Crypto World

Bitcoin Devs’ Inaction on Quantum Will Frustrate Institutions: VC

Major Bitcoin-holding institutions may eventually lose patience with Bitcoin developers for not addressing quantum computing concerns quickly enough, according to venture capitalist Nic Carter.

“I think the big institutions that now exist in Bitcoin, they will get fed up, and they will fire the devs and put in new devs,” Carter said during the Bits and Bips podcast episode published on Thursday.

“I think the devs will continue to do nothing,” Carter said.

“If you’re BlackRock and you have billions of dollars of client assets in this thing and its problems aren’t being addressed, what choice do you have?” he said.

“Corporate takeover” is a possibility, says Carter

BlackRock, the world’s largest asset manager, holds around 761,801 Bitcoin (BTC), valued at roughly $50.15 billion as of publication. That amounts to around 3.62% of Bitcoin’s total supply.

Carter warned that if Bitcoin developers don’t move quickly to implement quantum-resistant cryptography, it will lead to “a corporate takeover,” arguing that it will be “a successful one.”

Zero Knowledge Consulting founder Austin Campbell echoed a similar sentiment. “If there is a structural problem here, and they have a large view, eventually they are going to be required to speak up,” Campbell said.

Carter has been vocal recently about the threat that quantum computing poses to Bitcoin. He said on Jan. 21 that Bitcoin’s “mysterious” price underperformance is “due to quantum” and is “the only story that matters this year.”

Bitcoin is trading at $70,281 at the time of publication, down 26.25% over the past 30 days, according to CoinMarketCap.

However, not everyone agrees that institutions would attempt to influence the network. Lumida Wealth Management founder Ram Ahluwahlia said that major institutions in Bitcoin are “passive” investors. “They are not activists,” he said.

Industry split over urgency of Bitcoin quantum risk

It comes as the broader industry continues to debate how imminent the threat to Bitcoin really is.

Related: Bitcoin passes $69K on slower US CPI print, but Fed rate-cut odds stay low

Capriole Investments founder Charles Edwards views quantum computing as a potential “existential threat” to Bitcoin, arguing that an upgrade is needed now to strengthen network security.

Meanwhile, CoinShares Bitcoin research lead Christopher Bendiksen argued in a post on Friday that just 10,230 Bitcoin of 1.63 million Bitcoin sit in wallet addresses with publicly visible cryptographic keys that are vulnerable to a quantum computing attack.

Some Bitcoiners, such as Strategy executive chairman Michael Saylor and Blockstream CEO Adam Back, believe quantum threats are overblown and will not disrupt the network for decades.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

Curve Finance Claims PancakeSwap Copied Its Code

The Curve Finance team has accused PancakeSwap of integrating its StableSwap code into the newer PancakeSwap Infinity release without a proper license. The dispute centers on the StableSwap module, which underpins swaps involving stablecoins and tightly pegged assets, and its deployment within Infinity, the latest iteration of the PancakeSwap decentralized exchange. Curve’s public note on X framed licensing as a prerequisite for any continued use of the code, inviting PancakeSwap to engage in formal licensing or collaboration to reduce legal risk and safeguard users. The exchange has signaled it may reach out to Curve to discuss the matter, with Curve replying that “better to be friends and build together.”

Beyond licensing, Curve stressed that deploying stable-swap capabilities safely requires deep specialized know-how. The post pointed to historically high-risk episodes tied to swap-based systems, underscoring that even seemingly straightforward integrations can become attack surfaces if not designed with rigorous safeguards. The reference points include Saddle Finance’s 2022 hack and the 2025 Balancer incident, which saw a $116 million exploit tied to swap-based code. These examples are invoked to warn users and developers about the potential for losses when complex liquidity mechanisms interact with permissionless platforms.

Cointelegraph contacted both Curve and PancakeSwap for comment, but neither side had responded by publication time. The absence of formal statements on licensing terms leaves a broader conversation about DeFi security, intellectual-property rights, and cross-chain interoperability still unresolved. The episode also highlights how fast-moving feature sets—such as cross-chain swaps and programmable liquidity—can collide with the practical and legal complexities of code reuse in open ecosystems.

The timing aligns with PancakeSwap’s ongoing ecosystem expansion. In April 2025, Infinity launched on Arbitrum and BNB Chain, introducing one-click cross-chain swaps intended to streamline asset movement across networks. The upgrade also introduced “hooks” — smart contract plug-ins that let liquidity providers tailor pool parameters, including dynamic fee structures, customized rebates, and on-chain limit orders that execute when predefined conditions are met. PancakeSwap said the upgrade reduced pool-creation fees by as much as 99%, signaling an attempt to accelerate liquidity onboarding and experimentation across chains.

Further growth followed later in 2025, with Infinity extending to Base, an Ethereum layer-2 network. PancakeSwap reported that trading on Base could be up to 50% cheaper when Ether (CRYPTO: ETH) trades against ERC-20 tokens, underscoring the economic incentives behind cross-chain expansions and the continued push to lower trading costs for users who bridge assets across networks. The Base deployment exemplifies how DeFi aggregators are increasingly pursuing multi-chain footprints to improve liquidity depth and user experience, even as they navigate new regulatory and security considerations. ERC-20 remains the dominant token standard on Ethereum-based assets, including many that flow through L2 ecosystems and cross-chain adapters.

Taken together, the episode illustrates a core tension in DeFi: rapid feature innovation and cross-chain interoperability versus the need for rigorous license compliance and robust security controls. As Infinity’s architecture becomes more sophisticated—incorporating hooks, dynamic fees, rebates, and conditional orders—the potential attack surface grows, even as the market appetite for seamless, multi-chain swaps intensifies. The fact that Curve explicitly linked licensing discussions with user safety signals that governance and IP considerations may increasingly influence how DeFi projects collaborate and compete in the coming years.

For readers tracking the evolution of cross-chain DeFi, the exchange between Curve and PancakeSwap is a useful case study in how open-source finance negotiates the line between rapid innovation and formal protection of codebases. It also raises practical questions for developers and users: how are licenses enforced in permissionless environments, what constitutes a legally safe deployment of shared code, and how quickly can open collaboration be formalized when risk signals emerge?

PancakeSwap Infinity launches and goes cross-chain

PancakeSwap Infinity debuted on Arbitrum and BNB Chain in April 2025, following the project’s earlier adoption of one-click cross-chain swaps to facilitate asset movement across different blockchains. The Infinity upgrade introduced “hooks,” programmable plug-ins that let liquidity pools adapt to varying strategies, including dynamic fees, tailored rebates, and on-chain limit orders triggered by user-defined conditions. The intent was to give liquidity providers greater control and to optimize trading experiences across an expanding ecosystem of connected networks.

In addition to the feature set, the upgrade also reduced pool-creation costs by up to 99%, which PancakeSwap framed as a measure to encourage experimentation and liquidity provisioning across chains. The company stressed that Infinity was designed with flexibility in mind, enabling multiple liquidity approaches and enabling developers to customize pool behavior without sacrificing core usability.

Base, launched later in 2025, represented the project’s move onto another major Ethereum layer-2. On Base, PancakeSwap Infinity again marketed cost savings for traders, claiming that ether-based trades against ERC-20 tokens could be significantly cheaper. This expansion aligns with broader industry interest in scaling Ethereum-based assets and reducing friction for users who want to move assets between Layer 1 and Layer 2 ecosystems while maintaining efficient execution and competitive fees. The emphasis on Base reflects a broader trend of DeFi platforms extending their reach to Layer-2 networks in pursuit of higher throughput and lower costs for on-chain activity.

Throughout these developments, ERC-20 remains a central element in the cross-chain narrative, given its role as the primary token standard for assets minted on Ethereum and widely adopted across L2s and sidechains. The practical implications of this reality are clear: as more protocols enable cross-chain swaps and multi-network liquidity, the compatibility and security of ERC-20 contracts—along with the associated wallets and bridges—becomes an ever more critical factor for users and developers alike.

In this context, the licensing debate between Curve and PancakeSwap serves as a reminder that DeFi’s future depends not only on clever feature design but also on the governance, licensing, and security frameworks that enable collaboration across networks. The dynamics of cross-chain liquidity—and the legal and technical safeguards that protect it—will likely shape how other protocols approach similar integrations in the months ahead. The industry will be watching closely to see whether licensing discussions translate into formal agreements, and whether security practices evolve in step with the increasingly interconnected DeFi landscape.

Why it matters

What makes this dispute notable is its potential to influence the pace and direction of DeFi interoperability. Licensing friction, if not resolved, could slow down the adoption of shared code and cross-chain features, prompting projects to pursue bespoke solutions rather than open collaborations. Conversely, a constructive licensing outcome could establish a template for responsible code reuse, enabling faster deployment of complex liquidity primitives while maintaining safeguards for users.

Beyond licensing, the case spotlights the broader risk-management challenges in DeFi. As protocols push dynamic fee schemes, programmable pools, and cross-chain bridges, the importance of robust security practices and audited codebases becomes more pronounced. The references to Saddle Finance’s 2022 incident and Balancer’s 2025 exploit highlight the real costs of insufficient safeguards, reinforcing the view that risk assessment must accompany innovation. In short, the industry is weighing how to balance rapid iteration with disciplined, verifiable security and licensing processes that protect users and the broader ecosystem.

For builders, the episode reinforces the value of collaboration under clear, enforceable terms and the importance of pre-emptive security design when deploying reusable components. For investors and users, it underscores the ongoing need to assess not just the functionality of new features but also the licensing posture and risk controls that accompany them. As cross-chain ecosystems mature, the ability to navigate legal and technical risk will be as critical as the product features themselves.

What to watch next

- Public licensing negotiations between Curve and PancakeSwap: will a formal agreement or licensing framework emerge?

- Security reviews and audits of Infinity’s hooks and cross-chain components, including any new penetration testing results.

- Additional Infinity deployments on other networks and any changes to pool-creation economics or fee structures.

- Regulatory and governance developments that could influence how open-source DeFi code is shared and deployed across ecosystems.

Sources & verification

- Curve Finance X posts discussing licensing and collaboration for StableSwap features.

- Curve Finance X posts emphasizing the need for deep stableswap expertise for safe integration and safety considerations.

- PancakeSwap Infinity launch announcement and description of hooks and dynamic parameters.

- Cross-chain swap developments and the Base deployment, including cost-structure improvements.

- Historical references to Saddle Finance 2022 hack and Balancer’s $116 million exploit, cited as cautionary examples of swap-based code vulnerabilities.

Crypto World

Bitcoin ETF Flows Flash a Structural Signal as Market Recalibrates After All-Time High

TLDR:

- Bitcoin exchange reserves have steadily declined since late 2024, pointing to reduced short-term selling pressure in the market

- Spot Bitcoin ETF outflows began after BTC hit its ATH, directly reducing institutional demand and influencing overall price direction

- The pace of Bitcoin ETF outflows has slowed notably, suggesting institutional position adjustments may be nearing their completion point.

- XWIN Research warns that a return to rising ETF holdings would trigger a full reassessment of the current bearish base scenario.

Bitcoin ETF flows have emerged as a critical structural signal in the current market cycle. Following Bitcoin’s recent all-time high, XWIN Research Japan released Analysis Report No. 228.

The report examines how exchange reserves and ETF holdings interact as key market indicators. Together, these data points offer a clearer picture of institutional demand and overall Bitcoin supply dynamics currently.

Exchange Reserves Reflect a Broader Shift in Holding Behavior

CryptoQuant data shows that Bitcoin exchange reserves have gradually declined since late 2024. Fewer coins on exchanges generally mean less immediate selling pressure in the market.

This trend points to a broader shift toward long-term holding or self-custody transfers. As a result, the available supply for short-term trading appears to be contracting steadily.

Ki Young Ju, Founder of CryptoQuant, shared supporting chart data on this exchange reserve trend. He noted the ongoing decline in Bitcoin balances held across major exchange platforms.

A sustained drop in exchange reserves is often associated with reduced short-term sell-side activity. However, it can equally reflect growing confidence among long-term Bitcoin participants.

XWIN Research indicates the market is currently in a supply-demand rebalancing phase. The short-term bias remains somewhat bearish, though selling pressure shows early signs of easing.

This combination of declining reserves and cautious sentiment creates a layered market picture. Analysts and traders are watching both supply and demand metrics closely at this time.

Supply-side data alone, however, cannot confirm the direction of the next price move. The current period resembles a consolidation phase following the post-ATH correction.

Institutional behavior, particularly as seen through ETF activity, plays a central role here. Both sides of the equation must align before a clearer directional trend can emerge.

ETF Outflow Pace Slows, Stabilization Comes Into View

Bitcoin ETF flows turned negative after BTC reached its recent all-time high. Spot ETFs hold actual Bitcoin, so sustained outflows directly reduce available institutional demand.

The pace of these outflows has noticeably slowed in more recent data periods. This development may suggest that institutional position adjustments are approaching completion.

XWIN Research has previously noted that ETF flows act as a structural driver in Bitcoin cycles. The post-ATH outflows and the subsequent price correction broadly align with that earlier framework.

Ki Young Ju’s data, cited in the report, provides a visual representation of this pattern. Monitoring ETF holdings therefore remains essential for assessing near-term market conditions.

Recent observations show that ETF outflows have largely paused in the current period. This pause does not yet confirm that a new inflow cycle has begun.

