3 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$113.1 million

- Cumulative net flows: $11.67 billion

- Total ETH holdings ~5.8 million

Source: Farside Investors

While You Were Sleeping

Crypto World

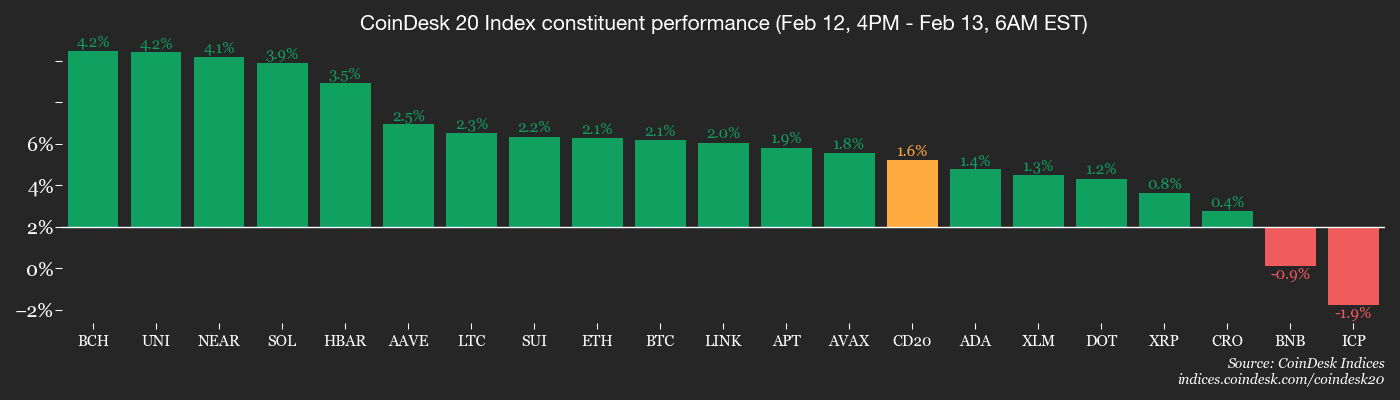

Is Crypto Becoming a Tool for Human Trafficking Networks?

Cryptocurrency flows to services linked with suspected human trafficking surged 85% year over year in 2025.

The findings come from a new report by blockchain analytics firm Chainalysis, which highlighted that the intersection of cryptocurrency and suspected human trafficking expanded markedly last year.

Sponsored

Sponsored

Which Crypto Assets Are Most Used in Suspected Human Trafficking Networks?

The report outlined four primary categories of suspected crypto-facilitated human trafficking. This includes Telegram-based “international escort” services, forced labor recruitment linked to scam compounds, prostitution networks, and child sexual abuse material vendors (CSAM).

“The intersection of cryptocurrency and suspected human trafficking intensified in 2025, with total transaction volume reaching hundreds of millions of dollars across identified services, an 85% year-over-year (YoY) increase. The dollar amounts significantly understate the human toll of these crimes, where the true cost is measured in lives impacted rather than money transferred,” Chainalysis wrote.

According to the report, payment methods varied across categories. International escort services and prostitution networks used stablecoins.

“The ‘international escort services are tightly integrated with Chinese-language money laundering networks. These networks rapidly facilitate the conversion of USD stablecoins into local currencies, potentially blunting concerns that assets held in stablecoins might be frozen,” Chainalysis noted.

CSAM vendors have historically relied more heavily on Bitcoin (BTC). However, Bitcoin’s dominance has declined with the rise of alternative Layer 1 networks.

Sponsored

Sponsored

In 2025, while these networks continue to accept mainstream cryptocurrencies for payments, they increasingly turn to Monero (XMR) to launder proceeds. According to Chainalysis,

“Instant exchangers, which provide rapid and anonymous cryptocurrency swapping without KYC requirements, play a crucial role in this process.”

The Dual Role of Crypto in Human Trafficking-Linked Transactions

Chainalysis noted that the surge in cryptocurrency flows to services linked with suspected human trafficking is not occurring in isolation. Instead, it mirrors the rapid expansion of Southeast Asia–based scam compounds, online casinos and gambling platforms, and Chinese-language money laundering (CMLN) and guarantee networks operating primarily through Telegram.

Together, these entities form a fast-growing regional illicit ecosystem with global reach. According to the report, Chinese-language services operating across mainland China, Hong Kong, Taiwan, and multiple Southeast Asian countries exhibit advanced payment processing capabilities and extensive cross-border networks.

Furthermore, geographic analysis reveals that while many trafficking-linked services are based in Southeast Asia, cryptocurrency inflows originate globally. Significant transaction flows were traced to countries including the United States, Brazil, the United Kingdom, Spain, and Australia.

“While traditional trafficking routes and patterns persist, these Southeast Asian services exemplify how cryptocurrency technology enables trafficking operations to facilitate payments and obscure money flows across borders more efficiently than ever before. The diversity of destination countries suggests these networks have developed sophisticated infrastructure for global operations,” the report read.

At the same time, Chainalysis stressed that blockchain transparency offers investigators deeper visibility into trafficking-related financial activity.

Unlike cash transactions, which leave little to no audit trail, blockchain-based transfers generate permanent, traceable records. This creates new opportunities for detection and disruption that are not possible with traditional payment systems.

Crypto World

The New Digital Human for Crypto

Bitget, the world’s largest Universal Exchange (UEX), has launched Gracy AI, the first animated digital human in crypto designed to bring real leadership thinking into one-on-one conversations with users.

Built around the experience and decision-making approach of Bitget CEO Gracy Chen, Gracy AI moves beyond charts and short-term signals. Instead, it gives users a space to talk through market cycles, strategy, career questions, and mindset with an AI that reflects how a real industry leader thinks about growth, risk, and long-term direction.

The launch marks a shift in how exchanges use AI. Rather than acting as another data layer, Gracy AI focuses on interpretation and context. Users can ask about where the industry is heading, how to think through uncertainty, or how to approach decision-making when markets are noisy. The goal is not to predict prices, but to help users think more clearly about them.

“Honestly, I still find it a little funny to see an AI avatar of me on screen,” said Gracy Chen, CEO at Bitget. She added:

“But a big part of my job is listening to user concerns, getting close to the details, and helping people understand what’s really happening in the market. The team built Gracy AI around that same approach so more users can connect, learn and grow feeling supported by me and the team.”

Gracy AI is part of Bitget’s broader AI roadmap as part of its UEX transformation. After GetAgent established Bitget’s AI capability in analytics and decision support, Gracy AI represents the more human-facing side of that strategy, where technology supports understanding rather than just execution.

To mark the launch, Bitget is rolling out themed Gracy AI conversations tied to moments of reflection and renewal. Valentine’s Day introduces self-care-focused chats, while Chinese New Year features guided conversations around goals, perspective, and new beginnings. These campaigns are designed to make AI interaction feel personal, timely, and useful, rather than transactional.

The Gracy AI launch builds on Bitget’s broader push to make AI genuinely useful for everyday traders. From AI-powered market insights and smart trading tools to products like GetAgent, which helps users navigate volatility with clearer signals and context,

Bitget has steadily integrated AI to reduce friction and improve decision-making. Gracy AI extends that approach by putting experience, perspective, and real-time intelligence into a more accessible, conversational layer for users. As Bitget continues to evolve into a Universal Exchange, Gracy AI reflects a simple idea: better tools matter, but better thinking matters more.

Experience Gracy AI here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Crypto World

10% Bounce Hope Rise As Whales Buy

Ethereum is trying to stabilize after weeks of heavy selling. The price is holding near the $1,950 zone, up around 6% from its recent low. At the same time, the biggest Ethereum whales have started accumulating aggressively.

But short-term sellers and derivatives traders remain cautious, creating a growing tug-of-war around the next move.

Biggest Ethereum Whales Accumulate as Bullish Divergence Stays Intact

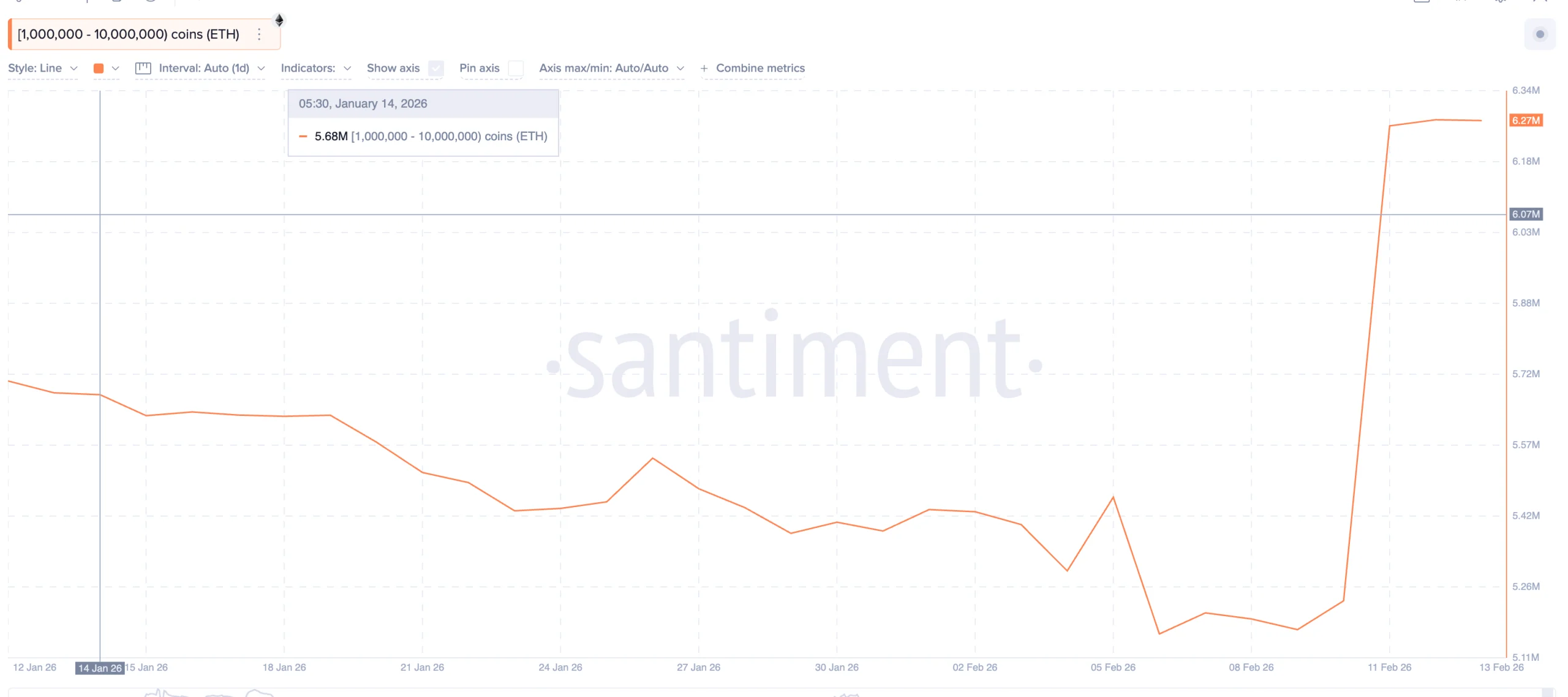

On-chain data shows that the largest Ethereum holders are positioning for a rebound. Since February 9, addresses holding between 1 million and 10 million ETH have increased their holdings from around 5.17 million ETH to nearly 6.27 million ETH. That is an addition of more than 1.1 million ETH, worth roughly $2 billion at current prices.

Sponsored

Sponsored

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This accumulation aligns with a bullish technical signal on the 12-hour chart.

Between January 25 and February 12, Ethereum’s price made a lower low, while the Relative Strength Index, or RSI, formed a higher low. RSI measures momentum by comparing recent gains and losses. When price falls, but RSI rises, it often signals weakening selling pressure.

This bullish divergence suggests downside momentum is fading.

The structure remains valid as long as Ethereum holds above $1,890, as the same signal flashed even on February 11 and still seems to be holding. A breakdown below this level would invalidate the divergence for now and weaken the rebound case.

For now, whales appear to be betting that this support will hold.

Sponsored

Sponsored

Short-Term Holders Are Selling?

While large investors are accumulating, short-term holders are behaving very differently.

The Spent Coins Age Band for the 7-day to 30-day cohort has surged sharply. Since February 9 (the same time when the whale pickup started), this metric has risen from around 14,000 to nearly 107,000, an increase of more than 660%. This indicator tracks how many recently acquired coins are being moved. Rising values usually signal possible profit-taking and distribution.

In simple terms, short-term traders are exiting positions. This pattern appeared earlier in February as well. On February 5, a spike in short-term coin activity occurred near $2,140. Within one day, Ethereum dropped by around 13%.

That history shows how aggressive selling from this group can quickly reverse moves. As long as short-term holders remain active sellers, upside moves are likely to face resistance.

Sponsored

Sponsored

Derivatives Data Shows Heavy Bearish Positioning

Derivatives markets are reinforcing this cautious outlook. Current liquidation data shows nearly $3.06 billion in short positions stacked against only about $755 million in long leverage. This creates a heavily bearish imbalance with almost 80% of the market betting on the short side.

On one hand, this setup creates fuel for a potential short squeeze if prices rise. On the other hand, it shows that most traders still expect further weakness. This keeps momentum muted but keeps the bounce hope alive if the whale buying pushes the prices up, even a little bit, crossing past key clusters.

On-chain cost basis data helps explain why Ethereum struggles to break higher. Around $1,980, roughly 1.58% of the circulating supply, was acquired. Near $2,020, another 1.23% of supply sits at breakeven. These zones represent large groups of holders waiting to exit without losses.

Sponsored

Sponsored

When price approaches these levels, selling pressure increases as investors try to recover capital. This has repeatedly capped recent bounces. Only a strong leverage-driven move or short squeeze would likely be powerful enough to push through these supply clusters.

Until then, these zones remain major barriers.

Key Ethereum Price Levels To Track Now

With whales buying and sellers resisting, Ethereum price levels now matter more than narratives.

On the upside, the first major resistance sits near $2,010. A clean 12-hour close above this level would increase the probability of short liquidations. And it sits near the key supply cluster.

If that happens, Ethereum could target $2,140 next, a strong resistance zone with multiple touchpoints. It also sits around 10% from the current levels. On the downside, $1,890 remains the critical support. A break below this level would invalidate the bullish divergence and signal renewed downside pressure. Below that, the next major support sits near $1,740.

As long as Ethereum holds above $1,890 and continues testing $2,010, the rebound structure remains intact. A sustained breakdown below support would cancel the current recovery attempt.

Crypto World

PGI CEO Gets 20 Years Over $200M Crypto Investment Scheme

A US federal judge in Virginia sentenced the chief executive of Praetorian Group International to 20 years in prison for running a $200 million cryptocurrency investment scheme that defrauded tens of thousands of investors.

According to the Department of Justice, 61-year-old Ramil Ventura Palafox, a dual US and Philippine citizen, was convicted of wire fraud and money laundering for what prosecutors described as a Ponzi scheme that falsely promised daily returns of up to 3% from Bitcoin trading.

The US Attorney’s Office for the Eastern District of Virginia said investors poured over $201 million into PGI between December 2019 and October 2021, including at least 8,198 Bitcoin (BTC) valued at about $171.5 million at the time. According to prosecutors, victims suffered losses of at least $62.7 million.

The sentencing concludes the criminal case brought by the DOJ and follows a parallel civil action by the Securities and Exchange Commission, marking one of the larger crypto-related fraud cases in recent years by investor count and funds involved.

Fake trading claims and luxury spending

Court filings said Palafox told investors PGI was engaged in large-scale Bitcoin trading capable of generating consistent daily profits.

However, prosecutors said the company was not trading at a level sufficient to support the promised returns. Instead, new investor funds were used to pay earlier participants.

Authorities said Palafox operated an online portal that falsely displayed steady gains, giving investors the impression their accounts were growing. He also used a multilevel marketing structure, offering referral incentives to recruit new members.

The DOJ said Palafox spent millions in investor funds on personal expenses, including $3 million on luxury vehicles, over $6 million on homes in Las Vegas and Los Angeles, and hundreds of thousands of dollars on penthouse suites and high-end retail purchases.

Authorities said he also transferred at least $800,000 and 100 BTC to a family member.

Related: Sam Bankman-Fried claims Biden DOJ silenced witnesses during FTX trial

Civil charges and international reach

The scheme began to unravel as regulators scrutinized PGI’s trading claims and fund flows.

In April 2025, the Securities and Exchange Commission filed a civil complaint alleging that Palafox misrepresented PGI’s Bitcoin trading activity and used new investor money to pay earlier participants.

The complaint said PGI promoted an AI-powered trading platform and guaranteed daily returns despite lacking trading operations capable of generating those profits.

Federal prosecutors in the Eastern District of Virginia later unsealed criminal charges accusing Palafox of wire fraud and money laundering arising from the same conduct.

Authorities had seized the company’s website in 2021, and related operations were shut down in the United Kingdom, signaling cross-border enforcement scrutiny before the US criminal case advanced.

The DOJ said victims may be eligible for restitution and directed them to the US Attorney’s Office website for information on filing claims.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

Ark Invest buys $18 million of crypto stocks including 10th consecutive Bullish (BLSH) purchase

Ark Invest added another $18 million worth of crypto-adjacent stocks to its holdings on Thursday, including a $2 million purchase of shares in cryptocurrency exchange Bullish (BLSH).

The St. Petersburg, Florida-based company also bought $12 million worth of crypto-friendly trading platform Robinhood (HOOD) and $4 million worth of ether treasury firm Bitmine Immersion Technologies (BMNR), according to an emailed disclosure on Friday.

Ark’s investment in Bullish, the parent company of CoinDesk, extends its run of consecutive equity purchases in the crypto exchange to 10 days. Bullish shares fell 0.53% to $31.71 on Thursday.

BLSH shares have lifted from a trough of around $24 on Feb. 5 to trade either side of the $30 mark over the last week. They remain, however, more than 16% lower year-to-date.

HOOD shares fell 8.9% on Thursday, closing at $71.12 as U.S tech stocks sank, taking bitcoin with them.

Bitmine defied the broader market to rise 1.39% to $19.74.

Crypto World

Ramil Ventura Palafox gets 20 years sentence over $200 million bitcoin Ponzi scheme

The CEO of Praetorian Group International (PGI) was sentenced to 20 years in prison in the U.S. for running a global Ponzi scheme that falsely claimed to invest in bitcoin and foreign exchange trading.

Ramil Ventura Palafox, 61, promised daily returns of up to 3%, misleading more than 90,000 investors and draining over $62.7 million in funds, according to a Thursday statement from the U.S. Attorney’s Office for the Eastern District of Virginia.

PGI collected more than $201 million from investors between late 2019 and 2021, including over 8,000 bitcoin , according to court records. Instead of investing the money, prosecutors said Palafox used new investor funds to pay old ones while siphoning millions for himself.

To keep the illusion going, Palafox built an online portal where investors could track their supposed profits, with numbers that were entirely fabricated.

In reality, Palafox was buying Lamborghinis, luxury homes in Las Vegas and Los Angeles and penthouse suites at high-end hotels. Prosecutors say he spent $3 million on luxury cars and another $3 million on designer clothing, watches, and jewelry.

The case was investigated by the FBI and IRS. Victims may be eligible for restitution. The SEC is pursuing civil penalties, and Palafox remains banned from handling securities.

Crypto World

Will $2.3B options expiry jolt Ethereum price from key strike levels?

Ethereum price continues to lag its 2021 peak as institutions rotate cautiously into ETH exposure while weighing ETF flows, on-chain activity, and broader macro risk.

Summary

- BlackRock lifts its Bitmine stake 166% to $246M, doubling down on a levered Ethereum price proxy even as ETH trades ~60% below its peak and Bitmine stock is down ~70%.

- Vitalik Buterin and Stani Kulechov recently sold millions in ETH while BlackRock and Goldman Sachs add exposure via Bitmine and Ethereum ETFs, treating the drawdown as opportunity.

- BlackRock’s thesis leans on Ethereum’s dominance in tokenized real‑world assets, with Larry Fink calling tokenization “necessary” as BTC, ETH and SOL trade as high‑beta macro risk proxies.

BlackRock is leaning into the pain on Ethereum (ETH) price, quietly ramping up its exposure to Bitmine even as blue‑chip crypto names slide and prominent insiders head for the exits.

BlackRock’s leveraged Ethereum bet

According to a 13F‑HR filing collated by Fintel, BlackRock’s Bitmine stake jumped 166% in Q4 2025 to about $246 million, cementing the asset manager as a key backer of the Ethereum‑heavy treasury vehicle. Bitmine, the second‑largest digital asset treasury firm and a levered proxy on Ether, has seen its own stock price crater nearly 70% over six months to roughly $20 per share. The move drew an approving response from Bitmine chair Tom Lee, who has publicly floated a $250,000 price target for Ethereum and responded with clapping emojis to the disclosure in a post on X.

BlackRock’s buying spree lands as Ethereum trades just under $2,000, roughly 60% below its August peak, with Standard Chartered’s Geoffrey Kendrick warning the token could drop a further 25% toward $1,400. “The best investment opportunities in crypto have presented themselves after declines,” Lee said on Monday, after Bitmine added another $80 million of Ether to its already underwater position, which is sitting on at least $6.6 billion in paper losses.

Insiders sell, Wall Street buys

February has seen crypto pioneers unload sizable Ether positions, even as Wall Street leans in. Ethereum co‑founder Vitalik Buterin sold at least $7 million worth of ETH last week to fund new initiatives, while Aave founder Stani Kulechov offloaded more than $8 million. At the same time, Goldman Sachs disclosed holdings of just over $1 billion in Ethereum exchange‑traded funds, joining BlackRock in treating the drawdown as an entry point.

BlackRock’s conviction rests on tokenisation. In January, the firm said Ethereum will lead the tokenisation of real‑world assets, noting that around 66% of all tokenised instruments sit on Ethereum, compared with about 10% on BNB Chain, 5% on Solana, 4% on Arbitrum, 4% on Stellar, and 3% on Avalanche. CEO Larry Fink has called tokenisation “necessary,” arguing in Davos that the goal is to bring “the entire financial system on one common blockchain.”

Market backdrop and key levels

The broader tape remains fragile. Bitcoin is down about 0.7% over the past 24 hours, trading near $66,582, while Ethereum has slipped roughly 0.4% to around $1,955. Spot dashboards show Bitcoin changing hands close to $66,618 with roughly $44.9 billion in 24‑hour volume, as Ethereum hovers near $1,961 on about $20.1 billion traded. Solana, another high‑beta proxy for crypto risk, trades around $192, with leading centralized exchanges printing quotes in the $191–$193 band on heavy liquidity.

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $66,600, with a 24‑hour range roughly between $65,000 and $68,400, on more than $30 billion in dollar volumes. Ethereum (ETH) changes hands close to $1,960, with about $20 billion in 24‑hour turnover and spot quotes clustering just below the $2,000 mark. Solana (SOL) trades near $192, fractionally lower on the day, with leading venues reporting individual pairs clearing hundreds of millions in volume.

For now, BlackRock is treating the selloff as structural opportunity rather than terminal decline, aligning its Bitmine bet with a broader thesis that Ethereum’s role in real‑world asset rails will outlast this drawdown.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Video1 hour ago

Video1 hour agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month