Crypto World

XRP ETFs Face $6.42M Outflow, Grayscale’s GXRP ETF Records Largest Loss

TLDR

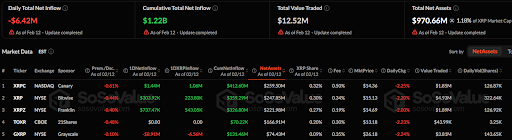

- XRP ETFs saw a daily outflow of $6.42 million, with cumulative inflows at $1.22 billion.

- XRPC ETF reported a $1.44M net inflow, but its market price declined by 2.25%.

- XRP ETF experienced a daily drop of 2.20% and a $303.92K net inflow.

- XRPZ ETF saw a 2.00% drop in market price, with $737.47K in daily inflows.

- The GXRP ETF recorded an $8.91M outflow, with a 2.24% drop in market price.

As of February 12, the daily total net inflow for XRP ETFs recorded a loss of $6.42 million. According to SoSoValue, the cumulative total net inflow remains positive at $1.22 billion. The total value traded stands at $12.52 million, showing a relatively low trading volume for the day. Total net assets for the XRP ETFs are valued at $970.66 million, representing 1.18% of the XRP market cap.

XRPC, XRPZ, and XRP ETFs Record Inflows

Among individual XRP ETFs, the XRPC ETF, listed on NASDAQ and sponsored by Canary, saw a slight 0.61% decline. It reported a 1-day net inflow of $1.44 million and a cumulative net inflow of $412.60 million. The ETF’s net assets stand at $259.50 million, with an XRP share of 0.32%. Its market price is $14.36, showing a 2.25% daily decline.

The XRP ETF, listed on the NYSE and sponsored by Bitwise, experienced a daily decrease of 2.20%. It saw a daily net inflow of $303.92 thousand and has a cumulative net inflow of $359.29 million. Its net assets stand at $247.85 million, representing 0.30% of XRP’s market share. The market price dropped to $15.13.

The XRPZ ETF, listed on the NYSE and sponsored by Franklin, experienced a 0.40% drop in value. It reported a daily inflow of $737.47 thousand with a cumulative net inflow of $326.80 million. Its net assets stand at $221.98 million, accounting for 0.27% of XRP’s market share. The ETF’s market price fell by 2.00% to $14.69.

GXRP Losses $8.91 as TOXR ETF Holds Stable

The TOXR ETF, listed on the CBOE and sponsored by 21Shares, saw a daily decline of 2.23%, with no changes in its flow for the day. It has net assets totaling $166.91 million, holding 0.20% of XRP’s market share.

Lastly, the GXRP ETF, listed on the NYSE and sponsored by Grayscale, recorded a 2.24% drop, with a daily net outflow of $8.91 million. This XRP ETF has net assets of $74.43 million, representing 0.09% of the XRP market. Its market price decreased to $26.18.

Crypto World

Real Reason Why Bitcoin and Ethereum ETFs are Bleeding Now

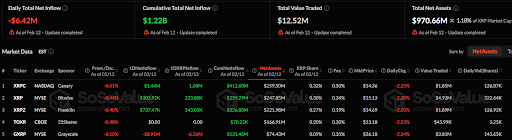

The US Spot Bitcoin and Ethereum ETFs are seeing sustained outflows as investors rotate capital into international equities. Both crypto ETFs have seen only 2 weeks of positive inflows so far in 2026.

The shift comes amid rising Treasury yields, a resilient US labor market, and record inflows into global ex-US stock funds.

Sponsored

Sponsored

Money is Shifting to International ETF Markets

Over the past several weeks, US spot Bitcoin ETFs have moved into clear net outflow territory. Total assets have dropped sharply from recent highs near $115 billion to roughly $83 billion.

Ethereum ETFs show an even steeper contraction, with assets declining from around $18 billion to near $11 billion.

This is not random volatility. It reflects capital leaving the asset class.

At the same time, international equity ETFs recorded their strongest inflows in years.

January saw record allocations into global ex-US funds, which absorbed roughly one-third of total ETF inflows despite representing a much smaller share of total assets.

That signals major rotation.

Sponsored

Sponsored

Institutional investors appear to be trimming exposure to crowded US growth trades — including crypto — and reallocating to cheaper overseas markets amid improving macro conditions abroad.

Meanwhile, stronger US jobs data pushed Treasury yields higher. Higher yields tighten financial conditions and increase the attractiveness of bonds relative to risk assets.

Bitcoin and Ethereum, which trade as high-beta liquidity plays, tend to weaken when capital moves toward safer or yield-generating assets.

The combination creates a structural headwind.

Crypto ETFs were a major source of demand in 2024, amplifying upward price moves through sustained inflows.

Now that mechanism is reversing. Instead of reinforcing rallies, ETFs are acting as distribution channels.

This does not invalidate the long-term crypto thesis. However, it weakens the short-term liquidity backdrop.

Until capital rotation slows or macro conditions ease, ETF outflows may continue to weigh on Bitcoin, Ethereum, and the broader crypto market.

Crypto World

Kalshi and Game Point Capital Launch Sports Hedging Partnership

TLDR

- Kalshi has partnered with Game Point Capital to offer sports risk hedging solutions for teams and players.

- The deal focuses on hedging performance bonus payouts tied to milestones like playoff berths or championships.

- Kalshi’s CEO Tarek Mansour highlighted the advantages of exchanges in expanding liquidity and bringing competition.

- Game Point Capital specializes in sports insurance and has already executed hedges for NBA teams using Kalshi’s platform.

- Kalshi experienced a surge in trading volume, reaching over $1 billion during Super Bowl Sunday in early 2026.

Kalshi, a leading prediction marketplace, has entered the institutional sports risk hedging space with a new partnership. The collaboration with broker Game Point Capital will allow teams to hedge performance bonus payouts. This deal comes after Kalshi recorded over $1 billion in trading volume during Super Bowl Sunday.

Kalshi’s Partnership with Game Point Capital

Kalshi’s recent deal with Game Point Capital marks a significant expansion into the sports insurance market. Game Point focuses on team and player performance bonus coverage, an area that has grown significantly in recent years. By partnering with Kalshi, Game Point aims to bring more liquidity and transparency to the industry, which has traditionally been dominated by opaque, over-the-counter reinsurance markets.

Kalshi CEO Tarek Mansour highlighted the advantages of using exchanges like Kalshi for hedging.

“Exchanges are a better alternative because they expand liquidity and bring competition,” Mansour wrote in a post on X.

This partnership offers an institutional solution to traditional markets and is expected to generate millions in trading volume from Game Point’s contracts alone in the coming months.

Kalshi has recently seen a surge in sports trading volume, contributing to the platform’s overall growth. The company reported a significant spike in activity beginning with the 2025 NFL season. By Super Bowl Sunday, Kalshi had processed over $1 billion in trades, showing how quickly sports have become the platform’s dominant sector.

The rapid growth of Kalshi is in line with the broader rise of sports betting in the United States. Companies like DraftKings are also seeing record revenues, particularly from states where traditional betting is still restricted. Kalshi’s ability to offer diverse trading options for major events like the Super Bowl has positioned it as a competitive player in the market.

Kalshi Faces Regulatory Challenges Amid Record Trading Volumes

Despite the strong growth, Kalshi is facing legal hurdles that could impact its future operations. The company is currently appealing a ruling in Nevada, where regulators have demanded compliance with state gaming rules. Kalshi also faces litigation in Massachusetts, where a court ruled that the platform cannot offer sports contracts without a state gaming license.

At the same time, Kalshi is challenging a cease-and-desist order from Tennessee, which temporarily halted its operations in the state. These legal battles come as the company continues to experience record trading volumes, including $9.6 billion in January 2026 alone.

Crypto World

Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026

When prompted with a precisely crafted query, Grok AI reveals bold outlooks for leading cryptos XRP, Cardano, and Bitcoin.

According to its analysis, all three have the potential to print fresh all-time highs (ATHs) before the end of 2026, a timeframe that may surprise investors.

Below, we examine how these AI-driven forecasts align with current chart signals and ongoing developments, and what the implications are for current HODLers.

XRP ($XRP): Grok AI Says Ripple’s Strategy Could Propel XRP to $8

In a recent blog post, Ripple reaffirmed that XRP ($XRP) remains foundational to its goal of positioning the XRP Ledger as a global, enterprise-grade payments network.

With near-instant transaction finality and ultra-low fees, XRPL is also likely to capture growth in two fast-expanding areas: stablecoins (RLUSD) and real-world asset tokenization.

XRP is currently trading around $1.36. Grok’s projection suggests a possible rally toward $8 by late 2026, representing nearly a sixfold increase (500%) from today’s levels.

Technical indicators also hint at a potential trend shift. XRP’s Relative Strength Index (RSI) sits at a low 30 after a couple days in oversold territory, often interpreted as a signal that selling pressure may be fading.

Upcoming potential catalysts include institutional inflows following approval of U.S.-listed spot XRP exchange-traded funds, Ripple’s expanding partnership network, and the strong possibility of U.S. lawmakers advancing the CLARITY bill later this year.

Cardano (ADA): Grok AI Forecasts a Potential 2,200% Upside

Created by Ethereum co-founder Charles Hoskinson, Cardano ($ADA) focuses on peer-reviewed development, strong security, scalability, and long-term network resilience.

With a market capitalization close to $10 billion and more than $125 million in total value locked (TVL), Cardano’s ecosystem continues to build despite broader market volatility.

Grok estimates that ADA could climb a little over 2,200%, rising from roughly $0.26 today to around $6 by the end of 2026, nearly double its 2021 ATH of $3.09.

That said, ADA is currently trading at its lowest price since October 2024.

Given the choppy conditions seen this year, further downside remains possible, including a retest of the $0.20–$0.25 support range if selling pressure persists.

Bitcoin (BTC): Grok AI Sees a Path Toward $225,000 and Beyond

Bitcoin ($BTC), the first and largest digital asset by market value, reached a record high of $126,080 on October 6 before retracing 47% to its current level near $67,000.

Often touted as digital gold, Bitcoin continues attracting both institutional and retail capital as investors seek hedges from inflation and global macro uncertainty.

Recent geopolitical tensions tied to U.S. military activity in Iran and Greenland has made general investors fearful of riskier assets. Even so, Grok’s assessment suggests Bitcoin’s broader bullish structure remains intact, with a 2026 target of $225,000.

The AI highlights accelerating institutional adoption and post-halving supply dynamics as major drivers that could push Bitcoin to multiple new highs this cycle.

Should U.S. policymakers follow through on Donald Trump’s Executive Order to establish a Strategic Bitcoin Reserve, Bitcoin’s upside could exceed even Grok’s already aggressive projections.

Maxi Doge: A New Meme Coin Steps Into the Spotlight

While Grok AI focuses on the steady climb of market leaders, risk-tolerant traders are diversifying into Maxi Doge ($MAXI), a new high-beta presale project that has already raised $4.6 million from savvy investors betting on a new meme supercycle this year.

The project features Maxi Doge, a degen, gym-obsessed Dogecoin rival (and distant relative) who claims to be the next alpha in the meme coin space, channeling the competitive and irreverent humor that originally fueled the space.

Presale participants can currently stake MAXI tokens for yields of up to 68% APY, with returns tapering as the staking pool expands.

MAXI is $0.0002803 in the current presale phase, with incremental price increases planned at each funding milestone. Prospective investors can purchase it using wallets such as MetaMask and Best Wallet or a bank card.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post Elon’s Grok AI Predicts the Price of XRP, Cardano and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Praetorian Group Scandal Echoes FTX Collapse

The US DOJ (Department of Justice) has secured a 20-year prison sentence against the founder of a sprawling crypto investment scheme.

According to prosecutors, this scheme had defrauded more than 90,000 investors worldwide of over $200 million.

Sponsored

Sponsored

DOJ Exposes and Dismantles $200 Million Bitcoin Ponzi as Founder Receives 20-Year Prison Term

In a statement released on Thursday, the DOJ confirmed that Ramil Ventura Palafox, 61, was sentenced after pleading guilty to wire fraud and money laundering charges.

Palafox was the founder, chairman, and CEO of Praetorian Group International (PGI), a multi-level marketing company that claimed to generate outsized returns through Bitcoin trading and crypto-related strategies.

According to court documents, PGI operated from December 2019 to October 2021, raising more than $201 million from investors worldwide. The company promised daily returns of 0.5% to 3%, marketed as profits from sophisticated Bitcoin arbitrage and trading activities.

In reality, investigators found PGI was not conducting trading at the scale required to generate such returns. Instead, it functioned as a classic Ponzi scheme, using funds from new investors to pay earlier participants.

Authorities said at least $30.2 million was invested in fiat currency, alongside 8,198 Bitcoin valued at approximately $171.5 million at the time of investment.

Confirmed losses reached at least $62.7 million, though prosecutors indicated the total financial harm could be significantly higher.

Lavish Lifestyle and Fabricated Profits: How Palafox Hid the Collapse Behind a Luxury Facade

To maintain the illusion of profitability, Palafox allegedly created and controlled an online investor portal that displayed fabricated account balances.

Sponsored

Sponsored

Between 2020 and 2021, the platform consistently misrepresented investment performance. It falsely showed steady gains and reinforced investor confidence even as the scheme unraveled behind the scenes.

Court filings detail how Palafox diverted substantial amounts of investor funds to finance a lavish personal lifestyle.

According to prosecutors, he spent roughly $3 million on 20 luxury vehicles. He also spent approximately $329,000 on penthouse accommodations at a luxury hotel chain and purchased four residential properties in Las Vegas and Los Angeles worth more than $6 million.

Additional expenditures included around $3 million on designer clothing, jewelry, watches, and home furnishings from high-end retailers.

Prosecutors further alleged that Palafox transferred at least $800,000 in fiat currency and 100 Bitcoin—then valued at approximately $3.3 million—to a family member.

The scheme began to collapse in mid-2021 after PGI’s website went offline and withdrawal requests mounted. Although Palafox resigned as CEO in September 2021, authorities said he initially retained control over company accounts.

Sponsored

Sponsored

Prosecutors described this case as one of the more significant crypto-related Ponzi schemes in recent years. The sentencing marks a decisive conclusion to a scheme that thrived on exaggerated crypto profits and global recruitment networks.

Parallels with FTX: How PGI Echoed a Larger Crypto Collapse

Despite differences in scale and sophistication, this case is similar in many ways to the FTX collapse and associated contagion. Both exploited the crypto boom, promising investors outsized, unrealistic returns:

- Palafox with daily Bitcoin gains of 0.5–3%,

- FTX through high-yield exchange products tied to Alameda Research.

Investor funds were misappropriated for lavish personal spending:

- Palafox on luxury cars, real estate, and designer goods

- SBF on Alameda’s risky bets, properties, and political donations.

Sponsored

Sponsored

Both schemes used deceptive methods to maintain investor confidence:

- PGI with a fake portal showing steady gains

- FTX with hidden liabilities and inflated valuations.

PGI defrauded over 90,000 investors with confirmed losses exceeding $62.7 million, while FTX affected millions and billions in missing funds.

Federal prosecutions followed, with Palafox sentenced to 20 years in February 2026 and SBF to 25 years in 2024.

All these highlight a trend among bad actors in crypto while also revealing the DOJ’s ongoing crackdown on crypto-related fraud.

Crypto World

Solana price breaks bearish structure, $95 target in focus

Solana price has broken its short-term bearish structure, signaling a potential momentum shift that could open the door for a bullish expansion toward the $95 resistance zone.

Summary

- Local bearish trend invalidated, signaling a shift in short-term momentum

- Holding above the value area low supports higher-low formation

- $95 high-timeframe resistance is the next target, if bullish structure persists

Solana (SOL) price action is showing a notable improvement in structure after breaking out of a local bearish downtrend that had controlled price movement for much of the week. This shift marks an important technical development, as Solana has now printed a new high, signalling a potential transition away from short-term bearish control.

While broader market conditions remain mixed, the change in local structure suggests that downside momentum is weakening. If Solana can continue to build acceptance above key value levels, the probability of a sustained move toward higher resistance increases.

Solana price key technical points

- Local bearish market structure has been broken, confirming a higher high

- Value area low remains intact, supporting higher-low formation

- $95 high-timeframe resistance is the next upside target, if momentum persists

The recent price action on Solana has produced a clear break in market structure on the lower timeframes. After a prolonged period of lower highs and lower lows, Solana has now pushed above prior resistance and established a new swing high. This move invalidates the immediate bearish trend and shifts short-term momentum back in favor of buyers.

Market structure breaks are often early signals of trend transitions, particularly when they follow extended consolidations or corrective phases. In Solana’s case, the breakout suggests that sellers are losing control, at least in the short term, and that buyers are becoming more aggressive at current levels.

Holding value area low is critical

Despite the bullish development, confirmation will depend on Solana holding above the value area low. This level represents the lower boundary of fair value within the current range and often serves as a key decision point for whether to continue or fail.

As long as price action remains above this level, Solana has the opportunity to establish a higher low. A higher low would further reinforce the bullish shift in structure and increase confidence that the breakout is sustainable rather than a short-lived reaction.

Failure to hold this level, however, would return Solana to balance and reopen the risk of renewed consolidation or downside rotation.

Higher highs and higher lows shift bias

If Solana continues to print higher highs while defending higher lows, the broader narrative within the current trading range will begin to shift. Multiple higher highs and higher lows would negate the prior bearish bias and suggest that the market is transitioning into a more constructive phase.

Such transitions often occur in stages, with initial breakouts followed by retests and consolidations before larger expansions take place. This underscores the importance of patience, as short-term pullbacks remain healthy within a developing bullish structure.

$95 resistance comes into focus

With the local bearish structure broken, attention now turns to the next major upside level. The $95 region represents a significant high-timeframe resistance area where price previously faced rejection. A move toward this level would align with typical follow-through behavior after a successful structure break.

Reaching $95 would also place Solana back into the upper portion of its broader trading range. How price behaves around this level will be critical in determining whether the rally extends further or transitions into another consolidation phase.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Solana is showing early signs of a bullish continuation. As long as price holds above the value area low and maintains the newly established higher high, the probability favors further upside exploration.

In the near term, traders should expect some volatility as the market digests the structure break. Controlled pullbacks that hold above support would strengthen the bullish case, while a loss of value could delay continuation.

For now, the evidence suggests that Solana’s recent breakout is meaningful. If momentum continues to build, the $95 resistance level stands out as the next key upside target in the current market phase.

Crypto World

Banks Should Embrace Stablecoin Yield in CLARITY Act: White House Adviser

Crypto companies and platforms that provide stablecoin rewards have become a major point of contention in the CLARITY crypto market structure bill.

The banking industry should not be threatened by crypto companies offering stablecoin yield to customers, and both sides must compromise on the issue, according to White House crypto adviser Patrick Witt.

Witt said it was “unfortunate” that the issue of stablecoin yield has become a major point of contention between the crypto industry and banks, adding that crypto service providers sharing yield with customers does not threaten the banking industry’s business model or market share. He told Yahoo Finance:

“They can also offer stablecoin products to their customers, just the same as crypto. This is not an unfair advantage in either way, and many banks are now applying for OCC bank charters themselves to start offering bank-like products to their customers.

In the future, I don’t think this is going to be an issue,” he continued, adding, “I think they’re going to find opportunities to use these products and leverage them and offer new products to their customers and expand their businesses.”

The ability of crypto service providers and platforms to offer rewards to customers who hold stablecoins has emerged as one of the most significant pain points for the industry, contributing to delays in passing the CLARITY market structure bill.

Related: White House crypto bill talks ‘productive,’ but no deal yet

Time is running out on passing the CLARITY Act, Witt and others warn

The proposed CLARITY Act establishes clear regulatory jurisdiction over crypto markets between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), and also creates an asset taxonomy for cryptocurrencies.

However, government officials and industry executives have warned that the looming 2026 US midterm elections could derail efforts to pass it into law and threaten to roll back crypto regulations established by the administration of US President Donald Trump.

“I think if the Democrats were to take the House, which is far from my best case, then the prospects of getting a deal done will just fall apart,” US Treasury Secretary Scott Bessent said on Friday.

“There’s a window here. The window is still open, but it is rapidly closing,” Witt said, adding that the White House Crypto Council is aiming to have the CLARITY Act signed into law before the midterms “take all of the oxygen out of the room.”

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Stocks Are Rising. S&P 500 Heads Back Toward Record High.

The S&P 500 mounted another early push toward its closing highs on Thursday.

The Dow Jones Industrial Average rose 180 points, or 0.4%. The S&P 500 was up 0.4%. The Nasdaq Composite was up 0.4%. The S&P was roughly 10 points away from its highest close on record.

The yield on the 2-year Treasury note fell to 3.52%. The 10-year yield dropped to 4.17%.

Crypto World

IREN Joins MSCI USA Index, Elevating Visibility for Institutional Investors

TLDR

- IREN has been included in the MSCI USA Index, enhancing its visibility among institutional investors and index-tracking funds.

- The inclusion is expected to trigger automatic buying by index-tracking entities, potentially boosting IREN’s stock in the short term.

- IREN has shifted focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech sector.

- CEO Daniel Roberts believes the MSCI inclusion will broaden institutional access as the company executes its AI Cloud strategy.

- Since the announcement, IREN’s stock has increased by around 7%, reflecting investor optimism despite concerns over recent financial results.

IREN, a company transitioning from a BTC mining operation to a dual-focus entity, has announced its inclusion in the prestigious MSCI USA Index. This move is set to elevate the company’s profile, attracting more institutional investors and index-tracking funds. It is expected to create a short-term surge in the stock price as automatic buying from these entities takes effect.

The inclusion in the MSCI USA Index provides IREN with enhanced visibility. Investors and funds that track the index will now automatically consider IREN as part of their portfolios. This may trigger a short-term surge in its stock value, supporting the company’s broader business goals.

Why MSCI USA Index Inclusion Matters for IREN

Daniel Roberts, Co-Founder and Co-CEO of IREN, expressed that being added to the MSCI USA Index is a sign of the company’s growth. “We believe this milestone will broaden institutional access to IREN as we continue to execute on our AI Cloud strategy,” he said. This inclusion comes as IREN shifts its focus from BTC mining to AI-driven infrastructure, positioning itself as a leader in the tech space.

As IREN pivots towards AI, the company’s shift in priorities is evident in its investments. It is spending more on AI-centric assets, such as data centers, than on traditional Bitcoin mining operations. This strategic move aims to capitalize on the growing demand for AI infrastructure, with plans to expand its power portfolio and attract long-term partnerships.

IREN’s Stock Response and Future Plans

Since the MSCI inclusion announcement, IREN’s stock has seen an upward movement. The company’s share price rose by approximately 7%, demonstrating investor optimism. However, concerns about the company’s financial performance remain, as recent quarterly results showed lower-than-expected revenues and widening losses.

Despite these concerns, IREN’s long-term outlook remains promising. The company is in talks for several major deals, including a multibillion-dollar contract that could further drive its growth. As the AI infrastructure market expands, IREN aims to leverage its secured power capacity to attract new contracts and raise its recurring revenue.

IREN continues to make progress with its energy initiatives, securing new data center campuses and large power agreements. These efforts position the company to meet the growing demand for energy from tech giants, ensuring a robust pipeline for future growth.

Crypto World

Why Chainlink price could rally to $10 as oversold RSI signals a bounce

Chainlink’s price is stabilizing at key Fibonacci support, with oversold RSI readings and improving momentum pointing toward a potential relief rally into the $10 resistance zone.

Summary

- $8.33 Fibonacci support is holding, confirming a short-term swing low

- RSI remains oversold, signaling selling pressure exhaustion

- Bullish momentum building, with $10 as the next key resistance

Chainlink (LINK) price action is beginning to show constructive signs after an extended period of downside pressure. Following weeks of aggressive selling, LINK has established a clear swing low and is now attempting to build a base above a technically significant support zone. This shift comes as momentum indicators flash oversold conditions, suggesting that bearish pressure may be exhausting.

As prices stabilize and buyers step in, the broader setup increasingly favors a corrective bounce rather than continued downside. With multiple technical factors aligning near current levels, Chainlink appears positioned for a potential rally toward higher resistance as momentum normalizes.

Chainlink price key technical points

- $8.33 support aligns with the 0.618 Fibonacci, reinforcing demand

- RSI remains in oversold territory, signaling momentum exhaustion

- Bullish follow-through opens a path toward $10 resistance, a key upside level

Chainlink has successfully established support around the $8.33 region, an area that carries notable technical importance. This level coincides with the 0.618 Fibonacci retracement, often referred to as the “golden ratio,” which frequently acts as a high-probability reaction zone in corrective moves.

The formation of a swing low at this level suggests that sellers are losing control and that demand is beginning to absorb supply. Price has since reacted positively from this area, confirming it as a short-term base and increasing confidence that a local bottom may be in place.

Holding above this support keeps the broader corrective structure constructive and limits immediate downside risk.

Oversold RSI signals momentum exhaustion

One of the most compelling elements supporting a potential rally is the Relative Strength Index (RSI), which remains in oversold territory. Oversold RSI conditions typically reflect excessive selling pressure and often precede relief rallies as momentum begins to revert toward neutral levels.

In Chainlink’s case, the oversold RSI is occurring after an extended downtrend, increasing the probability that the market is entering a mean-reversion phase. As price continues to stabilize and push higher, the RSI is likely to recover toward neutral territory, supporting further upside continuation.

Importantly, RSI recoveries do not require full trend reversals. Even within broader corrective structures, oversold conditions often produce sharp counter-trend moves as selling pressure fades.

Bullish influxes support the bounce

Recent price action suggests that the current rise is not purely mechanical. Bullish influxes are beginning to appear, indicating renewed buying activity. This shift in behavior is critical, as sustainable bounces require demand to return rather than relying solely on short covering.

As long as bullish participation continues and price maintains acceptance above support, the probability of a continuation move higher increases. The structure now favors a rotation toward the next major resistance rather than an immediate retest of lows.

$10 resistance comes into focus

If the current momentum persists, the next key upside target sits near the $10 level. This zone represents a significant resistance area where price previously faced rejection and where sellers may re-emerge. A move into this region would be consistent with a corrective rally driven by oversold conditions rather than a full trend reversal.

Reaching $10 would allow the RSI to normalize and provide the market with a clearer view of underlying demand strength. How price behaves around this resistance will be crucial in determining whether the rally can extend further or transition into consolidation.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Chainlink appears poised for a relief rally as long as the $8.33 support holds. Oversold RSI conditions, Fibonacci confluence, and improving bullish participation all support further upside.

In the near term, consolidation above support followed by higher lows would strengthen the bullish scenario. A $8.33 loss on a closing basis would weaken the setup and reintroduce downside risk.

Crypto World

U.S. Senate Clash Over Crypto Policy

Key Insights

- Warren questions SEC case dismissals, warning politics may be shaping crypto enforcement and investor protection.

- SEC Chair Atkins defends a shift away from lawsuits, prioritizing fraud prevention and clearer regulatory guidance.

- Senate clash highlights divide: clearer crypto laws vs stricter enforcement to protect markets and innovation.

Senate Hearing Turn Into a Crypto Flashpoint

A heated Capitol Hill hearing on February 12 thrust US crypto regulation into the spotlight as Senator Elizabeth Warren challenged Securities and Exchange Commission (SEC) Chair Paul Atkins over the agency’s recent enforcement decisions.

🚨 WARREN CALLS OUT TRUMP’S SEC OVER CRYPTO DONORS!

Sen. Elizabeth Warren ( @ewarren ) grilled SEC Chair Paul Atkins ( @SECPaulSAtkins ) over dropped cases against major crypto firms tied to Donald Trump’s ( @realDonaldTrump ) inauguration.

New data shows sharp declines in SEC… https://t.co/MAZx9QxpnA pic.twitter.com/PIbQvlzl4y

— BSCN (@BSCNews) February 13, 2026

Warren directly questioned why several investigations into major crypto firms were dropped, particularly those connected to companies that financially supported Donald Trump’s inauguration. She argued the timing raised serious concerns about political influence and investor protection.

Atkins rejected the allegations, saying the SEC is moving away from “regulation by enforcement” and back toward its core mandate: preventing fraud, protecting investors, and maintaining fair markets. He insisted previous leadership relied too heavily on lawsuits instead of clear guidance.

Is SEC Enforcement Really Declining?

Warren cited public statistics suggesting enforcement has slowed:

- Securities offering cases fell 10.64% from 2024 to 2025

- Investment adviser actions dropped 23.71%

- Broker-dealer cases declined 29.51%

Independent research also reported fewer settlements in fiscal 2025. However, Atkins countered that final annual data has not yet been released and argued the agency is prioritizing fraud over technical registration violations.

Supporters say the shift corrects regulatory overreach seen under former Chair Gary Gensler. Critics warn fewer actions could weaken accountability in the digital asset market.

Registration Violations or Innovation Barriers?

Central to the debate is whether unregistered token offerings automatically constitute misconduct. Crypto companies have long argued unclear securities definitions made compliance difficult.

Atkins supports legislation similar to the Digital Asset Market Clarity Act, which would divide oversight between the SEC and the Commodity Futures Trading Commission. He compared the past environment to innovators stuck between two competing regulators.

Warren disagreed, warning reduced oversight could usher in a “golden age of fraud.”

Could Politics Be Influencing Crypto Policy?

Warren highlighted dismissed cases involving major exchanges including Kraken, Coinbase, Gemini, and Binance, noting their financial ties to inauguration events. She also questioned dropped actions tied to executives who later received presidential clemency.

Atkins maintained pardons do not erase civil liability and emphasized that fraud investigations continue regardless of industry.

Conclusion

The battle discloses a larger policy divide: is a more explicit legislation more crucial in fostering innovativeness or is weaker enforcement more likely to hurt investors. The future of the United States regulation of digital assets may be determined by the final effect of Congress discussing crypto-market-structure legislation.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video11 hours ago

Video11 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?