However, it does reduce near-term selling pressure from the institutional side. XWIN Research states that a return to rising ETF holdings would require a full reassessment of its base scenario.

For now, Bitcoin ETF flows remain the clearest forward-looking indicator to watch. The market continues moving through a transitional period between correction and potential stabilization.

Until consistent institutional inflows return, caution remains the dominant market posture. Participants across the industry are closely watching upcoming ETF data for further directional cues.

Crypto World

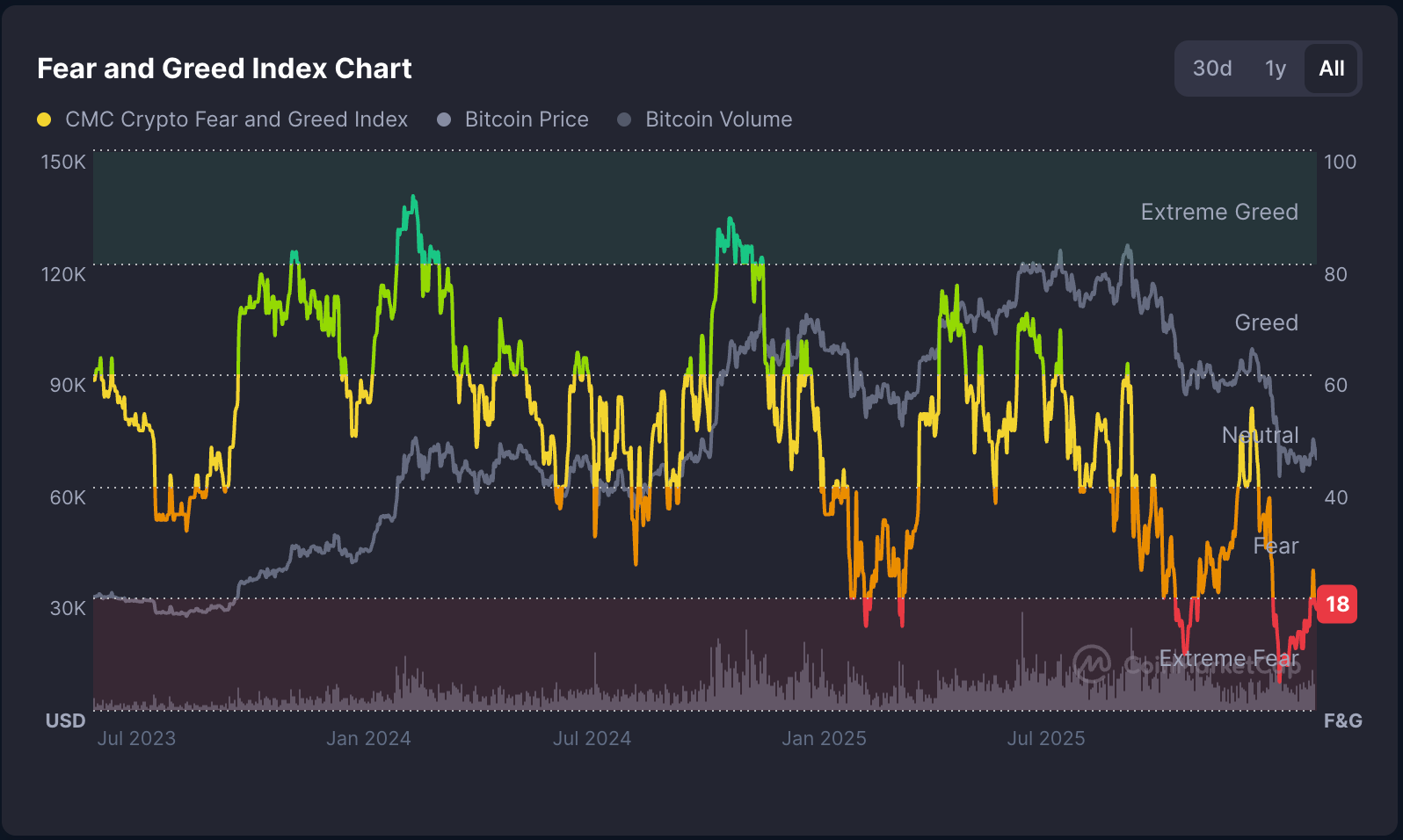

Crypto Fear and Greed Index Dips Back to Extreme Fear Levels

Bitcoin (CRYPTO: BTC) and the broader crypto ecosystem are navigating a fresh wave of risk aversion as the Crypto Fear and Greed Index retreats to extreme fear territory. The gauge sits at 18, down from 20 on Friday, after a brief midweek uptick to 25 before sentiment cooled again amid escalating geopolitical frictions and macro uncertainty. The retreat underscores a phase of cautious trading, with liquidity tightening and volatility increasing as investors weigh a bear market that has stretched since late 2025. While BTC has faced a severe downdraft, the broader altcoin sector has suffered disproportionately, highlighting a liquidity squeeze that has yet to fully reverse.

Key takeaways

- The Crypto Fear and Greed Index is at 18, signaling “extreme fear,” after a transient bounce to 25 earlier in the week, reflecting a fragile risk appetite among market participants.

- Around 38% of altcoins are hovering near all-time low prices, with CryptoQuant data indicating roughly a 50% decline in overall trading volume alongside price erosion across the sector.

- BTC remains emblematic of the downturn, with the bear market taking hold since October 2025 and BTC’s price down more than half from its all-time high, while the altcoin market has erased hundreds of billions in value.

- Public interest in crypto sentiment has waned, evidenced by a surge in searches such as “Bitcoin going to zero” on Google Trends, signaling waning investor confidence amid macro and geopolitical headwinds.

- Liquidity and sentiment fragility persist as geopolitical tensions and macro uncertainties continue to weigh on risk assets, including digital currencies.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The combined effect of souring sentiment and liquidity strains has pressured Bitcoin and the broader altcoin market, contributing to continued price declines.

Trading idea (Not Financial Advice): Hold. Given the breadth of macro and geopolitical headwinds, traders may prefer patience until there are clearer signs of demand returning or a stabilization in liquidity conditions.

Market context: The sentiment drag sits against a backdrop of thinning liquidity and cautious risk-off behavior that has characterized crypto markets since late 2025. Geopolitical frictions and macro policy considerations—such as rate expectations and debt dynamics—have restrained appetite for risk assets, amplifying drawdowns in both BTC and altcoins.

Why it matters

The current mood matters because sentiment indicators often precede tangible shifts in trading behavior and liquidity. When the Fear and Greed Index registers extreme fear, it tends to reflect caution among retail and professional participants alike, potentially delaying bottoming processes and extending drawdowns if macro headlines intensify. The data suggests that buyers remain scarce even as some traders watch for any technical or fundamental catalyst that could rekindle demand.

Liquidity dynamics are particularly telling. CryptoQuant’s take—highlighting that altcoins are disproportionately affected and that overall trading volume has contracted by roughly half—points to a market where capital is increasingly concentrated in the largest assets and a few high-conviction bets. In a phase where liquidity governs price formation, thinner order books can exacerbate volatility and lead to sharper declines on adverse headlines. This pattern aligns with social sentiment metrics that show altcoin interest at multi-year lows, which secondaries often interpret as a sign of capital flight from riskier corners of the market.

Meanwhile, the public’s interest in crypto has cooled, as evidenced by Google Trends data showing a spike in searches for “Bitcoin going to zero.” Such behavior mirrors a broader risk-off environment: when the public narrative turns skeptical, both liquidity inflows and risk-taking capacity tend to retreat, making rallies harder to sustain without a clear macro or sector-specific catalyst. These trends underscore the importance of context when evaluating the market’s next moves—macro relief, regulatory clarity, or a shift in geopolitical dynamics could alter the balance between risk and reward for market participants.

What to watch next

- Monitor the Fear and Greed Index for a potential material shift away from extreme fear, signaling a thaw in risk appetite.

- Observe BTC price action and key support levels for possible technical breakouts or breakdowns, in concert with macro data releases and policy signals.

- Track altcoin liquidity and on-chain activity, paying attention to whether the nearly 50% drop in trading volume begins to reverse as risk sentiment improves.

- Keep an eye on geopolitical developments and macro indicators that influence rate expectations, liquidity, and global risk sentiment.

- Watch social and search trends for any renewed interest in Bitcoin or altcoins that could foreshadow a risk-on rally or a renewed round of capital inflows.

Sources & verification

- CoinMarketCap: Fear & Greed Index page (https://coinmarketcap.com/charts/fear-and-greed-index/)

- CryptoQuant data via public posts (e.g., liquidity and altcoin price/volume observations) including the cited post (https://x.com/cryptoquant_com/status/2028740883588243868/photo/1)

- Google Trends data on searches for “Bitcoin going to zero” (https://trends.google.com/explore?q=Bitcoin%20going%20to%20zero&date=today%205-y&geo=Worldwide)

- Cointelegraph coverage referenced in the original report, including market sentiment and price-action pieces (e.g., https://cointelegraph.com/explained/what-is-the-crypto-fear-and-greed-index, https://cointelegraph.com/news/bitcoin-drops-back-record-fear-levels-as-it-wipes-weekend-gains, https://cointelegraph.com/news/38-altcoins-near-all-time-lows)

Market mood and the liquidity squeeze: what the latest data show

The latest readings underline a market that remains structurally fragile. The Bear Market narrative—from the October 2025 decline that shaved more than half from Bitcoin’s price to the subsequent erosion in altcoin value—has left a lasting imprint on investor psychology. Even with occasional micro-recoveries, the aggregate appetite for risk has not yet returned to levels that would sustain a broad-based rally. As long as geopolitical tensions persist and macro conditions remain unsettled, liquidity will likely stay a key driver of price action for both Bitcoin and the altcoin universe.

The data also remind readers that sentiment indicators are not merely cyclical curiosities; they can act as early warning signals for shifts in capital allocation. If risk-on dynamics begin to re-enter markets—through improved macro clarity, favorable regulatory developments, or concrete ETF-related flows—the Fear and Greed Index could move away from the current extreme fear reading, potentially unlocking a new phase of demand. Until then, market participants should prepare for continued volatility, with a focus on risk controls, diversification, and a disciplined approach to liquidity management.

Crypto World

AI Does the Work, Blockchain Moves the Value: The Convergence That Is Rewriting Economic Infrastructure

TLDR:

- Companies are now hiring AI agents — not humans — to write content, run experiments, and engage developers autonomously.

- Traditional banking was built for humans; blockchain fills the gap with autonomous wallets, smart contracts, and stablecoin rails.

- The x402 protocol and Circle’s gas-free nanopayments are live infrastructure designed for high-frequency agent commerce.

- Anthropic’s labor report shows 75% AI task coverage for programmers, signaling rapid displacement across exposed occupations.

AI agents are no longer a future concept — they are being hired today. Companies are posting job listings for autonomous agents to write content, run experiments, and engage developers without human involvement.

As these agents begin earning and transacting, a structural gap in traditional finance is becoming impossible to ignore.

Blockchain is stepping in as the rails that make autonomous economic activity possible at machine speed and global scale.

AI Takes Over the Work While Blockchain Handles the Money

Companies are actively recruiting AI agents for operational roles previously held by humans. This is not theoretical — job listings exist right now for fully autonomous agents.

When those agents start earning, traditional banking infrastructure immediately breaks down. Bank accounts require human identity, and KYC compliance demands legal credentials machines cannot provide.

Wire transfers run on compliance layers built for human speed and oversight. AI agents, however, operate 24 hours a day across borders without pause or supervision.

Blockchain removes that friction entirely by offering autonomous wallets and smart contract settlement. An agent can receive stablecoins, allocate budget, and pay for compute — all without a human intermediary.

Programmable spending rules allow agents to manage resources and even hire other agents downstream. The value flow becomes fully autonomous from receipt to disbursement.

Bilal bin Saqib MBE wrote on X, “AI gives the agent intelligence. Blockchain gives it economic sovereignty.” Together, they form the backbone of what economic autonomy looks like at scale.

The x402 payment protocol now enables machine-to-machine transactions natively over HTTP. Circle launched gas-free stablecoin nanopayments on testnet, designed for high-frequency agent commerce.

These are not roadmap items — the infrastructure is operational and being adopted. The convergence between AI and blockchain is no longer a prediction; it is already running.

Both technologies solve the same core problem from different directions. AI removes gatekeepers from work. Blockchain removes gatekeepers from money.

When combined, they create a system where value and decision-making move without permission. That is the convergence, and it is accelerating.

Labor Data Confirms AI Is Reshaping Work Faster Than Expected

Anthropic published a labor market report this week with findings that reflect real momentum. Computer programmers now face 75% task coverage from existing AI tools.

Customer service and data entry roles show similarly high exposure rates. The most AI-exposed occupations are projected to grow the least through 2034, per Bureau of Labor Statistics data.

External research recorded a 6 to 16% employment drop among AI-exposed workers aged 22 to 25. That decline is driven by slower hiring rather than active layoffs.

Anthropic’s own data shows no systematic unemployment rise yet among those workers. However, the directional pattern is consistent and measurable across multiple data sources.

As AI covers more workflow categories, the volume of autonomous agent transactions will grow. More agents mean more economic activity happening entirely outside traditional financial rails.

Blockchain becomes more critical as that volume increases, not less. The infrastructure underneath agents scales with the agents themselves.

Pakistan passed the Virtual Assets Act 2026 and is building PVARA as an AI-native regulatory authority. Nations with clear, enforceable frameworks will attract capital, builders, and the infrastructure layer itself.

Governance, not technology, is now the defining variable in this race. Countries that treat the convergence as a policy challenge first will set the rules for everyone else.

Crypto World

BlackRock’s Former Head of Crypto Explains How He Pitches ETH to Wall Street

TLDR:

- BlackRock’s former Head of Crypto, Joseph Chalom now leads Sharplink, a $1.5 billion Ethereum treasury company.

- Stablecoins at $310 billion and tokenized assets at $32 billion are both projected to grow into the trillions.

- Chalom pitches ETH as a trust commodity, grounded in fundamentals, with no short-term price predictions made.

- Chalom firmly separates ETH from Bitcoin, arguing Ether holds intrinsic value tied to global financial infrastructure.

BlackRock’s former Head of Crypto is now making a direct case for Ethereum to institutional investors. Joseph Chalom, who once led crypto strategy at the world’s largest asset manager, now serves as CEO of Sharplink.

Sharplink is a $1.5 billion Ethereum treasury company focused on digital assets. Drawing from his Wall Street background, Chalom has built a structured method for pitching ETH.

His approach centers on Ethereum’s long-term role in global finance, avoiding short-term price predictions entirely.

How Chalom Opens the ETH Conversation With Institutions

Coming from BlackRock, Chalom understands exactly how institutional investors think and evaluate assets. He uses that background to frame the Ethereum opportunity before touching on ETH as an asset.

He points out that stablecoins currently stand at around $310 billion in total market value. That market, he argues, is heading into the trillions in the coming years. Tokenized assets sit at roughly $32 billion today and are on a similar growth trajectory.

Beyond stablecoins and tokenized assets, institutional DeFi adoption is also accelerating at a rapid pace. Chalom further raises agentic finance as another layer of the broader Ethereum opportunity.

These combined trends build a case for Ethereum as core infrastructure for global finance. Institutional investors, he notes, tend to agree with this framing once it is laid out clearly.

Chalom captured this view directly, stating: “The Ethereum ecosystem is going to be the future settlement layer for finance.”

That framing shifts the conversation away from speculation and toward structural financial transformation. Rather than positioning Ethereum as a crypto asset, his pitch presents it as an emerging financial backbone. That foundation, he explains, is where every institutional conversation must begin.

Why Chalom Separates ETH From Bitcoin in Every Pitch

With the ecosystem case established, Chalom then turns the focus to ETH as a stand-alone asset. He draws on his BlackRock experience to steer institutions away from common misconceptions about Ether.

He explains that as the Ethereum network grows, more Ether is needed to secure and settle transactions. This creates a direct link between ecosystem expansion and rising structural demand for ETH.

Chalom elaborated on this positioning, saying: “As the Ethereum ecosystem grows, you need more Ether to secure and settle these transactions. Therefore, Ether ends up becoming a trust commodity.”

He added that the pitch stays grounded in principles and fundamentals at all times. “What we don’t do is make up numbers and talk about short-term price predictions for Ether,” he said.

That discipline keeps institutional conversations anchored in long-term structural value rather than market noise.

Chalom also makes a deliberate point of separating ETH from Bitcoin in every conversation. He firmly rejects the idea that Ethereum is simply a “little brother” running as a coefficient of Bitcoin’s value.

“ETH is not a derivative of Bitcoin,” he stated, noting it holds intrinsic value to the future of the financial system. He reinforced this by saying:

“The number one thing to do is not make up numbers. And number two, Ethereum has intrinsic value to the future of the financial system.” That distinction, rooted in his Wall Street experience, is central to how he earns institutional confidence in ETH.

Crypto World

CAAT Pension Plan Fires CEO Derek Dobson Over $1.6 Million Vacation Payout

TLDR:

- CAAT CEO Derek Dobson resigned immediately after a $1.6M vacation payout triggered public outrage in 2026.

- A settlement agreement requires Dobson to repay the controversial 2025 vacation payout to the plan fully.

- Acting CEO Kevin Fahey appointed five internal senior leaders to restore stability and stakeholder trust.

- CAAT remains financially strong, with a funded status of 124%, holding over $23 billion in total plan assets.

The CAAT Pension Plan has announced the immediate departure of CEO Derek Dobson after a $1.6 million vacation payout triggered widespread public backlash.

The Toronto-based organization reached a settlement requiring his resignation and full repayment of the 2025 vacation payment.

A new senior leadership team has since been appointed to lead the plan. CAAT manages over $23 billion in assets and remains one of Canada’s most well-funded pension organizations.

Settlement Agreement Closes Dobson’s Chapter at CAAT

The CAAT Board of Trustees confirmed that Dobson’s departure took effect immediately under a formal settlement. He agreed to resign and repay the full $1.6 million vacation payout received for 2025.

Both parties acknowledged the importance of moving forward to support the plan’s long-term health. The agreement brings closure to a period that raised serious governance concerns.

CTV News first reported the controversy, revealing the payout Dobson received as part of his 2025 compensation. The report quickly drew public attention and sparked debate about executive pay at pension funds.

Many questioned whether such a payment was appropriate for a public-facing pension organization. The board responded swiftly, settling shortly after the story surfaced.

Reactions spread across social media as the story gained traction online. One widely shared comment captured the public mood: “He thought taking a $1.6 million vacation payment was a good use of funds?” That response reflected growing frustration over accountability at pension institutions. The board’s quick action was broadly seen as a necessary step toward rebuilding trust.

The Financial Services Regulatory Authority of Ontario also engaged constructively with the plan throughout this process. CAAT thanked the regulator for its role in helping strengthen governance and oversight practices.

Their involvement reflected broader scrutiny of pension fund management across the sector. It also reinforced the board’s commitment to acting in the best interests of all members.

New Leadership Team Steps In to Drive Stability and Trust

Acting CEO Kevin Fahey, who also serves as Chief Investment Officer, now leads CAAT’s day-to-day operations. Five senior leaders from within the organization were appointed to report directly to Fahey.

Addressing the appointments, Fahey stated: “I am proud that these five senior leaders are all existing CAAT employees who will drive stability and institutional continuity.“ He added that their internal relationships would help teams better serve members every day.

John Baiocco was appointed Senior Vice President of Funding and Sustainability, while Stephen Hewitt became Senior Director of Communications.

Laura Foster was named interim Chief Financial Officer, Jillian Kennedy took on the role of Chief Operating Officer, and James Fera was appointed Chief Legal Officer and General Counsel.

The board expressed confidence in the team’s ability to engage staff and serve members throughout the transition. A search for a Chief Human Resources Officer remains ongoing at this time.

Board Chair Audrey Wubbenhorst praised Fahey for the progress made since his appointment as acting CEO. She said: “The Board continues to focus on its work in the best interests of members.”

Wubbenhorst also expressed gratitude to all stakeholders for their “ongoing trust and confidence in the Plan.” Restoring the plan’s reputation stands as a clear priority as new leadership takes hold.

CAAT reported a funded status of 124%, holding $1.24 for every $1 of promised pension benefits. The plan also carries over $6 billion in funding reserves to guard against market volatility and demographic risks.

These figures provide a layer of stability as the organization navigates this leadership change. The plan’s financial foundation remains solid as it enters this new phase.

Crypto World

Crypto Fear and Greed Index Stumbles Back to ‘Extreme Fear’ Territory

The Crypto Fear and Greed Index, one of the most widely used gauges of crypto investor sentiment, has fallen back down to “extreme fear” levels after briefly recovering on Wednesday.

The Crypto Fear and Greed Index is at 18 at the time of this writing, down from the 20 recorded on Friday, according to CoinMarketCap. 20 signals “fear,” an atmosphere of caution among investors, but an improvement over rock-bottom market sentiment.

Sentiment briefly spiked to 25 on Wednesday, but contracted as geopolitical tensions between the US, Israel and Iran continue to erode risk appetite and increase macroeconomic uncertainty among market participants.

The index hit a yearly low of 5 in February amid the crypto market downturn and several headwinds, including renewed geopolitical tensions and macroeconomic concerns, such as uncertainty over interest rate policy, liquidity levels and rising US government debt.

Crypto assets have been in a bear market since the October 2025 crash, which slashed the price of Bitcoin (BTC) by over 50% from its all-time high, before BTC staged a limited recovery, and erased hundreds of billions of dollars in value from the altcoin market.

Related: Bitcoin sentiment hits record low as contrarian investors say $60K was BTC’s bottom

Alts suffer the most as sentiment craters

38% of altcoins are hovering near all-time low prices, which is more severe than the aftermath of the FTX collapse, according to CryptoQuant analyst Darkfost.

The price collapse was accompanied by about a 50% reduction in crypto trading volume, Darkfost told Cointelegraph.

“Altcoins remain the last sector of the crypto market where liquidity typically flows, so this situation is not surprising, given the geopolitical and macroeconomic deterioration observed over the past several months,” he said.

Mentions of altcoins on social media platforms sank to their lowest level in two years, according to crypto market sentiment analysis platform Santiment.

In February 2026, worldwide Google search volume for “Bitcoin going to zero” also hit its highest level since 2022, according to data from Google Trends, corroborating the low investor confidence measured by other sentiment indicators.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Crypto World

Gold Should Have Exploded When the Iran War Started: Here’s Why It Did Not

TLDR:

- Gold spiked to $5,390 on February 28 but dropped 4% by March 4, settling at $5,093 after strikes.

- Oil surged 13% and jet fuel jumped 140% while gold gained only 2.3% since the Iran war began.

- Dollar strength from inflation expectations historically outbids gold in phase one of energy crises.

- Goldman Sachs targets $6,300 gold by end-2026, leaving a $1,207 gap the market has not yet priced.

Gold should have exploded when the Iran war started, but it did not. That unexpected restraint is now the central question driving institutional analysis worldwide.

Since US-Israeli strikes on February 28 killed Iran’s Supreme Leader and closed the Strait of Hormuz, gold gained only 2.3 percent.

Brent crude surged 13 percent. Jet fuel jumped 140 percent. For seasoned market watchers, understanding why gold held back matters far more than the price itself.

Why Gold Stayed Quiet While Every Other Crisis Asset Moved

The war began with dramatic force. US-Israeli strikes destroyed twenty Iranian warships within 48 hours and closed a critical global shipping lane.

Gold briefly spiked to $5,390 intraday on February 28. Yet by March 4, just six days into the largest Middle East military campaign since the Gulf War, gold had dropped roughly 4 percent in a single session.

The answer to gold’s restraint sits in the dollar. An oil spike does not immediately trigger a safe-haven gold bid. Instead, it activates the inflation expectation channel, which strengthens the dollar and tightens real yields. That is the one macro environment where gold historically underperforms other assets.

Analyst Shanaka Anslem Perera framed it plainly in a widely circulated post. “This is not gold failing,” he wrote, describing gold as being temporarily outbid by the dollar during an inflation shock’s opening phase. The dollar roared following the oil move, and gold waited. That sequence is not random — it is structural.

The Fed now faces three competing pressures at once. Oil-driven inflation calls for rate hikes. A war-related growth shock calls for cuts. War financing calls for monetization.

Markets read the inflation signal first and bought dollars instead of gold. That is why the numbers look the way they do today.

Understanding the Two-Phase Pattern That Explains What Comes Next

Every major energy-driven geopolitical crisis in modern history has followed the same two-phase sequence. Phase one sees the dollar strengthen on inflation expectations, leaving gold behind.

Phase two begins when sustained economic damage becomes visible, recession probability rises, and markets shift from pricing inflation to pricing monetary debasement.

In 1973, that second phase took about six months and delivered gold gains of 73 percent. The 2022 Russia-Ukraine war compressed the timeline because the conflict stayed geographically contained. In 2026, the duration of Hormuz disruption determines when and whether phase two arrives.

Goldman Sachs has already moved its end-2026 gold target to $6,300, conditioned on prolonged Hormuz closure. Gold sits at $5,093 today. That leaves a $1,207 gap the market has not yet priced.

According to Perera, that gap exists because the market is still betting on a short war while the evidence points toward a longer one.

The $5,000 support level is the technical number every trader is now watching. The Fed’s March 18 meeting and the UN Security Council session on March 10 are the next key events.

If support holds through both, the base for phase two remains intact. Gold did not explode when the Iran war started — but the structure building beneath it suggests the delay, not the direction, is what analysts got wrong.

Crypto World

Bank of Canada issues Canada’s first tokenized bond in a pilot

Canada has wrapped up a formal test of distributed ledger technology in its debt markets, marking a milestone with the issuance of the country’s first tokenized bond. The Bank of Canada announced on a recent Friday that Project Samara brought together the central bank, Export Development Canada, Royal Bank of Canada, and TD Bank Group to explore whether a blockchain-inspired infrastructure could streamline the lifecycle of bonds—from issuance to settlement. The pilot involved a CAD 100 million instrument maturing in under three months, issued to a closed group of investors, and settled using wholesale central bank deposits rather than traditional commercial bank money. The platform, built on Hyperledger Fabric, linked separate cash and bond ledgers to enable near-instant settlement and end-to-end lifecycle management, including issuance, bidding, coupon payments, redemption, and secondary trading.

Key takeaways

- The pilot issued a CAD 100 million tokenized bond with a maturity of less than three months to a select group of investors, representing a tangible step toward tokenized government-like debt in Canada.

- Settlement relied on wholesale central bank deposits rather than conventional bank money, underscoring a shift in how payment rails could interact with tokenized securities.

- Hyperledger Fabric served as the core platform, integrating separate ledgers for cash and bonds to support a full lifecycle from issuance to trading with near-instant settlement.

- Participants tested a comprehensive workflow—issuance, bidding, coupon payments, redemption, and secondary trading—highlighting both operational gains and governance or regulatory hurdles.

- Early results point to improved data integrity and operational efficiency, while signaling that broader uptake will hinge on governance, regulatory alignment, and integration with existing financial infrastructures.

Sentiment: Neutral

Market context: The Canadian pilot sits within a growing global wave of experiments where governments and financial institutions explore tokenized and blockchain-enabled bonds. Notable precedents include the World Bank’s Bond-i issuance in 2018, which is widely cited as the first bond whose lifecycle was managed on a blockchain, and Singapore’s 2022 introduction of Project Guardian to study digital-asset use in wholesale markets. Hong Kong’s tokenized green bond program launched in 2023, with subsequent expansions in 2024 and 2025, and the World Bank’s 2024 collaboration with Swiss National Bank and SIX Digital Exchange illustrate a broader push toward digital settlement rails for traditional assets.

Why it matters

The Canadian experiment adds momentum to the concept that distributed ledger technology can streamline bond issuance, trading, and settlement by harmonizing disparate ledgers and enabling faster, more transparent post-trade processing. In theory, tokenized bonds promise reduced counterparty risk and improved data integrity, because the lifecycle—issuance, auction, coupon payments, and redemption—can be captured on an auditable, shared ledger with restricted access controls. The use of wholesale central bank deposits for payments further signals a potential evolution of settlement rails that aligns with central bank objectives for digital currency and streamlined settlement finality.

Yet the pilot also exposes real-world frictions. Governance structures and regulatory regimes must adapt to tokenized asset workflows, encompassing disclosure, investor protection, and cross-ledger interoperability. The need to integrate a distributed system with established financial infrastructures—clearing, custodial practices, and risk management frameworks—presents a non-trivial hurdle for scale. In addition, the transition from pilot to live, broad-based issuance requires careful calibration of operational risk, access rights, and oversight to ensure that security, privacy, and settlement finality meet both market and regulatory expectations.

Beyond Canada, the trend toward tokenized debt is not simply a technology story; it reflects evolving market architecture preferences. The World Bank’s historic Bond-i project demonstrated the feasibility of recording bond lifecycles on a blockchain platform, while MAS’s Project Guardian has driven industry exploration into digital-asset tokenization in wholesale markets. The Hong Kong Monetary Authority’s tokenized-bond initiatives show strategic regulatory support for digitalized debt, and Switzerland’s engagement with SIX Digital Exchange to settle a Swiss-franc digital bond highlights a growing ecosystem of cross-border experimentation. Taken together, these efforts illustrate how tokenization and distributed ledgers could eventually broaden access to capital markets, reduce settlement risk, and enable more granular post-trade data analytics—though each jurisdiction faces its own governance and technical integration challenges.

In this context, Canada’s test represents a proof-of-concept that a traditional debt instrument can be issued, traded, and settled on a ledger that mirrors wholesale central-bank-ready infrastructures. It also demonstrates a collaborative model among a government authority, a crown corporation, and large domestic banks, which could serve as a blueprint for future pilots or potential live deployments in other markets. The emphasis on end-to-end lifecycle management—issuance through secondary trading—addresses a longstanding pain point in bond markets: friction and latency in post-trade processes. While the initiative does not imply immediate disruption to conventional bond markets, it signals a path toward more efficient settlement, tighter data governance, and potentially new forms of investor access, should scale and regulatory support align in the coming years.

For participants and observers, the key takeaway is not that a single tokenized bond will disrupt the market but that a working, production-grade, distributed-ledger environment validated by major financial institutions can execute a bond’s lifecycle with high degrees of automation and near-instant settlement. The learnings—benefits in operational clarity and data integrity, paired with governance and integration challenges—will inform both policy considerations and private-sector decisions about the role of blockchain-inspired architectures in the capital markets ecosystem. As central banks and regulators monitor live pilots, the Canadian example reinforces the proposition that tokenized assets can be more than a speculative concept; they can be engineered into functional components of a broader, digitized financial infrastructure.

The Bank of Canada’s announcement and accompanying materials provide a window into how pilots like Project Samara are shaping practical experimentation. The release notes that the bond issuance and settlement occurred on a distributed ledger platform, with payments routed through wholesale central bank deposits. For more granular details on the official pilot, see the Bank of Canada’s announcement here: Bank of Canada, Export Development Canada, RBC, TD successfully complete bond issuance experiment using distributed ledger technology.

As the data set from this pilot becomes more concrete, observers will be watching for how governance structures evolve, how regulators respond to cross-jurisdictional interoperability considerations, and whether subsequent pilots scale to larger debt issues or longer maturities. The path from a single trial to a broader adoption hinges not only on technical feasibility but on the alignment of risk controls, settlement finality guarantees, and fiscal-technical harmonization across institutions and regulatory bodies. In that sense, Project Samara is less about the immediate utility of the CAD 100 million note and more about demonstrating that a coordinated, ledger-based approach can support end-to-end bond management in a way that resonates with evolving central-bank digital currency and digital-asset policy discussions.

What to watch next

- whether Canada expands the pilot to include larger issues or longer tenors within the same framework

- regulatory guidance or updates that address governance and interoperability for tokenized fixed income in Canada

- additional participants from the private sector or other Canadian provinces contemplating similar experiments

- technical refinements to the ledger architecture that improve scalability and cross-ledger reconciliation

- potential live deployments or cross-border pilots tied to wholesale settlement rails

Sources & verification

- Bank of Canada, Export Development Canada, Royal Bank of Canada, and TD Bank announce successful bond-issuance experiment using distributed ledger technology (March 2026): https://www.bankofcanada.ca/2026/03/bank-canada-export-development-canada-rbc-td-successfully-complete-bond-issuance-experiment-distributed-ledger-technology/

- World Bank: Bond-i—the first global blockchain bond issuance (2018): https://www.worldbank.org/en/news/press-release/2018/08/23/world-bank-prices-first-global-blockchain-bond-raising-a110-million

- Monetary Authority of Singapore: Project Guardian and wholesale digital-asset initiatives (2022): https://www.mas.gov.sg/news/media-releases/2022/mas-partners-the-industry-to-pilot-use-cases-in-digital-assets

- Hong Kong Monetary Authority: tokenized green bond issuance and program updates (2023–2025): https://www.hkma.gov.hk/eng/news-and-media/press-releases/2023/02/20230216-3, https://www.hkma.gov.hk/eng/news-and-media/press-releases/2024/02/20240207-6

- World Bank: partnership with Swiss National Bank and SIX Digital Exchange to advance digitalization in capital markets (2024): https://www.worldbank.org/en/news/press-release/2024/05/15/world-bank-partners-with-swiss-national-bank-and-six-digital-exchange-to-advance-digitalization-in-capital-markets

Tokenized bonds in Canada: outcomes, mechanics, and implications

Canada’s tokenized-bond pilot under Project Samara represents a deliberate, methodical step toward reimagining debt markets through distributed ledger technology. The collaboration among the Bank of Canada, Export Development Canada, and two of the country’s largest banks demonstrates a practical, governance-conscious approach to testing a full lifecycle on a shared ledger. The CAD 100 million instrument with a sub-three-month maturity illustrates how tokenization can be deployed for relatively short-duration debt in a controlled setting, providing a limited but meaningful data point for how such assets might behave in real markets.

The mechanics of the Pilot Samara platform—built on Hyperledger Fabric and featuring integrated cash and bond ledgers—address a core challenge in traditional bond markets: the latency and risk associated with post-trade processing. By enabling issuance, bidding, coupon settlement, redemption, and secondary trading on a single ledger, and by processing payments through wholesale central bank deposits, the pilot pushes the envelope on settlement efficiency and inter-ledger coherence. The approach also offers a blueprint for potential future interoperability with central bank digital currencies and wholesale payment rails, a topic of growing interest among policymakers around the world.

However, the pilot also makes clear that technology alone is not a panacea. Governance structures, cross-border data agreements, and regulatory requirements remain critical to the viability of broader adoption. The institutions involved acknowledged that while operational improvements were evident, so too were governance and integration hurdles—issues that would need to be resolved before any large-scale rollout. As the market grows more comfortable with the idea of tokenized assets and as central banks continue to refine their digital-currency frameworks, pilots like Samara provide a concrete, observable test of how tokenized debt could function within a regulated, institutionally trusted ecosystem.

In the broader context, Canada’s experiment sits at the intersection of technological capability and policy design. It reflects a systematic, risk-conscious approach to exploring new settlement paradigms while preserving market integrity and investor protection. The results contribute to a landscape in which tokenized bonds are no longer a speculative curiosity but a potential instrument for more efficient settlement and improved data governance. Investors, financial institutions, and policymakers will be watching closely for how Canada translates pilot insights into scalable solutions that could reshape the structure and speed of debt markets in the years ahead.

Crypto World

Circle and Stripe Race to Replace Credit Cards With Stablecoin Payments for AI Agents

TLDR:

-

- Circle launched Arc blockchain and nanopayments, cutting transaction costs to fractions of a penny for AI agents.

- Stripe and Paradigm built Tempo blockchain, raising $500M at a $5B valuation for stablecoin payment rails.

- Credit card fees make microtransactions unworkable, giving stablecoins a structural edge in machine-to-machine commerce.

- Coinbase’s x402 recorded just $24M in volume, exposing a wide gap between agentic payment ambition and adoption.

- Circle launched Arc blockchain and nanopayments, cutting transaction costs to fractions of a penny for AI agents.

Circle Internet Group and Stripe are locked in a race to build payment systems for a world that does not yet exist. Both companies are developing infrastructure designed for autonomous AI agents that settle transactions in stablecoins.

The goal is to replace the traditional credit card swipe with programmable, machine-driven payments. Investors are watching closely, with Stripe reaching a $159 billion valuation and Circle shares climbing nearly 30% since the start of 2026. The competition is already reshaping how the payments industry thinks about the future.

Two Companies, One Vision, Different Approaches

Circle is moving fast on the infrastructure side. The company launched Arc, a new blockchain built specifically for stablecoin payments.

It also began testing “nanopayments,” a capability that lets autonomous agents hold balances and transact across networks.

Costs run at fractions of a penny per transaction, making high-frequency machine-to-machine commerce economically practical for the first time.

Stripe is taking a different but equally aggressive path. Together with crypto venture firm Paradigm, it is building Tempo, a blockchain designed from the ground up for stablecoin settlement.

The project raised $500 million at a $5 billion valuation, with Visa, Mastercard, UBS, and Shopify signing on as partners.

Stripe has also spent more than $1.1 billion acquiring stablecoin infrastructure, including the 2025 purchase of Bridge.

The two companies are effectively building parallel highways toward the same destination. Circle is focused on the settlement layer and the nanopayment capability.

Stripe is focused on merchant integration and blockchain rails. Together, their investments represent the most serious institutional bet yet that stablecoins will power the next generation of commerce.

Why Credit Cards Cannot Compete in an Agent-Driven World

The structural argument against credit cards is straightforward. Traditional card networks charge fixed fees and percentage-based pricing on every transaction.

That model works for a consumer buying a $50 item but breaks down entirely when a software agent pays cents for a data request or an API call.

Circle CEO Jeremy Allaire framed the opportunity clearly on the company’s February 25 earnings call. He described a future where AI agents consume services from one another at scale.

A legal skills agent, for instance, might field thousands of micro-requests from external agents daily. Each transaction might be worth only a fraction of a dollar, making card fees prohibitive.

Analyst Mark Palmer of Benchmark-StoneX reinforced that point. “Microtransactions are a poor fit for traditional rails in terms of cost, latency and programmability,” he said.

Stablecoins embedded directly into software workflows, he added, remove the settlement delays and cost structures that make cards unworkable at that scale.

The Road Between Ambition and Adoption

Despite the infrastructure race, real-world volume tells a more cautious story. Coinbase’s x402, an open standard built for agentic payments, reported just $24 million in total volume over the past 30 days.

That figure sits against a global e-commerce market projected to reach $6.88 trillion this year. The gap between the two numbers is difficult to overlook.

Merchant adoption presents another hurdle. Chris Donat of BWG Global noted that merchants follow consumer demand.

“They aren’t going to bother accepting something unless they are asked by a meaningful number of consumers to do it,” he said. Right now, consumers are not asking for stablecoin payments in significant numbers.

Stablecoin transactions also lack the fraud protection, dispute resolution, and credit extension built into every card payment.

A practical near-term path may involve AI agents using virtual cards that settle on the back end through stablecoin rails.

That model would allow card networks and stablecoin infrastructure to coexist, rather than forcing an immediate winner-takes-all outcome.

Allaire himself acknowledged that the timeline for meaningful agentic transaction volume remains uncertain, even as the race to build the pipes intensifies.

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Ann Taylor

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

NewsBeat7 days ago

NewsBeat7 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech7 days ago

Tech7 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Sports6 hours ago

Sports6 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

Tech5 days ago

Tech5 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

NewsBeat2 days ago

NewsBeat2 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter