Crypto World

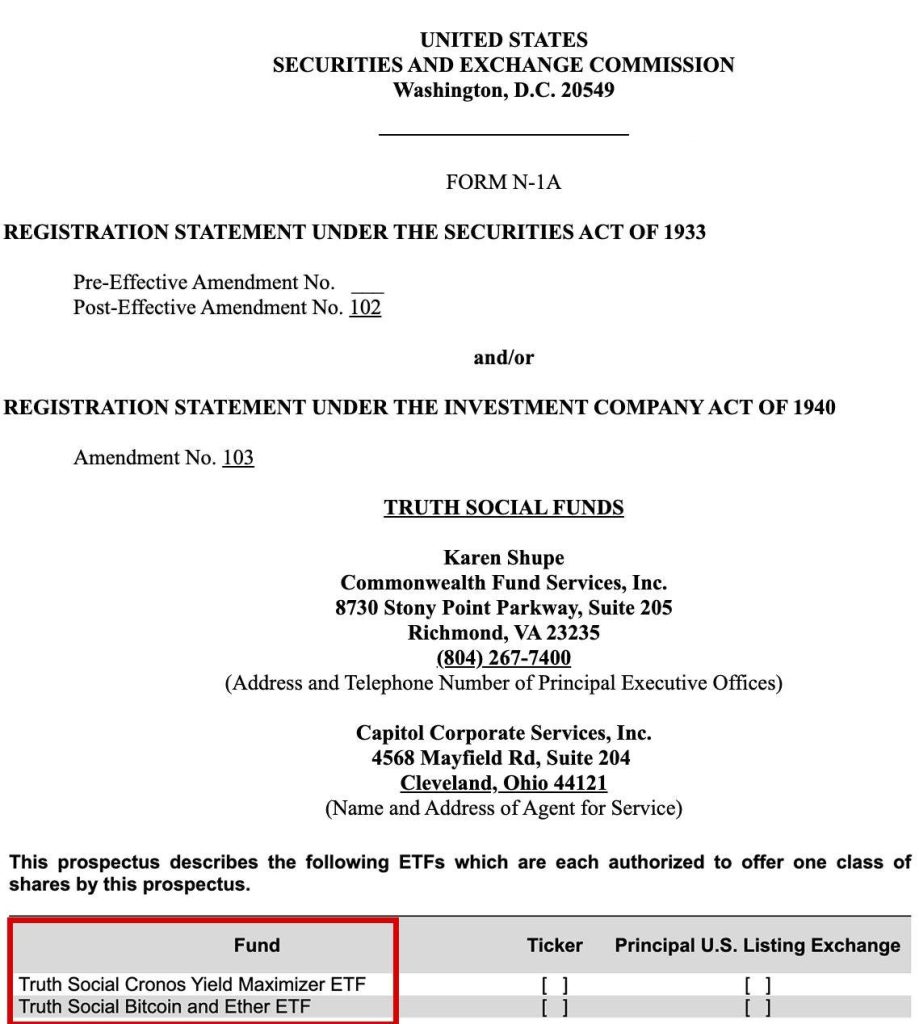

Is Trump Media Good for Crypto After All? Files for Bitcoin, Ether, and Cronos ETFs

Trump Media is stepping deeper into crypto, and this time it is not subtle.

The company just filed with the SEC to launch two new crypto linked ETFs tied to Bitcoin, Ether, and even Cronos.

This is not just about tracking price either. The plan targets active traders who want exposure plus potential yield through staking rewards. It is an expansion of the so called America First strategy straight into digital assets.

- TMTG filed for a blended Bitcoin/Ether fund and a specialized Cronos Yield Maximizer ETF.

- Both funds propose a 0.95% management fee, with Crypto.com providing custody and liquidity services.

- The move defies current trends, as Bitcoin ETFs recently saw heavy outflows totaling over $360 million.

Truth Social Expands Crypto ETFs Footprint Amid Desperate Market

The new ETFs would be managed by Yorkville America Equities and offered through Foris Capital. More interesting though is the deeper link with Crypto.com.

Back in September, they teamed up to build a treasury vehicle focused on accumulating CRO. So this is not random.

The timing is intersting. U.S. spot Bitcoin ETFs have seen four straight weeks of outflows. That tells you institutions are cautious right now.

Big asset managers are not leaving the space. Some are still quietly increasing exposure, treating this dip as a longer term opportunity. Trump Media seems to be doing exactly that.

Staking Rewards and The Cronos Surprise

These are not basic spot ETFs. The structure is built for yield. The Truth Social Bitcoin and Ether ETF would hold roughly 60% BTC and 40% ETH, with a clear plan to stake the ETH portion and generate rewards.

Then there is the Cronos Yield Maximizer ETF. Pretty sound name if you ask me. It is designed to track CRO while also earning income through staking on the Cronos network.

That puts a direct spotlight on Crypto.com ecosystem exposure, not just Bitcoin and Ethereum.

With a projected 0.95% management fee, these funds are positioning themselves as more active, premium vehicles rather than low cost, passive spot trackers.

The post Is Trump Media Good for Crypto After All? Files for Bitcoin, Ether, and Cronos ETFs appeared first on Cryptonews.

Crypto World

Florida Senate Approves First Stablecoin Bill, Awaits DeSantis’ Signature

Florida lawmakers have approved a state-level framework regulating payment stablecoins, moving the legislation to Governor Ron DeSantis’ desk for final approval.

In a Friday post on X, Samuel Armes, founder of the Florida Blockchain Business Association, revealed that Senate Bill 314 has cleared the Florida Senate unanimously. The measure is set to become law once signed by DeSantis, which Armes expects within the next month.

“It has now passed the Senate and the House, and will be signed by DeSantis within the next 30 days!” he wrote on X.

The bill establishes regulatory guidelines for payment stablecoin issuers operating in Florida. Working alongside House Bill 175, the measure introduces consumer protection standards and financial oversight rules aligned with the federal GENIUS Act, which was signed into law in July.

Related: Florida narrows scope of revived Bitcoin reserve proposal for 2026

Florida bill amends money laundering law to include stablecoins

Under SB 314, Florida’s Control of Money Laundering in Money Services Business Act will be amended to explicitly include stablecoins. The update requires stablecoin issuers to comply with existing financial regulations while banning unlicensed issuance within the state. The legislation also clarifies that certain payment stablecoins will not be classified as securities.

Issuers based outside Florida must notify the state’s Office of Financial Regulation (OFR) before operating. Oversight will depend on the structure of the issuer. Some stablecoin operators will fall exclusively under the OFR, while others will face joint supervision alongside the Office of the Comptroller of the Currency.

The law also addresses potential risks tied to stablecoin incentives. Qualified issuers will be barred from paying interest or yield to holders if federal rules prohibit such payments.

Related: Trump sues JPMorgan in Florida court for $5B over debanking claims: Report

Florida revisits state crypto investment bill

In October last year, Florida lawmakers revived efforts to integrate cryptocurrencies into state investment strategies. The Florida House Bill 183, filed by Republican Representative Webster Barnaby, would allow the state and certain public entities to allocate up to 10% of their funds into digital assets. The revised proposal expands beyond Bitcoin (BTC) to include crypto exchange-traded products, crypto securities, non-fungible tokens and other blockchain-based assets.

HB 183 is a revised version of HB 487, which was withdrawn in June after failing to advance in a House operations subcommittee.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Bitcoin Dip May Continue as Retail Buys Under $70K, Santiment Says

Bitcoin has shown renewed volatility as buyers and sellers clash at key levels. Retail participants have been loading up after the price dipped below $70,000, while larger holders have been trimming positions. Over a period spanning Feb. 23 to Mar. 3, Bitcoin traded roughly between $62,900 and $69,600, underscoring the tug-of-war between accumulation by smaller wallets and profit-taking by whales. The latest moves come as the market tries to discern whether the correction is over or if another leg lower lies ahead, particularly after a brief rally that pushed the price toward $74,000 before retreating.

Key takeaways

- Retail demand increased as Bitcoin failed to sustain a break above $70,000, while large holders began to reduce their exposure after a sharp rally past $74,000.

- Whales, defined as wallets holding 10–10,000 BTC, reportedly accumulated heavily in late February into early March when the price moved in the $62,900–$69,600 range.

- From the Wednesday peak, these whales offloaded roughly 66% of their recent purchases, even as smaller holders continued to add to positions below 0.01 BTC.

- The Crypto Fear & Greed Index sank to 12, placing the market in “Extreme Fear” as the pullback intensified.

- Spot Bitcoin ETFs posted the largest outflow day in three weeks, with about $348.9 million sliding out of 11 products, signaling a shift in near-term demand dynamics.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. Bitcoin traded around the mid-$60k range after peaking near $74k earlier in the week.

Trading idea (Not Financial Advice): Hold — watch for a clearer bid near key support zones before committing further risk).

Market context: The move comes amid a broader sell-off in risk assets and shifting ETF flows, with on-chain behavior showing growing retail interest while wholesale players trim exposure. The combination of real-time price action and fund outflows suggests sentiment remains cautious, even as some participants see value in recent pullbacks.

Why it matters

The paradox in today’s Bitcoin dynamics rests on diverging activity between retail and whale cohorts. Santiment highlighted that, after Bitcoin breached the $74,000 mark, “key stakeholders began taking profit,” a pattern that can precede further near-term weakness if demand does not re-emerge. The dataset shows that while smaller holders were accumulating, larger holders were actively realizing gains, a combination that can slow the pace of a sustained rally even when retail buyers persist.

From a price-structure perspective, the volatility has shifted the narrative from a straight-line ascent to a more cautious outlook. The market technicals are complicated by macro considerations, including risk-off sentiment and liquidity conditions that influence whether a deeper correction can be avoided. The latest price action—moving down from $74k and hovering in the low to mid-$60k zone—echoes a broader market that is trying to price in both the potential for a rebound and the risk that the lows might retest if demand falters. This is reinforced by the fear gauge in crypto markets, which dropped into Extreme Fear and reflects a broader uncertainty among participants about near-term direction.

On the ETF side, the data point of $348.9 million in net outflows across eleven spot Bitcoin ETF products marks the largest single-day drain in three weeks. The outflows could reflect profit-taking amid the pullback, but they also underscore that ETF-driven demand has not yet returned to the pace seen during prior uplegs. In a broader sense, the ETF flows are part of a larger mosaic—retail demand, institutional positioning, and on-chain behavior—that determines whether a low-risk entry point emerges or if the market faces another test of support around the $60k–$68k corridor.

Analysts have stressed that the pattern of rising retail accumulation while whales exit could signal that the correction isn’t fully complete. If demand from smaller investors remains resilient while large holders refrain from aggressive buying, Bitcoin could spend more time consolidating before the next leg higher. As Mn Trading Capital founder Michael van de Poppe noted in a subsequent post, a lack of support in the $67k–$68k region could lead to a renewed test of liquidity lows before buyers step in again. That view dovetails with the chart-level work some observers conduct to determine whether the market is forming a basin or merely pausing amid a broader downtrend.

The history of Bitcoin’s volatility also provides a frame for current conditions. After an all-time high near $126,000 in October, the price dipped to around $60,000 in February—a level some analysts consider a potential floor, though that assessment remains contested as new data flows in. The mix of lower price levels and risk-off currents creates an environment where both the narrative of value and the mechanics of supply-and-demand play critical roles in the next few weeks. The current data points—retail accumulation, whale distribution, ETF outflows, and the fear index—should be weighed together when evaluating potential trajectories for Bitcoin in the near term.

For market participants, the takeaway is that the market continues to reflect a balance of risk appetite and caution. The conditional nature of the moves—where strong on-chain demand from smaller buyers exists alongside prudence from larger holders—means that a decisive breakout or breakdown will likely require a fresh catalyst, whether it be macro news, regulatory signals, or a notable shift in ETF flows. Until then, traders will be watching price interaction around the $67k–$68k zone and the evolving sentiment indicators that accompany daily price changes.

What to watch next

- Monitor Bitcoin’s price behavior around the $67k–$68k support region; a break below could imply deeper liquidity testing.

- Track the ongoing flow of spot Bitcoin ETFs in upcoming reporting periods to gauge institutional demand resilience or fatigue.

- Observe the divergence between retail accumulation and whale distribution to assess whether the imbalance signals a longer bottom-building phase.

- Watch the Crypto Fear & Greed Index and related sentiment metrics for any reversal that might precede a price bounce.

Sources & verification

- Santiment: analysis noting wholesale profit-taking at $74k and heavy accumulation by whales between Feb. 23 and Mar. 3.

- CoinMarketCap price data referenced for current price context.

- Crypto Fear & Greed Index data source used to frame sentiment movement.

- Michael van de Poppe’s public commentary on price support in the $67k–$68k zone.

- Farside ETF flow data, outlining the $348.9 million net outflows across 11 spot Bitcoin ETF products.

Bitcoin (CRYPTO: BTC) market dynamics and potential path forward

Bitcoin (CRYPTO: BTC) has once again proven that market direction hinges on a combination of on-chain activity, macro risk sentiment, and fund flows. The latest sequence—retail accumulation even as whales take profits, followed by a price retreat from a $74k high—underscores the complexity of pricing in a market where multiple participant types pursue different time horizons. The data from Santiment points to a tactical pattern that, if repeated, could foretell continued volatility in the near term. On the other hand, ETF outflows remind market watchers that demand from traditional vehicles remains a critical swing factor that can either accelerate a rebound or extend the correction depending on how flows align with price action. The next few weeks will likely hinge on whether the $67k–$68k band provides a durable foundation or if liquidity tests push the price toward the next set of support levels, potentially revisiting the sub-$60k region if demand falters.

Bitcoin’s current trajectory remains a reading of market mood as much as a function of technical levels. Traders will want to align price action with the evolving narratives around risk appetite, regulatory signals, and the appetite of institutional players for exposure to a volatile asset class. The ongoing tension between retail demand and wholesale posture will continue to shape the path of least resistance for Bitcoin in the near term, even as the longer-term thesis remains intact for those who view the asset as a hedge against inflation and a flexible store of value in a volatile macro landscape.

Sources and verification: Santiment report on this week’s market dynamics; CoinMarketCap price data; Crypto Fear & Greed Index page; Michael van de Poppe’s X post; Farside ETF flow data.

Crypto World

Dubai Regulator VARA Issues Cease and Desist Orders to 2 Crypto Exchanges

The local regulator said the two exchanges have been offering trading services without the necessary approval.

The Virtual Asset Regulatory Authority (VARA), which is the main watchdog for cryptocurrency-related businesses in Dubai, has issued a formal cease and desist order to KuCoin and MEXC.

The regulator argued that it had come to its attention that the popular trading platforms “may be providing Virtual Asset activities to Dubai residents without the necessary regulatory approvals and misrepresenting” their legal statuses.

Aside from the cease and desist issued to all unlicensed VA activities, the official statement on KuCoin reads that investors and consumers must be aware of the potential risks.

“Engaging with unlicensed companies that are not in compliance with VARA Regulations, associated Rulebooks, and relevant UAE legislation exposes users to significant financial risks and potential legal consequences for violating regulatory requirements or criminal laws.”

It reasserted that KuCoin does not hold any license to provide crypto services in or from Dubai, which means that all such activities advertised or conducted by the exchange were “therefore in breach of the VARA Regulations.”

Dubai’s VARA introduced the comprehensive regulatory framework four years ago and requires all service providers to be licensed to operate legally in the jurisdiction.

A day before this notice against KuCoin, the regulator issued a similar alert against one of its competitors – MEXC. The message was identical, instructing a cease and desist order on all of its activities in and from Dubai.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

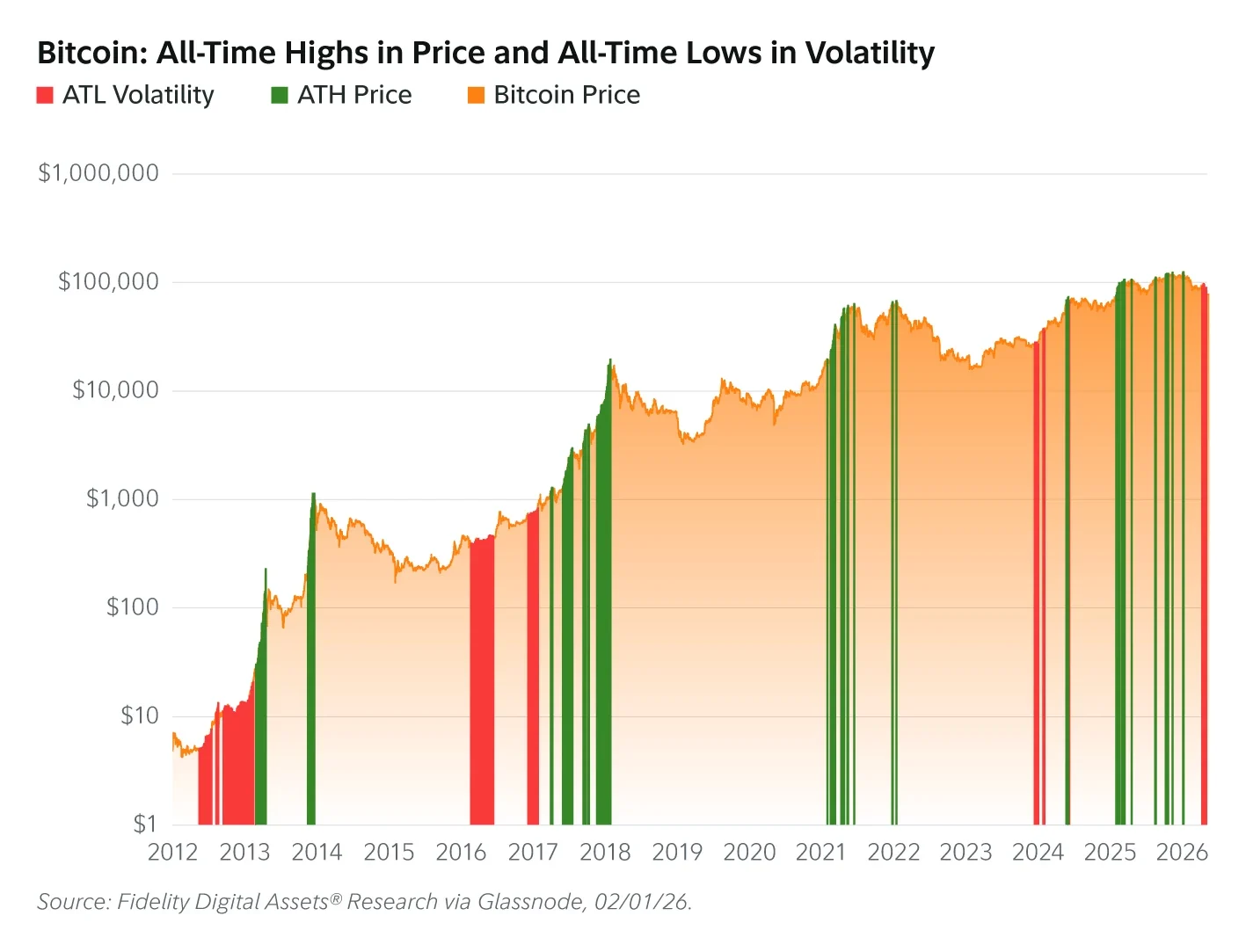

Bitcoin’s Four-Year Cycle May Be Ending, Fidelity Research Suggests

TLDR:

- Fidelity data shows Bitcoin volatility hitting record lows even months after the 2025 price peak near $126,000.

- Public companies and ETFs now hold nearly 12% of Bitcoin supply, signaling major institutional accumulation.

- Bitcoin’s MVRV ratio has stayed near 2x realized value this cycle, far below peaks seen in past bull markets.

- Fidelity’s profit-to-volatility ratio has remained above 0.015 since 2023, marking the longest stability period.

Bitcoin’s market behavior may be entering a new phase, according to recent research from Fidelity Digital Assets.

The firm argues that long-standing boom-and-bust cycles could weaken as institutional demand reshapes the market. Data shows volatility hitting record lows even months after Bitcoin reached new price highs.

The question now is whether the classic four-year Bitcoin cycle still defines the crypto market.

Bitcoin Volatility Trends Challenge the Classic Four-Year Cycle

Bitcoin reached a market capitalization near $2.5 trillion during its October 2025 peak. Prices climbed above $126,000 during that rally.

However, volatility moved in the opposite direction. One-year realized volatility recorded 17 new all-time lows in January 2026.

According to Fidelity Digital Assets research, this pattern differs sharply from previous cycles. Historically, volatility surged as Bitcoin approached market peaks.

The current trend suggests a shift toward a larger and more liquid market. Fidelity compared Bitcoin’s growth to large-cap technology companies reaching maturity.

The firm notes that Bitcoin’s market size has expanded rapidly across cycles. The asset is now twice as large as its 2021 peak valuation.

It also stands nearly ten times larger than the 2017 cycle peak. Compared with 2013, Bitcoin’s market capitalization has expanded more than 200-fold.

Fidelity’s data shows volatility began declining in late 2023. At the time, Bitcoin traded near $27,000 before starting its latest rally.

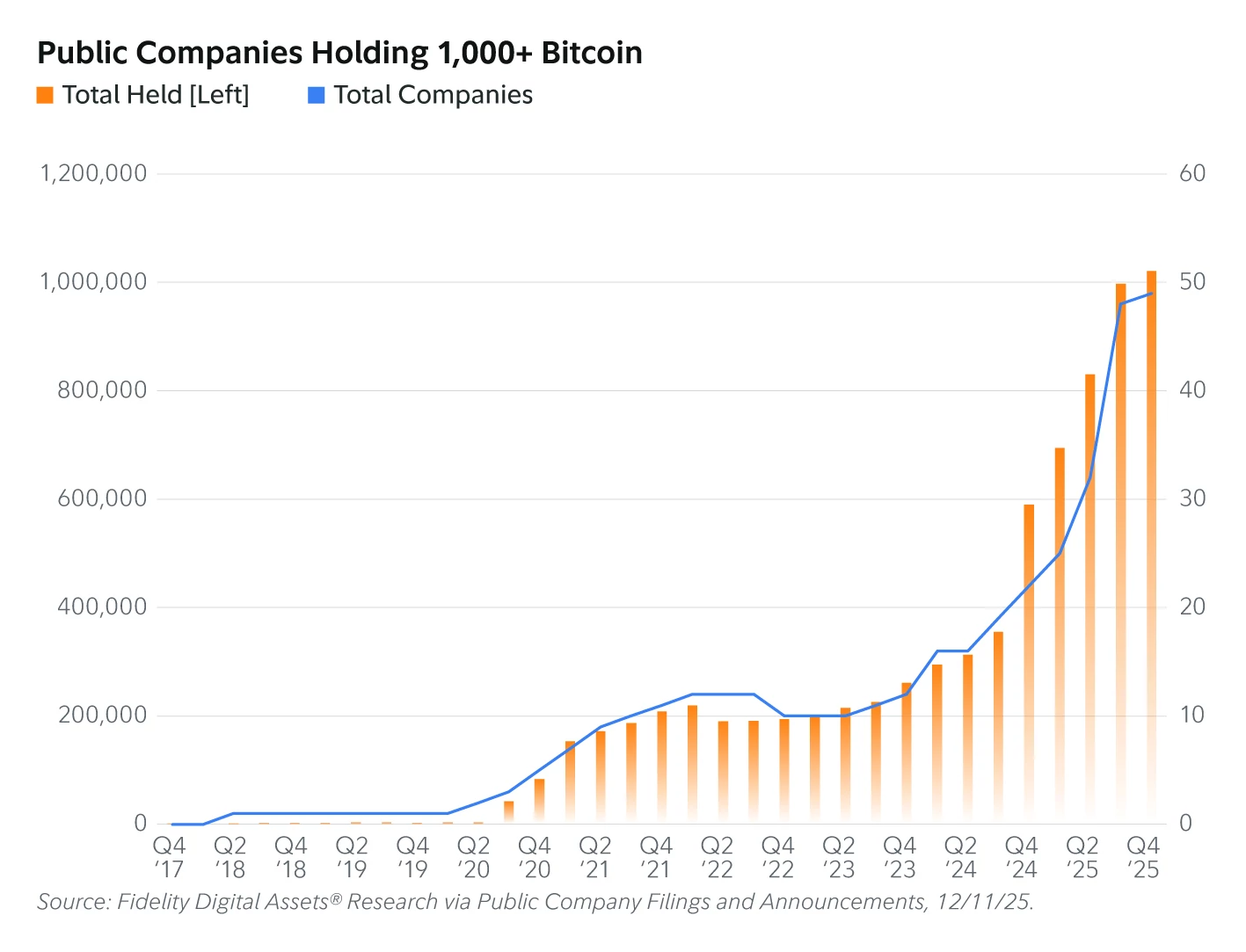

Institutional Demand Reshapes Bitcoin Market Structure

Demand patterns have changed significantly as institutions enter the market. Public companies and exchange-traded products now hold a growing share of supply.

According to Fidelity Digital Assets, 49 public companies hold more than 1,000 Bitcoin each. Combined holdings exceed one million BTC.

That amount represents more than five percent of Bitcoin’s circulating supply. The cohort has steadily increased holdings since early 2020.

Exchange-traded products have accelerated institutional accumulation. Spot Bitcoin ETPs launched in the United States in January 2024.

By January 2026, those vehicles collectively held nearly 1.3 million Bitcoin. This equals roughly 6.4 percent of the circulating supply.

Fidelity reported that the leading Bitcoin ETF surpassed $75 billion in assets within two years. Gold’s GLD ETF required almost seven years to reach that milestone.

On-chain metrics also suggest a calmer market cycle. Bitcoin’s market value to realized value ratio has remained near two throughout the current bull market.

Earlier cycles saw sharper expansions. The ratio reached six during 2013 and four during both the 2017 and 2021 cycles.

Fidelity estimates that reaching a ratio of four again would imply a $4.5 trillion Bitcoin market cap. That level corresponds to roughly $225,000 per coin.

The firm also introduced a “Profit to Volatility Ratio” metric. It compares profitable addresses with realized volatility.

That ratio has remained above 0.015 since late 2023. Fidelity describes this period as the longest stretch of stability in Bitcoin’s history.

Crypto World

AI Model Finds 22 Firefox Vulnerabilities in Two Weeks

TLDR:

- Claude Opus 4.6 found 22 Firefox bugs in 2 weeks, 14 flagged high-severity by Mozilla researchers.

- The 14 high-severity finds equal nearly a fifth of all such Firefox bugs Mozilla fixed in 2025.

- Claude succeeded in building working exploits in only 2 of several hundred automated attempts.

- Anthropic spent roughly $4,000 in API credits testing Claude’s exploit development capabilities.

Anthropic’s Claude Opus 4.6 identified 22 security vulnerabilities inside Firefox in just two weeks. Fourteen of those bugs were classified as high-severity by Mozilla. That figure represents nearly a fifth of all high-severity Firefox flaws remediated throughout 2025.

The findings emerged from a structured research partnership between Anthropic and Mozilla.

Claude AI Uncovers High-Severity Firefox Bugs at Record Speed

The collaboration began as an internal model evaluation.

Anthropic wanted a harder benchmark after Claude Opus 4.5 nearly solved CyberGym, a known security reproduction test. Engineers built a dataset of prior Firefox CVEs and tested whether the model could reproduce them.

Claude Opus 4.6 replicated a high percentage of those historical vulnerabilities. That raised a concern: some CVEs may already have existed in Claude’s training data.

Anthropic then redirected the effort toward finding entirely new bugs in the current Firefox release.

Within twenty minutes of beginning exploration, Claude flagged a Use After Free vulnerability inside Firefox’s JavaScript engine. Three separate Anthropic researchers validated the bug independently.

A bug report, alongside a Claude-authored patch, was filed in Mozilla’s Bugzilla tracker.

By the time that first report was submitted, Claude had already produced fifty additional crashing inputs. Anthropic ultimately scanned nearly 6,000 C++ files and submitted 112 unique reports to Mozilla. Most fixes shipped to users in Firefox 148.0.

Firefox 148 Ships Fixes as AI Exploit Research Raises New Alarms

Mozilla triaged the bulk submissions and encouraged Anthropic to send all findings without manual validation. That approach accelerated the pipeline significantly. Mozilla researchers have since begun testing Claude internally for their own security workflows.

Anthropic also tested whether Claude could move beyond discovery into active exploitation.

Researchers gave Claude access to the reported vulnerabilities and asked it to build working exploits. The goal was to demonstrate a real attack by reading and writing a local file on a target system.

Across several hundred attempts, spending roughly $4,000 in API credits, Claude succeeded in only two cases.

According to Anthropic’s published findings, the model is substantially better at finding bugs than exploiting them. The cost gap between discovery and exploitation runs at least an order of magnitude.

The exploits that did work required a test environment stripped of standard browser security features. Firefox’s sandbox protections were not present.

Anthropic noted that sandbox-escaping vulnerabilities do exist and that Claude’s output represents one component of a broader exploit chain.

Anthropic urged software developers to accelerate secure coding practices. The company also outlined a “task verifier” method, where AI agents check their own fixes against both vulnerability recurrence and regression tests.

Mozilla’s transparent triage process helped shape that approach throughout the research.

Crypto World

Flow Network Incident Resolved as HTX Restores Full FLOW Services

TLDR:

- HTX confirms all FLOW assets remained intact during the Flow network incident and verification process

- Flow developers patched the vulnerability responsible for abnormal transactions on December 27

- HTX restored FLOW trading, deposits, and withdrawals after verifying network stability

- Exchange removed its January notice following Flow’s detailed post-incident security report

Flow blockchain’s December security incident has reached a full resolution after coordination between the network and major exchange HTX.

The update confirms the vulnerability responsible for abnormal transactions has been patched and network operations restored. HTX also verified that all user-held FLOW tokens on its platform remain intact.

Trading, deposits, and withdrawals for the token have resumed normal operations.

Flow Network Incident Resolved as HTX Confirms Normal Operations

The Flow ecosystem shared an update confirming that the issue reported on December 27 has been fully resolved. The incident involved abnormal transactions triggered by a technical vulnerability on the network.

HTX activated internal emergency procedures once it detected the event. The exchange maintained communication with Flow ecosystem partners while monitoring the situation.

The latest update indicates that developers patched the vulnerability and restored normal network activity. The Flow team also identified and addressed abnormal minted assets during the review process.

Flow stated that ecosystem services have stabilized after the corrective actions. Network operations now function normally across supported platforms.

HTX verified user asset balances during the investigation period. The exchange reported that all FLOW tokens held by customers remain fully validated.

HTX Restores FLOW Trading, Deposits, and Withdrawals

HTX confirmed that FLOW trading resumed after reviewing the network’s recovery. Deposits and withdrawals for the token now operate without restrictions.

The exchange initially issued a notice about the incident on January 13. That notice questioned the security status of the Flow network at the time.

HTX later removed the notice after reviewing the Flow Foundation’s post-incident report. According to HTX, the report provided detailed explanations addressing earlier concerns.

The exchange stated that the new information clarified how developers handled the vulnerability. It also confirmed that the response restored stability across the network.

Flow Foundation acknowledged the collaboration between both organizations during the investigation period. The foundation stated it expects continued cooperation with HTX moving forward.

HTX reiterated that user asset security remains its top priority. The exchange said it will continue monitoring supported networks and working with ecosystem partners.

The update confirms the incident no longer affects current operations. FLOW trading infrastructure across HTX now runs under normal conditions.

Crypto World

BTC slips below $68,000 as dollar posts steepest weekly gain

Bitcoin fell to $67,960 by Saturday morning, down 3.4% over the past 24 hours and retreating sharply from the past week’s high. The move fits what has become a recurring script in recent months, with late-week selling dragging prices toward the lower end of the range heading into Saturday.

Majors took the harder hit again. Ether dropped 4.4% to $1,974, solana fell 4% to $84.31, dogecoin lost 2.9% to $0.09, and BNB slid 2.6% to $627. XRP fell 2.2% to $1.37.

The weekly picture tells a more nuanced story though. Bitcoin is still up 3.6% over seven days. Ether has gained 2.6%. BNB added 2.1%. The mid-week surge absorbed the war shock and then some, even if Friday’s pullback took the shine off.

Meanwhile, the dollar posted its steepest weekly gain in a year, strengthening as markets priced in higher energy costs, stickier inflation, and a Fed that has even less room to cut rates. That’s a direct headwind for bitcoin and every other asset denominated against the dollar.

“As tensions escalated in the Middle East last week, investors moved quickly to the safety of the U.S. dollar, which strengthened as markets began pricing in higher energy prices and reignited inflation fears, potentially delaying Federal Reserve rate cuts,” said Björn Schmidtke, CEO of Aurelion, in an email to CoinDesk.

The on-chain data paints a fragile picture beneath the surface. Glassnode data shows 43% of bitcoin’s total market supply is now sitting at a loss. That’s a significant overhang.

As bitcoin recovers, those underwater holders have an incentive to sell into any rally to break even, creating persistent resistance on the way up. It’s one reason the push to $74,000 on Thursday couldn’t hold. Every bounce toward higher prices runs into supply from people who’ve been waiting months to get out.

One bright spot came from stablecoin flows. Messari recorded a 415% jump in net stablecoin inflows to $1.7 billion over the week, with daily transfers up nearly 10%. That’s potentially dry powder waiting to be deployed, and it suggests retail isn’t entirely absent despite the fear-heavy sentiment. Whether that capital rotates into bitcoin or waits for lower prices is the question.

The war continues to set the tempo. The U.S.-Iran conflict showed no signs of resolution this week. Oil remains elevated. The Strait of Hormuz is still disrupted. And the macro backdrop of strong dollar, sticky inflation, and delayed rate cuts is the worst combination for risk assets.

Bitcoin’s week looked impressive in headlines, touching $74,000 mid-week, but the round trip from $68,000 to $74,000 and back to $68,000 is just another lap of the range.

Crypto World

Bitcoin Dip May Not Be Over As Retail Ramps Up Buying: Santiment

Retail investors have been scooping up Bitcoin after it slipped below $70,000, but whale activity suggests the price could still head lower if past patterns repeat, according to crypto sentiment platform Santiment.

“The moment Bitcoin hit $74k, these key stakeholders began taking profit,” Santiment said in a report on Friday.

Santiment explained that whales — those holding between 10 and 10,000 Bitcoin (BTC) — “accumulated heavily” between Feb. 23 and Mar. 3, when Bitcoin was trading between $62,900 and $69,600.

Since Wednesday, when Bitcoin climbed past $70,000 and touched $74,000, the cohort has offloaded around 66% of their recent purchases, Santiment said. Meanwhile, retail investors — those holding below 0.01 Bitcoin — have been increasing their positions.

Correction may not be over yet, says Santiment

“When retail buys while whales sell, it typically signals that the correction is not yet over,” Santiment said. Bitcoin is trading at $67,984 at the time of publication, according to CoinMarketCap.

Bitcoin’s price decline led the Crypto Fear & Greed Index to fall 6 points, pushing it further into “Extreme Fear” territory with a score of 12 on Saturday.

MN Trading Capital founder Michael van de Poppe shared a similar outlook, saying a further decline is possible. “If Bitcoin doesn’t find support in this $67-68K region, then we’re likely going to retest the lows for liquidity before bouncing back upwards,” van de Poppe said in an X post on Friday.

Spot Bitcoin ETFs post largest outflow day in three weeks

The decline coincided with US-based spot Bitcoin ETFs posting their largest outflow day since Feb. 12, with a total of $348.9 million in net outflows across the 11 ETF products, according to Farside data.

Related: Trump’s National Cyber Strategy pledges to support crypto and blockchain

Bitcoin’s price fell as low as $60,000 on Feb. 6 during its downtrend from the October all-time high of $126,000 before showing a modest recovery. Economist Timothy Peterson suggests this level could be the floor for the time being.

“This valuation level has always marked a bottom for Bitcoin. About 99.5% chance it stays above $60k,” Peterson said in an X post, referring to the Bitcoin Price to Metcalfe Value chart.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Trump’s National Cyber Strategy Backs Crypto and Blockchain

The US administration released its National Cyber Strategy on Friday, signaling that crypto and blockchain technologies are now explicitly targeted for protection and secure integration within the nation’s digital infrastructure. Industry executives say the emphasis could shape policy levers ranging from funding for security research to potential enforcement actions. The six-page document frames the crypto ecosystem not only as a financial frontier but as a critical layer in national security, calling for secure supply chains and privacy protections from design to deployment. As crypto firms digest the implications, questions linger about how the administration will balance innovation with controls on privacy tools, mixers, and unregulated off-ramps.

Among the bold lines, the strategy states a commitment to “build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies.” That clause, highlighted by industry observers as a first for a US cybersecurity framework, signals a potential opening for closer public-private collaboration on security standards. Yet, the policy also contains tougher language about criminal infrastructure and the denial of financial exits for illicit actors, a section that some analysts say could justify crackdowns on privacy-focused tools and crypto mixers in the longer run.

“We will build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies.”

For Galaxy Digital’s head of firmwide research, the wording is a telling shift. Alex Thorn argued that explicitly naming crypto and blockchain as technologies to be protected marks a milestone in how Washington views the sector’s role in national security. The broader document, the industry veteran noted in a post, maps a future where cybersecurity risk management dovetails with crypto governance, potentially guiding federal engagement with crypto firms and infrastructure projects.

Another thread running through the document concerns resilience against emerging threats, notably quantum computing. Castle Island Ventures founder Nic Carter has been vocal about quantum risk to Bitcoin and the broader crypto ecosystem. In a take that aligns with the strategy’s emphasis on modernizing federal information systems, Carter pointed to the section calling for “post-quantum cryptography, zero-trust architecture, and cloud transition” as proof that policymakers are taking quantum threats seriously. “Sure seems like they’re taking quantum seriously. Nothing to worry about, I’m sure,” he said on X.

Bitcoin’s quantum risk lens tightens policy dialogue

The strategy’s posture toward quantum resilience comes at a time when the industry has debated how close practical quantum computing is to undermining current cryptographic underpinnings. Carter’s views reflect a broader tension inside the crypto community: balancing the need for robust, future-proof security with the practicalities of ongoing network upgrades and governance. The document’s emphasis on post-quantum cryptography is not merely an academic exercise; it foreshadows potential standards for federal and industry-grade security that could ripple through crypto custody, exchanges, and other critical components of the ecosystem.

In the same breath, the strategy reframes AI as a frontier technology that warrants careful risk management and innovation safeguards. The document states, “We will secure the AI technology stack—including our data centers—and promote innovation in AI security.” For crypto developers and asset managers, that phrasing suggests a growing overlap between AI-enabled security tooling, data integrity, and the safeguarding of sensitive financial information within crypto networks.

Beyond technology, the strategy highlights the importance of recruiting the next generation of cyber professionals to design and deploy advanced cyber technologies. This workforce emphasis mirrors a broader policy objective of aligning national security priorities with a vibrant tech economy, including the crypto sector, which relies on sophisticated cryptography, secure software supply chains, and resilient cloud infrastructure.

Market context

Market participants are watching how this policy direction translates into practical steps. The strategy’s emphasis on secure technologies and anti-criminal enforcement may influence risk sentiment, regulator expectations, and capital flows within crypto markets. While the document stops short of prescribing specific new rules, its signaling—particularly around post-quantum security, zero-trust architectures, and secure supply chains—could shape future standards, audits, and compliance requirements for crypto firms and their service providers.

Why it matters

For crypto users and investors, the strategy’s framework could translate into clearer security expectations and potentially more formal coordination between government agencies and the private sector on safeguarding digital assets. Acknowledging crypto and blockchain as technologies warranting protection might open avenues for collaboration on security research, testing, and standard-setting, helping to reduce systemic risk in the space.

For builders and operators, the document signals that security-by-design will be a central theme in any future regulatory guidance. Post-quantum readiness, zero-trust adoption, and robust cloud migration plans could become de facto prerequisites for governmental contracts, subsidies, or public-private partnerships, shaping how wallets, exchanges, and custody solutions structure their software, audits, and incident-response playbooks.

From a policy perspective, the juxtaposition of safeguarding innovation with criminal offense enforcement creates a dynamic tension. The “uproar against criminal infrastructure” language may push policymakers to balance privacy rights with anti-money-laundering goals, a debate that will likely surface in regulatory conversations and legislative proposals in the months ahead. Market participants will need to watch not only for new rules but for how agencies interpret and implement the strategy’s guardrails across different fiscal cycles and political winds.

What to watch next

- Implementation details on the post-quantum cryptography rollout and zero-trust adoption across federal information systems.

- Guidance or proposed regulations related to privacy-focused tools, mixers, and off-ramps for digital assets.

- Standards development and collaboration efforts between government agencies and crypto industry participants on secure supply chains.

- Budget allocations or policy actions that fund cybersecurity research relevant to crypto infrastructure.

Sources & verification

- President Trump’s Cyber Strategy for America (White House PDF): https://www.whitehouse.gov/wp-content/uploads/2026/03/President-Trumps-Cyber-Strategy-for-America.pdf

- Galaxy Digital’s Alex Thorn on crypto security in the strategy: https://x.com/intangiblecoins/status/2030078133303455922?s=20

- Nic Carter on quantum readiness and policy emphasis: https://x.com/nic_carter/status/2030091238742053115?s=20

- Bitcoin quantum risk discussion and institutional concerns: https://cointelegraph.com/news/bitcoin-quantum-computing-risk-institutions-developers

- Bitcoin price context referenced in coverage: https://cointelegraph.com/bitcoin-price

National Cyber Strategy reframes crypto under security and quantum guardrails

The six-page document makes it clear that the administration views cryptography, digital assets, and blockchain as components of critical national infrastructure rather than peripheral technologies. While the exact regulatory path remains to be seen, the emphasis on post-quantum readiness and secure, privacy-conscious design sets a baseline for how federal agencies intend to engage with the crypto ecosystem. Industry voices have already started parsing the strategy’s language for practical implications—ranging from research funding opportunities to potential investigations into privacy-preserving architectures and on-ramps.

The strategy’s commitment to privacy-by-design, coupled with its tough stance on combatting illicit financial activity, positions the policy as a pivot point for the sector. Whether this translates into collaboration on cryptographic standards or a tightening of enforcement around privacy tools remains to be seen. What is clear is that the policy framework now recognizes crypto and blockchain as central to national security considerations, not just speculative technologies with speculative risk profiles.

Crypto World

$35M Corporate Crypto Bet Crashes, CFO Gets Prison Sentence

TLDR:

- Former CFO diverted $35M into DeFi lending platforms despite company policy requiring conservative investments.

- Crypto investments promising 20% yields collapsed within weeks, wiping out nearly all of the company funds.

- The software firm laid off 60 employees after the financial losses triggered a major restructuring.

- A federal court sentenced the executive to two years and ordered repayment of the full $35,000,100.

A former chief financial officer has received a two-year prison sentence after diverting $35 million in company funds into risky cryptocurrency investments.

U.S. federal prosecutors said the executive secretly transferred the money to a DeFi platform he controlled. The funds quickly collapsed in value after being placed in high-yield crypto lending protocols.

The case exposes how unauthorized crypto bets can devastate corporate finances.

CFO Moves $35M Into DeFi Lending Platforms

Nevin Shetty served as chief financial officer at a private software company beginning in March 2021. The firm raised capital to support growth and product development.

Company leadership adopted an investment policy designed to protect those funds. The policy restricted investments to conservative instruments such as money market accounts.

According to the U.S. Attorney’s Office for the Western District of Washington, Shetty helped draft that policy. However, he later transferred company funds into a cryptocurrency venture he secretly controlled.

Court records show Shetty launched a side company called HighTower Treasury in early 2022. The business had no outside customers.

Between April 1 and April 12, 2022, Shetty ordered wire transfers totaling $35,000,100 from a Chase branch near his home. The funds moved into HighTower Treasury accounts.

Prosecutors said Shetty then deployed the money across decentralized finance lending protocols. These platforms advertised yields exceeding 20 percent.

HighTower planned to return a smaller fixed payment to the software company. Shetty and his partner would keep the remaining profits.

Federal prosecutors stated the arrangement allowed Shetty to personally benefit from returns generated with company funds.

Crypto Investments Collapse Within Weeks

Initial results appeared profitable. According to court filings, the strategy generated roughly $133,000 in profits during the first month.

However, the DeFi investments soon deteriorated. Crypto market losses rapidly erased the value of the positions.

By May 13, 2022, the investment portfolio had nearly reached zero value. Almost the entire $35 million disappeared.

After the collapse, Shetty informed two fellow executives about the transfers. The company dismissed him immediately.

The financial damage forced the firm to restructure operations. Court documents state the company laid off around 60 employees after the loss.

The U.S. Attorney’s Office described the scheme as a calculated fraud carried out over several months. Prosecutors argued Shetty misled colleagues and financial institutions during the transfers.

Following a nine-day trial, a jury convicted Shetty in November 2025 on four counts of wire fraud. Federal investigators from the FBI’s Seattle field office supported the case.

A federal judge sentenced Shetty to two years in prison and ordered repayment of $35,000,100. He will serve three years of supervised release after prison.

The court also barred him from serving as a corporate officer without approval from a probation officer.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business17 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion13 hours ago

Fashion13 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat7 days ago

NewsBeat7 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed